Home

Services

About us

Blog

Contacts

Navigating Chicago’s Parking Revolution: From ParkChicago to Custom Mobile Parking App Solutions

Finding a parking spot in Chicago shouldn't feel like winning the lottery. Yet for decades, drivers circled downtown blocks, feeding expired meters, and praying to avoid those dreaded orange parking tickets. Today, smartphone technology has transformed this urban frustration into a streamlined experience through specialized parking applications. The Chicago city parking app ecosystem now represents a sophisticated digital infrastructure managing 36,000 metered spaces across the nation's third-largest city.

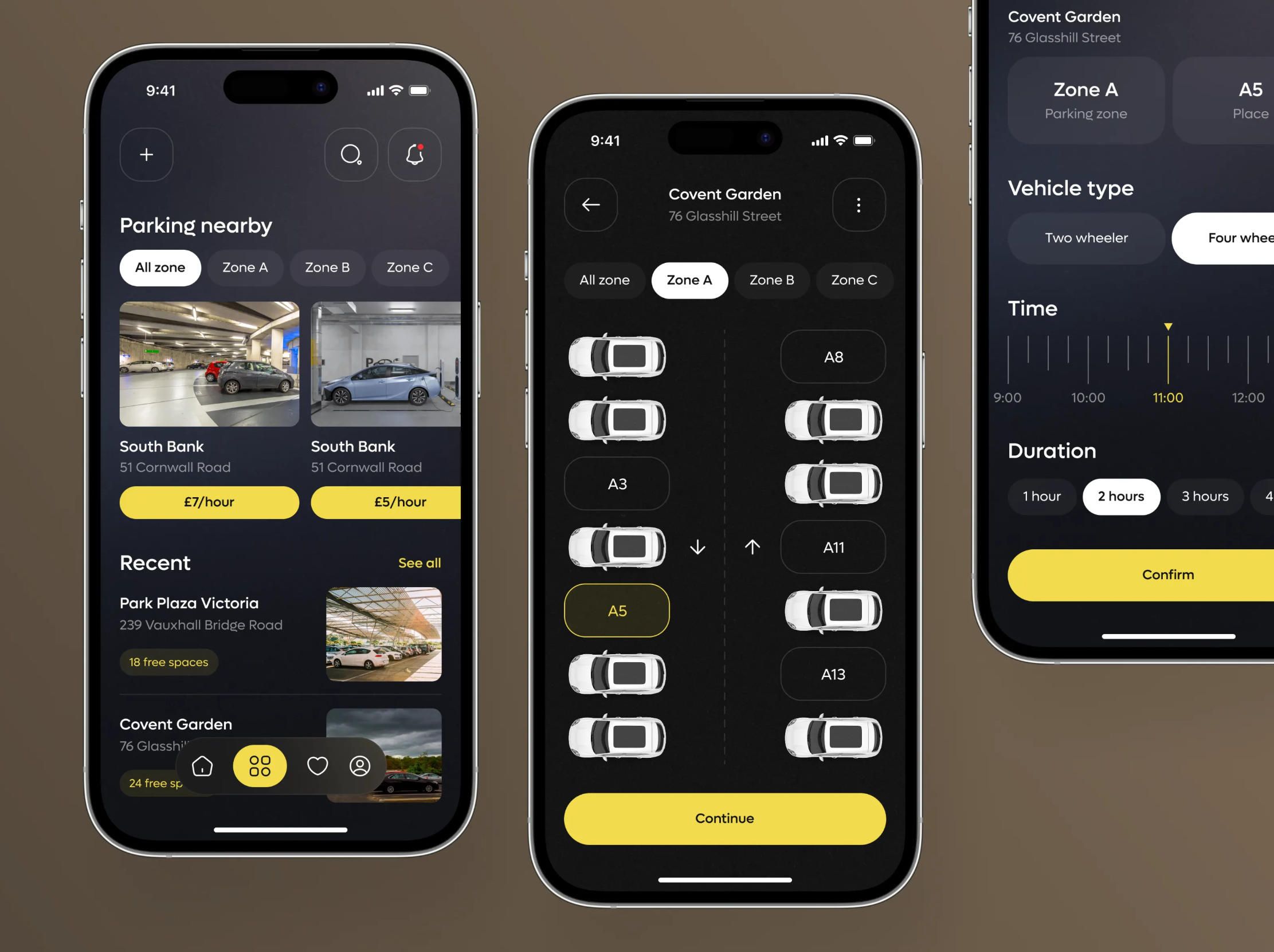

A-Bots.com specializes in developing cutting-edge mobile parking applications and IoT solutions that address real-world urban mobility challenges. With over 70 successfully delivered projects spanning mobile app development, web platforms, chatbot integration, and blockchain technology, our team brings proven expertise to the parking management sector. Whether you need a comprehensive city-wide parking system comparable to ParkChicago, a competitive garage reservation platform rivaling SpotHero, or enterprise-level parking management for private facilities, A-Bots.com delivers scalable solutions engineered for high-traffic environments. Our development approach combines real-time sensor integration, dynamic pricing algorithms, license plate recognition systems, and predictive analytics to create applications that don't just process payments but actively optimize the entire parking experience.

The company's technical capabilities extend beyond standard app development to encompass comprehensive testing services for existing parking applications. A-Bots.com conducts rigorous quality assurance protocols including stress testing under peak-load conditions, cross-device compatibility verification across hundreds of Android and iOS configurations, payment gateway security audits, GPS accuracy validation, and user experience optimization. For parking operators experiencing issues with their current systems, A-Bots.com's testing services identify critical vulnerabilities before they impact revenue or user satisfaction. This dual capability—both building new solutions and enhancing existing ones—positions A-Bots.com as a complete technology partner for parking management organizations.

From municipal governments seeking to modernize their parking infrastructure to private parking operators wanting competitive advantages, A-Bots.com tailors solutions to specific market requirements. The development team understands that parking applications serve diverse stakeholders: daily commuters requiring subscription models, event attendees needing surge capacity management, delivery drivers demanding commercial vehicle accommodations, and disabled parking enforcement. Every project begins with comprehensive stakeholder analysis, competitive landscape evaluation, and revenue model optimization. Whether deploying for a single parking garage, a citywide network, or a multi-city enterprise operation, A-Bots.com's architecture scales appropriately while maintaining sub-second response times and 99.9% uptime guarantees that parking operations demand.

Understanding Chicago's Official City of Chicago Parking App: ParkChicago

The city of Chicago parking app known as ParkChicago represents the official municipal solution for on-street metered parking management across Chicago's 77 neighborhoods. Operated by Chicago Parking Meters, LLC under a controversial 75-year, $1.15 billion privatization agreement signed in 2008, this application manages 36,000 metered parking spaces throughout the metropolitan area. Unlike many municipal parking systems that simply digitize quarter-feeding, ParkChicago has evolved into a comprehensive parking management platform that fundamentally changed how Chicagoans interact with the city's parking infrastructure.

The ParkChicago app implementation addresses several critical urban mobility challenges simultaneously. First, it eliminates the need for drivers to carry coins or return to meters before expiration, a convenience that seems simple but dramatically reduces parking-related stress. Second, the system provides the city with unprecedented data on parking utilization patterns, enabling evidence-based decisions about meter placement, rate adjustments, and zone modifications. Third, it streamlines enforcement by allowing parking control officers to verify payments electronically through license plate recognition rather than checking physical receipts. This digital transformation has reduced fraudulent meter tampering and provided more accurate revenue collection compared to traditional coin-operated meters.

Available through both the Apple App Store (Download ParkChicago for iOS) and Google Play Store (Download ParkChicago for Android), the park chicago app requires users to create an account, verify their phone number, and establish a 4-digit PIN for security. The application imposes a $0.35 convenience fee for parking sessions under two hours, a pricing structure that has generated considerable user criticism but remains integral to the operational model. Users must pre-fund their digital wallets with a minimum $20 balance, though this amount can be refunded upon account closure. The app supports multiple payment methods including major credit cards, debit cards, and PayPal integration, providing flexibility for diverse user preferences.

One of the most valuable features distinguishing Chicago parking apps from traditional meters is the notification system. ParkChicago sends push notifications when parking time is running low, allowing drivers to extend their sessions remotely without returning to their vehicles. This extension capability operates within posted meter time limits, so drivers cannot circumvent maximum stay restrictions, but it eliminates the anxiety of rushing back before expiration. The app maintains a complete transaction history, providing email receipts for each parking session—a feature particularly valuable for business travelers requiring expense documentation. For fleet managers and businesses with multiple vehicles, ParkChicago offers enterprise accounts that centralize parking expenses and simplify reimbursement processes.

The companion application ParkChicago Map represents an innovative addition to Chicago's parking technology ecosystem. This free application displays real-time parking availability predictions across the city's 36,000 metered spaces using a color-coded system: green indicates high probability (three or more available spaces), orange signals moderate availability (two spaces), and purple warns of low availability (one space or none). According to Dennis Pedrelli, CEO of Chicago Parking Meters, LLC, "The ParkChicago Map app directs users to areas where they are more likely to find available parking spaces while helping them avoid areas where parking is scarce." The predictive algorithm analyzes several years of historical parking data combined with recent weeks of usage patterns, accounting for events, construction projects, and seasonal variations that impact parking availability. This predictive capability reduces the time drivers spend circling blocks searching for spaces, directly addressing urban congestion issues that cost American drivers an estimated $88 billion annually in wasted fuel and time.

However, the Chicago city parking app system has faced legitimate criticism from users since its introduction. The mandatory $20 minimum wallet funding feels excessive for occasional parkers who might only need a few dollars of parking during infrequent downtown visits. The $0.35 convenience fee on sessions under two hours accumulates significantly for frequent users, effectively imposing a premium on the digital payment method that should theoretically reduce operational costs. App Store reviews reveal recurring complaints about vehicles being towed despite valid parking payments, typically due to temporary no-parking zones marked only at pay boxes rather than parking signs. One frustrated user reported: "My car was towed because the paper saying no parking was on the pay box, not on the parking sign that I was next to. The papers stopped at the pay box, which was about 30 feet short of the edge of the no parking zone."

Technical performance issues have also plagued the city of chicago parking app at various points. Users report occasional difficulties with zone number entry, GPS accuracy problems that place vehicles in incorrect parking zones, and payment processing delays during peak usage periods. The system's reliance on accurate zone number entry creates vulnerability to user error—entering the wrong 6-digit zone code results in invalid parking and potential citations. While the app displays zone numbers prominently on signs, the requirement for manual entry rather than automatic GPS-based zone detection represents a usability compromise. More sophisticated parking applications in other cities have implemented automatic zone detection using geofencing technology, eliminating this potential failure point entirely.

Despite these shortcomings, ParkChicago has fundamentally modernized Chicago's parking infrastructure. The city has saved enforcement costs, improved revenue collection accuracy, and gained valuable data on parking utilization patterns that inform urban planning decisions. The system processed millions of transactions annually, demonstrating that smartphone-based parking payment has transitioned from novelty to mainstream adoption. For municipalities and parking operators considering similar systems, ParkChicago provides both a successful implementation model and cautionary lessons about user experience design, pricing transparency, and the importance of comprehensive signage coordination.

SpotHero: Chicago's Homegrown Parking Reservation Pioneer

While ParkChicago manages on-street metered parking, Chicago parking apps also include robust solutions for off-street garage and lot reservations. SpotHero, founded in Chicago in 2011 by Mark Lawrence and Jeremy Smith, has evolved from a local startup into North America's leading parking reservation marketplace, operating in over 300 cities with access to more than 11,000 parking facilities. Unlike ParkChicago's focus on municipal meter management, SpotHero addresses the entirely different challenge of pre-booking parking spaces in garages, lots, and valet services—a distinction that makes the two applications complementary rather than competitive within Chicago's parking ecosystem.

SpotHero's business model centers on aggregating parking inventory from facility owners and offering that capacity to drivers at discounted rates, typically 20-50% below drive-up prices. This marketplace approach benefits both supply and demand sides: facility owners fill unused capacity and increase predictable revenue, while drivers secure guaranteed spaces at known prices without the uncertainty of circling for availability. The platform's success stems from solving a genuine pain point—anyone who has arrived at a sporting event, concert, or airport with uncertain parking prospects understands the value of confirmed reservations. In 2018, Time magazine recognized SpotHero on its inaugural list of 50 Genius Companies, noting that "By allowing users to reserve a spot rather than circling dense city centers, apps like SpotHero can help stem congestion and pollution."

Available through the SpotHero iOS application and SpotHero Android application, the platform provides a streamlined user experience: enter your destination address or venue name, select dates and times, compare available facilities with pricing and amenities, pre-pay to reserve your spot, and receive a mobile parking pass with entry instructions. The application integrates with Apple CarPlay, allowing drivers to search and book parking without touching their phones—a safety feature particularly valuable for unfamiliar destinations. SpotHero also offers business accounts that separate personal and professional parking expenses, automatically sending receipts to expense management platforms including Concur, Expensify, Certify, and Chrome River. For commuters with pre-tax parking benefits through providers like WageWorks, SpotHero enables the use of pre-tax dollars for daily parking near workplaces, offering tax advantages that reduce effective parking costs by 20-30% depending on tax brackets.

The technical architecture behind apps for parking in chicago like SpotHero involves sophisticated real-time inventory management across thousands of facilities with varying capacity, pricing structures, time restrictions, and special conditions. The system must handle dynamic pricing that adjusts based on demand patterns, upcoming events, weather forecasts, and competitive positioning. Integration with individual facility management systems requires standardized APIs that can communicate parking availability, process reservations, validate entries, and coordinate billing across diverse legacy systems. SpotHero's platform accomplishes this integration through a proprietary parking developer platform that facility operators can implement to connect their systems, creating a network effect where more facilities attract more users, which in turn attracts more facilities.

SpotHero's strategic partnerships demonstrate the application's integration into broader transportation and mobility ecosystems. In 2019, SpotHero partnered with Waze, Google's GPS navigation software, to link navigation and parking into a unified user experience—drivers can now search destinations in Waze, view SpotHero parking options near their destination, and book spots without switching applications. The company has also prepared 500 Chicago parking facilities for autonomous vehicles, anticipating a future where self-parking cars will require coordinated digital communication with parking facilities. SpotHero's acquisition of competitors including ParkPlease in 2015, Parking Panda in 2017, and Rover Parking in 2020 consolidated the fragmented North American parking reservation market, establishing SpotHero as the dominant platform.

However, SpotHero has encountered operational challenges that highlight the complexity of parking marketplace operations. User reviews document occasions when drivers arrived at reserved facilities only to find them full, forcing refund requests and alternative parking searches at precisely the moment they could least afford delays. While SpotHero's customer service team generally resolves these situations with refunds or credits, the experience undermines the core value proposition of guaranteed space availability. Other complaints involve facilities charging additional fees beyond the pre-paid reservation amount, creating unexpected costs when drivers attempt to exit. These issues typically arise from disconnects between SpotHero's reservation system and individual facility management practices, demonstrating the operational complexity of aggregating thousands of independently operated parking facilities into a coherent digital marketplace.

The competitive landscape for Chicago parking apps includes additional players such as ParkMobile, ParkWhiz, and ParkChirp, each offering variations on the parking reservation and payment theme. ParkMobile focuses primarily on municipal meter payment similar to ParkChicago but operates across multiple cities, creating convenience for travelers who can use a single application across different metropolitan areas. ParkChirp differentiates itself by eliminating the commission fees charged by most parking marketplaces, passing cost savings directly to users—the company advertises itself as having "the cheapest online rates" specifically because it doesn't charge facility operators and parkers the expensive commissions that platforms like SpotHero impose. This commission-free model represents an alternative approach to parking marketplace economics, though it remains to be seen whether ParkChirp can achieve the scale and network effects that make SpotHero's commission model sustainable.

For Chicago app development firms analyzing the parking application market, these existing solutions provide valuable lessons in user experience design, payment processing architecture, real-time inventory management, and the operational challenges of coordinating diverse stakeholders. The parking application sector demonstrates that successful urban mobility solutions require more than elegant code—they demand deep understanding of regulatory environments, established relationships with facility operators, sophisticated pricing algorithms, and the operational capacity to resolve the inevitable conflicts between digital systems and physical infrastructure.

The $587 Million Opportunity: Market Dynamics for Parking Applications

The economic scale of parking applications extends far beyond Chicago's city limits, representing a rapidly expanding sector within the broader smart city technology movement. According to Future Market Insights, the United States parking meter apps market was valued at $94.7 million in 2024 and is projected to reach $587.4 million by 2035, representing a compound annual growth rate of 18.4% throughout the forecast period. This remarkable growth rate reflects not merely incremental adoption of existing technology but fundamental transformation of urban parking infrastructure from mechanical systems installed in the 1930s to connected, data-driven platforms that integrate with comprehensive urban mobility ecosystems.

The broader parking management market exhibits even more substantial economic potential. Market Research Future estimates the overall U.S. parking management market reached $40.48 billion in 2023 and will expand to $127.75 billion by 2035, growing at a 9.503% CAGR during the forecast period. This encompasses not only mobile applications but the entire infrastructure of smart meters, parking access and revenue control systems, license plate recognition technology, guidance systems, and analytics platforms that collectively constitute modern parking management. The differential growth rates—18.4% for mobile apps versus 9.5% for the overall market—underscore that digital interfaces are becoming the primary user touchpoint, even as physical infrastructure modernization proceeds more gradually.

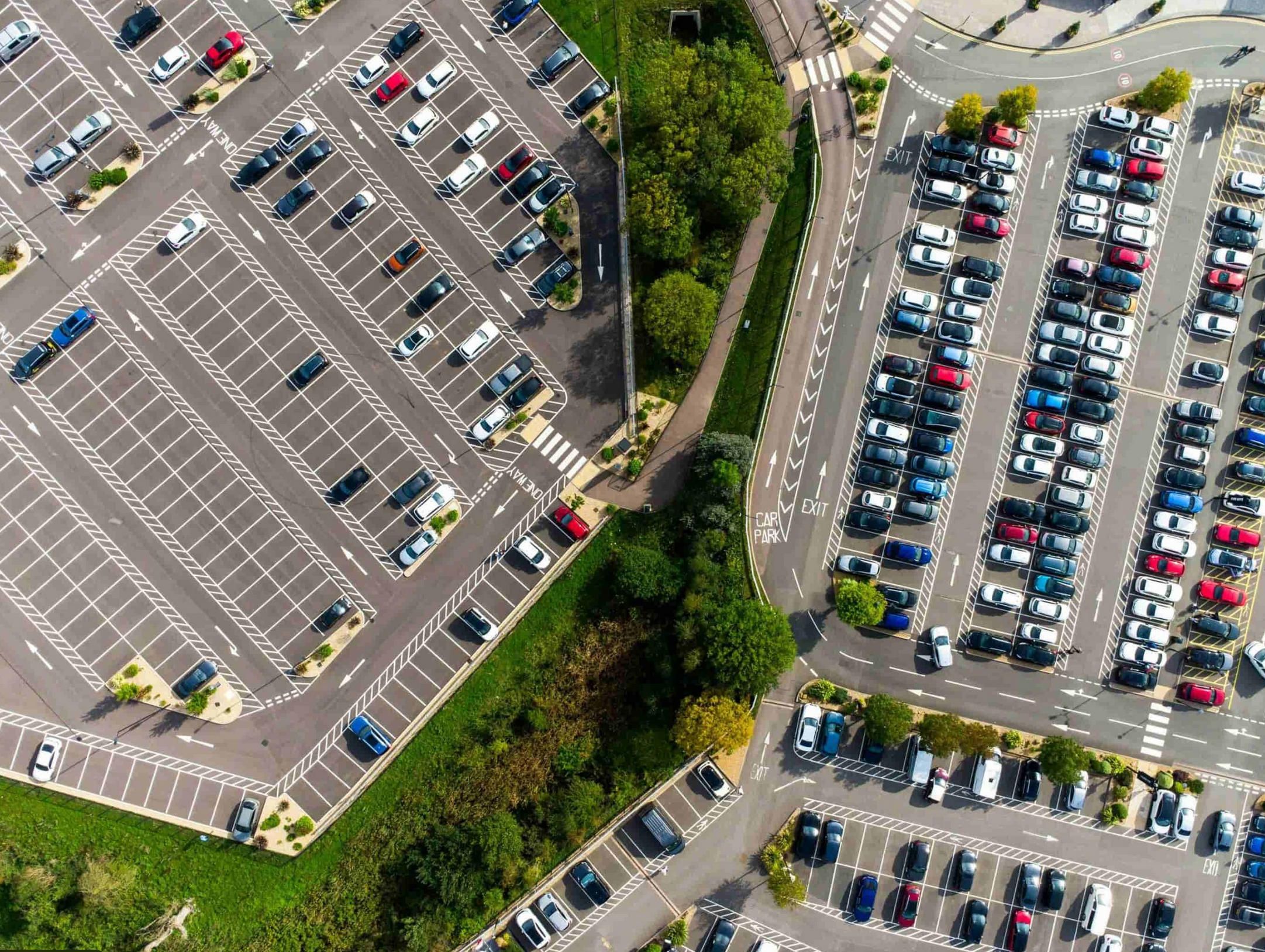

Several macroeconomic and demographic factors drive this expansion. The U.S. Census Bureau projects that urban areas will house approximately 89% of the total U.S. population by 2050, up from current urbanization levels around 82%. This demographic shift intensifies pressure on existing parking infrastructure in cities that were largely designed for much lower density. Chicago, with its relatively constrained geography bounded by Lake Michigan to the east and existing neighborhood structures throughout, cannot simply build more parking garages indefinitely. Instead, cities are pursuing optimization strategies that maximize utilization of existing capacity—precisely the value proposition that parking applications deliver. Smart parking technologies can reduce the average time drivers spend searching for spaces from 8-10 minutes to 2-3 minutes, directly addressing congestion that costs American drivers approximately $88 billion annually in wasted time and fuel.

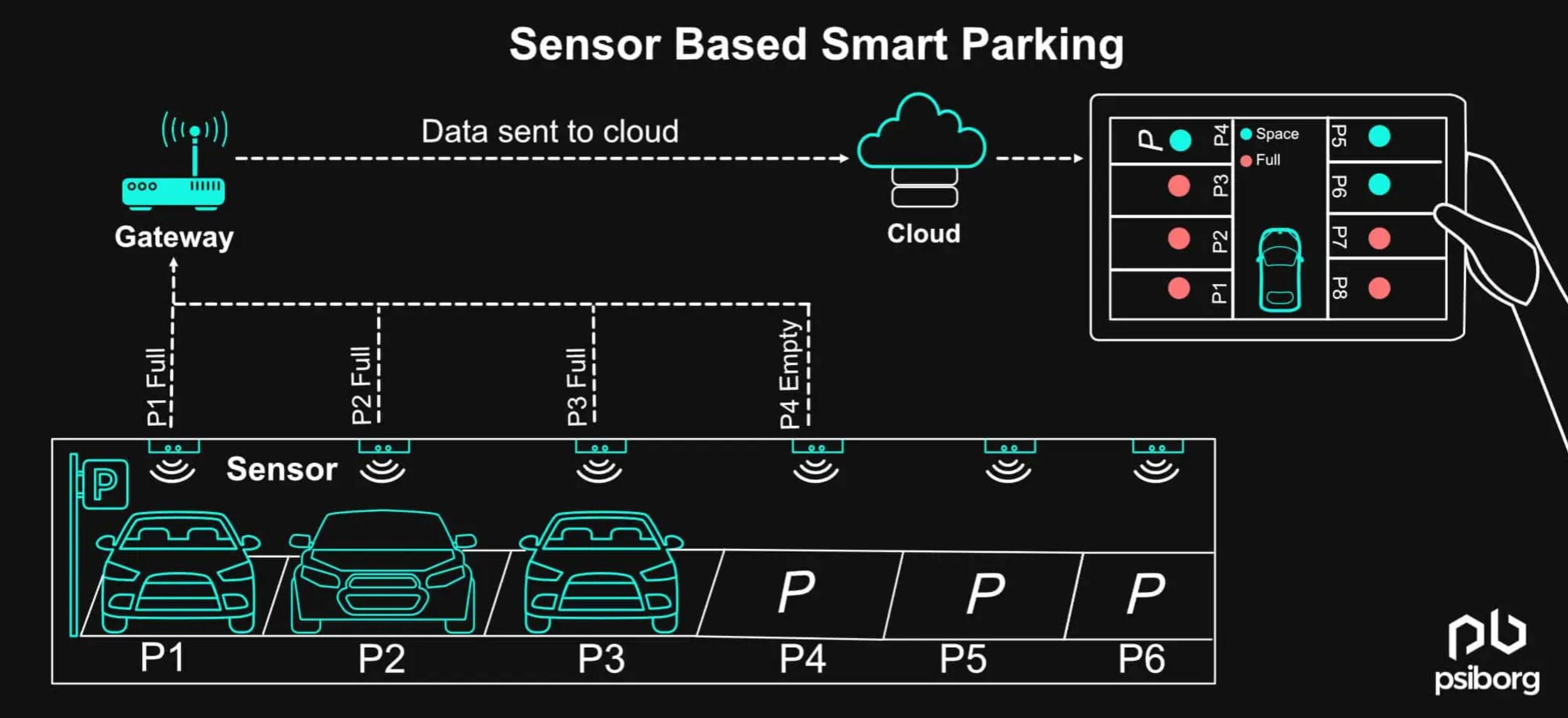

The technology architecture enabling these improvements centers on Internet of Things sensor networks that provide real-time parking space occupancy data. IoT Analytics projects the global smart parking market will reach $8.1 billion by 2023, expanding at a 13.2% CAGR through 2030. These sensor systems—whether ultrasonic sensors mounted above individual spaces, magnetic sensors embedded in pavement, or computer vision systems analyzing parking lot imagery—generate continuous data streams that parking applications process to show drivers accurate availability. The integration between sensor hardware and mobile applications represents a complete vertical stack: physical sensors detect vehicle presence, edge computing systems aggregate local sensor data, cloud platforms process citywide parking patterns, predictive algorithms forecast future availability, and mobile applications deliver this intelligence to end users. Building parking applications without understanding this entire technology stack produces superficial solutions that cannot deliver the real-time accuracy users expect.

Market segmentation reveals that the personal end-user segment accounts for approximately 63% of parking meter app revenue in 2025, with business and commercial users comprising the remaining 37%. This distribution reflects that most parking transactions involve individual drivers paying for their own spaces, but the commercial segment grows faster as companies recognize the expense management benefits of digital parking platforms. Fleet operators, delivery services, ride-sharing drivers, and business travelers collectively generate substantial parking expenses that companies want to track, control, and potentially reduce through pre-negotiated rates. SpotHero's business-focused service launched in 2017 specifically targets this segment with expense management integration, monthly parking subscriptions, and consolidated billing—features that individual consumer applications don't require but that represent significant value for corporate users.

Geographic concentration patterns show North America, and particularly the United States, dominating the global parking management technology market with over 40% market share. This leadership position stems from several factors: earlier adoption of automobile-dependent urban planning, higher per-capita vehicle ownership, larger existing installed base of metered parking infrastructure, greater smartphone penetration rates, and established digital payment ecosystems. Chicago exemplifies these characteristics—the city implemented parking meters in 1935, making it one of the earliest adopters, and the 2008 meter privatization deal created economic incentives for rapid modernization. Cities like New York, Los Angeles, San Francisco, and Chicago serve as proving grounds for parking technologies that subsequently diffuse to smaller metropolitan areas and international markets.

The competitive landscape includes major technology conglomerates alongside specialized parking technology firms. Siemens and Amano dominate parking access and revenue control systems in commercial facilities, while companies like Passport, INRIX, and Flowbird focus on municipal on-street parking management. In October 2022, Amano McGann announced that Chicago's Soldier Field now deploys the Amano ONE platform, described as "the most user-friendly, potent, and reliable parking access and revenue control system." The cloud-based platform provides seamless upgrades, minimal maintenance expenses, and simple quick-scan onboarding, enabling guests and spectators to reach parking locations more quickly through 20 lanes of automated equipment. This installation at one of Chicago's most prominent venues demonstrates how parking technology extends beyond street meters to comprehensive venue management systems.

For Chicago app development companies evaluating whether to enter the parking application sector, these market dynamics present both opportunity and challenge. The opportunity lies in substantial and sustained market growth driven by urban density increases, smart city initiatives, and electric vehicle charging integration. The challenge involves competing against established platforms with network effects, navigating complex regulatory environments that vary significantly across municipalities, and developing operational capabilities beyond software development to include facility operator relationship management and customer service infrastructure. The most successful parking applications combine technical excellence with operational sophistication—the development quality that A-Bots.com delivers represents the necessary foundation, but not the sufficient condition, for marketplace success.

Technical Architecture: Building Parking Applications That Scale

Developing robust parking applications requires sophisticated technical architecture capable of handling millions of transactions, real-time inventory updates, location-based services, payment processing, and integration with diverse legacy systems. The technology stack extends far beyond standard mobile application development to encompass IoT sensor networks, geospatial databases, payment gateway security, license plate recognition, dynamic pricing algorithms, and push notification infrastructure. Chicago app development firms undertaking parking projects must understand these technical requirements comprehensively—superficial implementations quickly reveal their limitations under production load and real-world usage patterns.

The mobile application frontend typically deploys native development for iOS using Swift and Android using Kotlin to maximize performance and access platform-specific capabilities including geolocation, push notifications, digital wallet integration, and camera access for QR code scanning. While cross-platform frameworks like React Native or Flutter can reduce development timelines, the high-transaction-frequency nature of parking applications and requirements for precise GPS accuracy generally justify native development. The user interface must accommodate rapid transaction flows—drivers parking on busy streets need to complete payments within 30-60 seconds, not navigate through elaborate multi-screen workflows. This design constraint influences everything from authentication patterns (biometric login rather than password entry) to payment processing (stored payment methods rather than manual card entry for each transaction).

Backend architecture requires high-availability infrastructure capable of handling transaction spikes during peak commuting hours, major events, and inclement weather when parking demand surges. Cloud platforms like Amazon Web Services, Google Cloud Platform, or Microsoft Azure provide the elasticity needed to scale automatically, though the selection involves tradeoffs between cost optimization and latency minimization. A parking application serving Chicago's downtown Loop district during morning rush hour might process 5,000-10,000 concurrent transactions, requiring load-balanced application servers, distributed caching layers, and database replication strategies. The backend must also maintain transaction consistency across distributed systems—when a driver reserves a parking space through SpotHero, that reservation must immediately become unavailable to other users, requiring distributed locking mechanisms and eventual consistency guarantees across geographically distributed data centers.

Integration with payment processing systems demands PCI DSS Level 1 compliance for organizations processing significant transaction volumes. Rather than handling raw credit card data directly, parking applications typically integrate with payment gateways like Stripe, Braintree, or PayPal that assume PCI compliance burden while providing tokenized payment methods. The payment architecture must handle various transaction patterns: single parking session payments ranging from $2-50, subscription-based monthly parking charges, pre-funded wallet systems requiring initial deposits and automatic top-ups, refund processing for cancelled reservations, and split payments when parking expenses are reimbursed through employer accounts. Each payment pattern introduces complexity around authorization holds, settlement timing, partial refunds, and reconciliation between the application's transaction records and payment processor settlement reports.

Location-based services represent one of the most technically challenging aspects of parking application development. Determining which parking zone a vehicle occupies requires GPS accuracy within 15-20 meters—easily achievable in open areas but problematic in urban canyons where tall buildings block GPS satellite signals or in parking garages where GPS doesn't function at all. Applications employ multiple positioning technologies: GPS provides primary positioning, cellular tower triangulation offers backup positioning when GPS is unavailable, WiFi access point mapping (similar to Google's WiFi positioning system) assists in indoor locations, and Bluetooth beacon networks in parking facilities provide venue-specific positioning. The Chicago city parking app addresses this challenge partially through manual zone entry, shifting the accuracy burden to users, but more sophisticated implementations use geofencing to automatically detect when vehicles enter defined parking zones and prompt payment without requiring zone code entry.

License plate recognition technology has become increasingly important in parking applications, both for enforcement and frictionless entry/exit. Computer vision systems analyze images from cameras mounted at garage entrances, extract license plate numbers using optical character recognition, match plates against reservation databases, and automatically open gates for authorized vehicles—eliminating the need for physical tickets or QR codes. The deep learning models powering these systems require training on diverse license plate formats across different states and countries, various lighting conditions including night vision, partial obstructions like bumper stickers or dirt, and the wide range of camera angles encountered in real-world installations. A-Bots.com's computer vision expertise, developed through agricultural machinery integration and delivery verification systems, translates directly to parking application requirements.

Dynamic pricing algorithms optimize revenue for facility operators while maintaining competitive rates that attract users to application-based bookings. These algorithms analyze historical utilization patterns, upcoming events (concerts, sports games, conventions), day of week, time of day, weather forecasts, competing facility pricing, and current booking velocity to adjust prices continuously. The optimization problem resembles airline yield management but operates on shorter time scales and with different constraints—unlike airline seats that become worthless after departure, parking spaces maintain value throughout operating hours. The pricing system must also accommodate regulatory constraints in municipal applications where maximum rates may be legally capped, and political considerations limit surge pricing during emergencies or disasters.

Push notification infrastructure serves a critical business function in parking applications—reminding users when parking sessions approach expiration generates extension transactions that increase revenue while preventing citation tickets that damage user satisfaction. However, push notifications face technical challenges including device-specific limitations (iOS and Android handle notifications differently), battery consumption concerns that make continuous background location monitoring impractical, and user privacy expectations around location tracking. Applications must balance notification frequency—too many notifications annoy users and get disabled, too few notifications fail to prevent expiration—with personalization based on historical user behavior. A commuter who consistently parks for 8 hours doesn't need notifications, while a shopper who parks for 1-2 hours highly values expiration warnings.

Analytics and business intelligence capabilities transform parking applications from simple payment processors into strategic tools for facility optimization and urban planning. Data collection includes parking duration distributions, arrival/departure patterns, space utilization rates, payment method preferences, user retention metrics, and peak demand periods. Visualization dashboards present this data to facility operators and municipal planners, enabling evidence-based decisions about pricing adjustments, capacity additions, enforcement strategies, and infrastructure investments. More sophisticated implementations employ predictive analytics to forecast future demand based on weather, events, holidays, and economic indicators, allowing proactive capacity management and dynamic pricing.

For organizations considering custom parking application development, understanding this technical complexity is essential for realistic project scoping and vendor evaluation. A-Bots.com's experience delivering 70+ projects across mobile applications, IoT integration, and real-time systems provides the breadth of expertise parking applications demand. The company's approach begins with comprehensive requirements analysis that maps business objectives to technical architecture, identifies integration touchpoints with existing systems, establishes performance benchmarks for transaction processing and response times, defines security requirements for payment and user data, and creates deployment strategies that minimize disruption to ongoing parking operations. This methodological rigor distinguishes professional development organizations from less experienced vendors who underestimate parking application complexity.

Event Parking Management: From McCormick Place to Wrigley Field

Chicago's status as a premier destination for conventions, sporting events, concerts, and festivals creates unique parking management challenges that standard municipal applications don't fully address. When 100,000 attendees converge on McCormick Place for a major convention, 41,000 fans pack Wrigley Field for a Cubs game, or 400,000 people attend the Chicago Air and Water Show along the lakefront, parking demand overwhelms normal infrastructure and requires specialized management strategies. Event parking represents a distinct market segment where Chicago app development expertise can deliver tremendous value through custom applications that coordinate temporary parking arrangements, optimize traffic flow, provide shuttle coordination, and prevent the neighborhood parking conflicts that generate community opposition to major events.

The operational requirements for event parking differ substantially from routine daily parking management. First, demand concentrates intensely in time—most attendees arrive within a 90-minute window before event start, creating bottlenecks at entrances, payment systems, and circulation routes. Applications must handle these transaction surges without degrading performance, requiring elastic cloud infrastructure that scales up automatically during peak periods. Second, event parking often involves temporary arrangements including closed streets converted to parking zones, commercial lots offering special event pricing, remote parking with shuttle service, and residential permit systems preventing neighborhood overspill. Coordinating these diverse parking resources into a coherent user experience demands sophisticated inventory management and mapping that standard parking applications don't provide.

Third, pricing strategies for events differ dramatically from standard parking. While normal downtown parking might range $4-7 per hour, event parking can command $30-100 for a single entry because demand is inelastic—attendees who purchased $200 concert tickets or traveled from other states for a game will pay premium parking rates rather than miss events. However, facilities want to maximize both utilization (filling all spaces) and revenue (charging appropriate rates), creating an optimization problem where early-bird discounts, pre-booking incentives, and dynamic pricing based on remaining capacity all play roles. SpotHero's event parking functionality addresses this by allowing venues to create event-specific inventory that appears when users search venues or specific event dates, but fully custom applications can integrate even more sophisticated pricing strategies including group discounts, season ticket holder preferences, and corporate partnerships.

Chicago's major venues demonstrate varying approaches to parking management. Soldier Field, home of the Chicago Bears, partners with multiple surrounding lots and garages, offering various price points based on distance from the stadium—$35-50 for lots within walking distance, $25-35 for lots requiring 5-10 minute walks, and $15-25 for remote lots with shuttle service. The United Center, hosting Chicago Bulls and Blackhawks games plus major concerts, offers similar tiered pricing but also accommodates 4,000 on-site spaces that use sophisticated access control systems. Wrigley Field presents unique challenges due to its Wrigleyville neighborhood location where residential streets surround the ballpark, creating ongoing tensions between fans seeking parking and residents wanting neighborhood access. The venue has implemented permit parking zones requiring resident permits during game times, forcing event parking into commercial lots that command premium prices—creating business opportunities for applications that aggregate this fragmented parking inventory.

McCormick Place, North America's largest convention center with 2.6 million square feet of exhibit space, faces perhaps the most complex parking management challenges of any Chicago venue. The facility offers 8,000+ on-site parking spaces plus access to additional nearby lots, but major conventions can draw 100,000+ attendees over multiple days, requiring comprehensive parking coordination. The venue uses variable pricing based on event type, arrival time, and booking method—pre-paid parking through the McCormick Place website costs $28-35 for typical events while drive-up rates run $35-42, incentivizing advance purchases that provide facility operators with demand forecasting data. Applications serving convention attendees could integrate hotel-parking-shuttle bundles, provide real-time availability updates, coordinate taxi/rideshare pickup zones, and reduce the congestion that plagues major convention openings.

For venues and event organizers seeking custom parking applications, Chicago app development firms can deliver capabilities unavailable in off-the-shelf solutions. Custom applications can implement multi-venue season ticket holder benefits, where fans receive parking discounts or guaranteed spaces across multiple events. They can coordinate with dynamic traffic management systems that adjust routing instructions based on real-time congestion patterns, directing drivers to underutilized lots instead of overflowing facilities. They can integrate weather monitoring to adjust pricing when rain or extreme cold increase parking demand relative to public transit usage. They can provide accessibility features that reserve appropriate spaces for disabled attendees and provide detailed navigation to designated accessible parking zones—a capability particularly important for venues with complex layouts.

The business model for event parking applications can involve several revenue mechanisms. Facility operators might license white-label applications that carry venue branding while providing comprehensive parking management functionality. Event organizers could pay transaction fees on parking sales similar to ticketing platforms that charge 10-15% service fees. Advertising opportunities exist around event-related businesses—restaurants, hotels, merchandise vendors—that want visibility among attendees. The most sophisticated implementations combine parking with comprehensive event experience applications that integrate tickets, maps, concessions ordering, merchandise sales, and transportation coordination into single platforms—transforming parking from standalone utility into integrated event ecosystem component.

A-Bots.com's experience with agricultural event management, particularly the National Western Stock Show system that coordinates 660,000+ annual visitors across multiple venues, translates directly to sporting and entertainment event parking challenges. The technical requirements mirror those of agricultural shows: coordinating diverse stakeholders, handling transaction surges, providing wayfinding to unfamiliar visitors, managing temporary infrastructure, and preventing neighborhood conflicts. Whether the application serves a single anchor venue or coordinates city-wide parking for multi-venue events like Lollapalooza that spans Grant Park and surrounding areas, A-Bots.com delivers the scalable architecture and operational sophistication that professional event management demands.

Municipal Parking Systems: Technology for City Governments

While commercial applications like SpotHero serve private parking operators and individual drivers, municipal governments face distinct parking management challenges that justify custom application development tailored to public sector requirements. Cities balance multiple objectives: generating parking revenue to fund transportation infrastructure, encouraging parking turnover to support commercial districts, enforcing parking regulations fairly and efficiently, accommodating residential parking permits, managing disabled parking access, and coordinating with broader transportation policies including public transit and traffic congestion management. The park chicago app demonstrates that municipal applications can succeed, but its privatized operational model and user experience limitations suggest opportunities for improved public-sector solutions.

The core functionality of municipal parking applications centers on digitizing meter payment while maintaining all the policy controls that physical meters provided. This includes enforcing maximum stay durations that prevent long-term parkers from monopolizing high-turnover commercial zones, implementing time-of-day pricing that charges premium rates during peak demand periods while offering lower rates evenings and weekends, coordinating with event parking that suspends normal meters during street festivals or parades, and accommodating special permits including residential parking permits, disabled parking placards, and commercial loading zones. Each of these policy layers adds technical complexity—the application must integrate with the city's permit database, validate credential expiration dates, enforce zone-specific restrictions, and coordinate with parking enforcement officers whose handheld citation devices query the payment system in real-time.

Chicago's experience with the 2008 parking meter privatization deal offers cautionary lessons about structuring municipal parking technology procurements. The 75-year concession agreement that sold Chicago's parking meter operations to Chicago Parking Meters, LLC for $1.15 billion generated immediate budget relief but created long-term liabilities. Under the agreement, if the city takes actions that reduce parking revenue—closing streets for bike lanes, converting parking to loading zones, or implementing new traffic patterns—it must compensate CPM for lost revenue. These "true-up payments" have cost the city over $135 million beyond the original agreement, demonstrating how poorly structured technology privatization can constrain future municipal policy flexibility. The Metropolitan Planning Council's analysis concluded that while the 2013 renegotiation improved terms and should save $1 billion over the contract's life, more strategic parking management could reduce or eliminate quarterly payments to CPM.

For municipalities evaluating custom parking application development, retaining public ownership of both the technology platform and the parking revenue stream preserves policy flexibility and long-term economic value. The upfront development and infrastructure costs are higher than privatized concessions, but municipal ownership allows cities to implement parking policies that serve broader urban planning objectives rather than maximizing private operator revenue. Washington, D.C. provides a contrasting example to Chicago's privatization—the District Department of Transportation operates its own parking meter system through the ParkMobile platform under a technology services contract rather than a revenue concession. This arrangement provides comparable digital payment functionality while preserving the city's ability to modify parking policies without compensating private concessionaires for revenue losses.

Technical integration requirements for municipal parking applications extend beyond the application itself to encompass the entire parking ecosystem. Enforcement systems must integrate with the payment platform so parking control officers can verify payment status through license plate lookups without approaching vehicles or checking windshield receipts. This real-time verification requires reliable cellular connectivity, encrypted data transmission to protect privacy, and sub-second query response times so officers can efficiently cover their assigned zones. The citation issuance system must cross-reference payment records before finalizing tickets to prevent issuing citations for paid parking—a common complaint that damages public trust when technological glitches produce erroneous tickets.

Payment reconciliation and financial reporting fulfill critical governmental accountability functions. Municipal parking applications must provide audit trails documenting every transaction with timestamps, geolocation data, vehicle identification, payment method, and operator identity when payments are processed by parking attendants. The system must integrate with municipal financial management systems, allocating parking revenue to appropriate budget accounts, tracking restricted funds designated for specific purposes (parking revenue often legally must fund transportation infrastructure), and providing the detailed reporting that governmental entities require for public accountability. Security and fraud prevention are paramount—systems must detect anomalies including unusually high transaction volumes from individual accounts, patterns suggesting stolen payment credentials, or suspicious employee transactions during cash handling.

The data generated by municipal parking applications creates valuable insights for urban planning and transportation management beyond simple revenue tracking. Heat maps showing parking demand across different neighborhoods and times inform decisions about meter installations, rate adjustments, and enforcement staffing. Dwell time analysis reveals whether turnover targets in commercial districts are being achieved or whether maximum stay limits should be adjusted. Comparison between metered capacity and observed demand identifies undersupplied areas where new parking infrastructure might be justified or conversely, low-utilization meters that could be removed. Integration with traffic management systems enables holistic analysis—neighborhoods with low parking availability and high traffic congestion might benefit from encouraging public transit use rather than adding parking capacity.

For cities throughout Illinois and the broader Midwest region, Chicago app development firms offer significant advantages for municipal parking projects compared to coastal technology centers. Geographic proximity facilitates on-site requirements gathering, testing with actual parking enforcement officers and city staff, and responsive support as systems deploy and encounter real-world usage patterns that didn't emerge during development. Understanding Midwest municipal procurement processes, public sector budgeting cycles, and the political dynamics of urban governance helps development firms navigate the extended timelines and stakeholder complexity that characterize public sector projects. A-Bots.com's experience across 70+ projects includes both private sector clients demanding rapid deployment and public sector engagements requiring comprehensive stakeholder management—delivering successful outcomes requires both technical excellence and organizational sophistication.

Private Parking Operations: Applications for Facility Owners

While municipal street parking and consumer-facing reservation platforms attract the most attention, private parking facility operators represent a distinct market segment with specialized application requirements. Parking garage owners, surface lot operators, hospital parking systems, university parking services, and corporate campus parking management all share common needs: maximizing facility utilization while minimizing operational overhead, providing convenient user experiences that encourage repeat business, collecting accurate revenue across multiple payment methods, and obtaining operational data that informs pricing and capacity decisions. For these operators, apps for parking in chicago aren't primarily about connecting with Chicago's broader parking ecosystem but rather about optimizing their specific facilities' operations.

The technical architecture for private facility applications centers on parking access and revenue control (PARC) systems that govern vehicle entry and exit. Traditional PARC implementations use physical tickets printed at entry gates, which drivers present at exit gates or payment kiosks along with payment before departure. While this system works functionally, it creates friction through lost tickets, slow payment processing, long queues during peak exit periods, and the operational costs of maintaining ticket printers, payment kiosks, and staffed cash booths. Modern PARC systems integrate license plate recognition cameras that automatically identify vehicles at entry and exit, eliminating physical tickets entirely. Mobile applications provide the payment interface—drivers enter their license plate number in the app, pay for parking, and exit gates automatically open when cameras recognize their plate, creating a seamless experience that reduces exit queuing and operational staffing.

Integration between mobile applications and PARC systems involves technical challenges around real-time communication, network reliability, and graceful degradation when connectivity fails. When a driver pays through a mobile app and proceeds to the exit gate, the PARC system must query the payment database, verify transaction validity, ensure the time limit hasn't expired, and open the gate—all within 2-3 seconds to prevent backup queues. This requires low-latency network infrastructure, typically cellular connectivity with wired broadband backup, and edge computing capabilities that cache recent transactions locally so gates can open even if connection to central servers is temporarily interrupted. Backup procedures for system failures are critical—gates stuck closed trap customers inside the facility while gates stuck open allow free parking, either situation causing significant operational and revenue problems.

Dynamic pricing capabilities help parking facility operators optimize revenue by adjusting rates based on demand patterns. Monthly parking subscriptions at offices might cost $200-300 for dedicated reserved spaces but only $150-200 for first-come first-serve spaces, with lower rates reflecting uncertainty about space availability during peak periods. Event pricing multiplies normal rates when nearby venues host games or concerts, capitalizing on temporarily inelastic demand. Early-bird specials offer discounts for arrivals before 9 AM that depart after 5 PM, encouraging all-day parkers who pay lower per-hour rates but guarantee long-duration occupancy. Weekend rates might run 50% below weekday rates to attract restaurant, shopping, and entertainment traffic when business commuter demand disappears. Implementing these pricing strategies through mobile applications requires sophisticated rate calculation engines that apply appropriate pricing based on entry time, exit time, customer account type, and current facility occupancy.

The operational dashboard provided to facility managers serves functions that consumer-facing applications don't address. Real-time occupancy displays show space availability across different sections—particularly valuable in multi-level garages where overflow parking can be directed to less-utilized floors. Historical utilization analysis identifies underperforming periods when promotional rates might attract incremental demand without cannibalizing full-price business. Revenue reporting breaks down income by payment method (cash, credit card, mobile app, monthly subscriptions) so operators understand processing costs and can incentivize lower-cost payment channels through small discounts. Alert notifications flag anomalies including gates stuck open, payment system outages, or unusual transaction patterns that might indicate fraud or technical malfunctions requiring immediate attention.

For medical centers, universities, and corporate campuses with large employee and visitor populations, integrated parking and access control delivers significant convenience value. A single credential—whether physical card, mobile app, or vehicle license plate—can provide building access, parking authorization, payment handling, and security tracking. Employees with parking privileges automatically have their monthly parking fees deducted from payroll, eliminating separate billing. Visitors can pre-register their vehicles and receive digital passes that grant building and parking access for specific dates, with appropriate hosts receiving notifications when visitors arrive. Emergency responders get automatic gate access without stopping, while the system logs vehicle entries for security purposes. These integrated access control systems represent high-value opportunities for Chicago app development firms with enterprise technology experience since they require coordination across HR systems, building management platforms, payment processors, and security infrastructure.

The subscription economy model has penetrated parking operations much as it has other service sectors. Rather than daily or hourly parking transactions, subscription parking offers unlimited monthly access to facilities or networks of facilities at fixed rates. For commuters, subscriptions eliminate daily payment friction while providing cost certainty—monthly rates typically amount to 15-20 parking days, so commuters parking 20+ days monthly save money. For operators, subscriptions provide predictable recurring revenue, reduce transaction processing costs, and create customer retention that fills base capacity before supplementing with more lucrative transient parking. Applications supporting subscription parking must handle recurring billing, prorated charges for mid-month subscriptions, suspension for vacations or leave periods, and the various payment failure scenarios when credit cards expire or decline.

A-Bots.com's IoT integration experience translates directly to private parking facility applications. The company's work on industrial machinery monitoring, agricultural sensor networks, and smart home systems all involve similar architectural patterns: physical sensors (occupancy sensors in parking), edge computing (local PARC controllers), cloud platforms (central management systems), mobile applications (user interfaces), and analytics dashboards (facility operator tools). The development methodology remains consistent across these IoT domains—begin with comprehensive requirements analysis documenting all stakeholder needs, architect systems for reliability and graceful degradation, implement security at every layer, conduct extensive testing under various failure scenarios, and provide ongoing support as operational realities inevitably reveal requirements that weren't apparent during design.

The Chicago Advantage: Why Local Development Matters

When organizations evaluate parking application development, the instinct often drives toward Silicon Valley firms or offshore development centers that promise cutting-edge technology and cost savings respectively. However, Chicago app development offers distinct advantages for parking projects specifically and urban mobility applications generally. The city's combination of robust technology talent, proximity to diverse client industries, understanding of Midwest business culture, and experience with urban infrastructure creates an ideal environment for developing parking solutions that must balance technology sophistication with operational pragmatism and regulatory complexity.

Chicago's technology sector has matured substantially beyond its historical manufacturing and finance roots. The metropolitan area now hosts vibrant startup ecosystems in neighborhoods like River North, Fulton Market, and the West Loop, along with established technology services firms, enterprise software companies, and the research and development centers of major corporations. This ecosystem produces deep talent pools across mobile development, cloud infrastructure, data analytics, IoT systems, and enterprise integration—precisely the skillsets parking applications demand. Unlike Silicon Valley where talent competition and cost of living drive compensation to levels that make many projects economically unviable, Chicago's lower cost structure enables sustainable economics for parking application development while still accessing world-class technical talent.

Geographic proximity matters significantly for parking application projects due to the importance of understanding operational context. Developing effective parking technology requires experiencing the frustration of circling for spaces, understanding how parking enforcement actually operates, observing how users interact with pay stations and mobile apps under time pressure, and comprehending the political dynamics between cities, facility operators, and neighborhood residents. Chicago developers naturally possess this contextual knowledge, while developers in San Francisco or Bangalore must spend time and effort acquiring understanding that local teams inherently bring to projects. When applications encounter operational issues after deployment—and they inevitably do—having developers within driving distance of affected facilities enables rapid problem diagnosis and resolution rather than remote debugging attempts.

The regulatory environment for parking in Chicago and Illinois broadly provides lessons applicable throughout the Midwest and many other regions. Illinois municipalities exercise home rule authority that grants cities broad powers over local parking regulation, creating somewhat fragmented regulatory landscape where different cities implement different rules. Understanding this regulatory complexity helps developers anticipate variation and architect flexible systems that accommodate jurisdiction-specific requirements without requiring complete rebuilds for each deployment. Chicago-based developers have navigated relationships with the Illinois Department of Transportation, Chicago Department of Transportation, and various municipal authorities, building networks and institutional knowledge valuable for parking projects requiring regulatory approvals, permit integrations, or public-private partnerships.

Client industries concentrated in the Chicago metropolitan area create natural synergies for parking application development. The region's healthcare sector, anchored by institutions including Northwestern Medicine, Rush University Medical Center, UChicago Medicine, and Advocate Health Care, collectively operate extensive parking facilities requiring sophisticated management. Corporate headquarters for companies including Boeing, McDonald's, Walgreens, Caterpillar, and numerous others maintain large campus parking systems. Major universities including University of Chicago, Northwestern University, University of Illinois Chicago, and DePaul University manage parking for tens of thousands of students, faculty, and staff. Convention and hospitality venues including McCormick Place, Navy Pier, numerous downtown hotels, and entertainment districts require event parking coordination. This concentration of potential clients within metropolitan Chicago creates opportunities for local development firms to build deep domain expertise and long-term client relationships.

The collaborative approach characteristic of Midwest business culture also influences successful parking technology projects. Unlike coastal tech scenes sometimes criticized for prioritizing disruption over stakeholder engagement, Chicago firms typically emphasize partnership approaches that respect existing operations while introducing technological improvements. For established parking operators hesitant about digital transformation, this collaborative stance reduces adoption barriers and increases project success rates. Understanding that parking facilities employ real people—attendants, managers, maintenance staff—whose jobs might be affected by automation, and approaching implementations with change management sensitivity rather than purely technological optimization, creates sustainable solutions that organizations can actually operate rather than impressive demonstrations that don't survive contact with operational reality.

The professional services orientation of Chicago's business culture extends to technology development, where long-term client relationships and ongoing support take precedence over short-term project transactions. Parking applications require continuous support—operating systems update, payment processing regulations change, new devices must be supported, security vulnerabilities require patches, and operational requirements evolve as facility operators learn from usage data. Development firms treating projects as one-time deliverables rather than ongoing partnerships leave clients stranded when inevitable maintenance needs arise. Chicago app development firms, inheriting the Midwest's manufacturing sector's service mentality, generally structure relationships for longevity rather than quick exits. A-Bots.com's 1.5 to 5+ year client relationships exemplify this orientation—projects evolve from initial development through testing, deployment, ongoing enhancements, integration expansions, and eventually to next-generation rebuilds, creating sustained partnerships rather than transactional engagements.

For organizations throughout the Midwest evaluating parking application development, Chicago's central location provides convenient access from Minneapolis, St. Louis, Indianapolis, Milwaukee, Detroit, and other major regional cities. This geographic convenience facilitates in-person meetings for requirements gathering, user testing sessions at actual facilities, and training for operational staff—all activities that benefit from face-to-face interaction difficult to replicate through video conferences. The cultural alignment between Chicago developers and Midwest clients also smooths communication—shared values around practicality, straightforward communication, and realistic assessments of what technology can accomplish create productive working relationships less prone to the miscommunications that plague projects spanning vastly different business cultures.

Testing Services: Ensuring Parking Application Quality

While custom development captures attention, comprehensive testing services represent equally critical capabilities that organizations often underestimate. Existing parking applications frequently suffer from performance degradation, security vulnerabilities, user experience friction, payment processing errors, and integration failures that damage user satisfaction and operational reliability. Rather than abandoning problematic applications for complete rebuilds, professional testing services can identify specific issues and guide targeted improvements that restore functionality at fractions of redevelopment costs. A-Bots.com's testing capabilities serve organizations with troubled parking applications as effectively as the company's development capabilities serve those building new systems.

Functional testing verifies that parking applications perform their advertised capabilities correctly under normal operating conditions. This includes validating that payment processing completes successfully across all supported payment methods (credit cards, debit cards, Apple Pay, Google Pay, PayPal), confirming that parking time extensions modify expiration correctly, ensuring that transaction histories display accurate records, verifying that notifications arrive at appropriate times, and checking that customer service features connect users with support resources. Comprehensive functional testing requires test cases covering every user journey through the application—from account creation through parking session completion to payment history review—documenting expected behaviors and identifying deviations indicating bugs or design defects.

Performance testing evaluates application behavior under load conditions that simulate real-world usage during peak demand periods. A parking application might function perfectly with 100 concurrent users but degrade catastrophically when 5,000 users attempt transactions simultaneously during morning rush hour or when major events create parking surges. Performance testing uses specialized tools that simulate thousands of virtual users executing representative transactions, measuring response times, error rates, and infrastructure utilization under increasing load. This testing identifies bottlenecks—database queries requiring optimization, insufficient application server capacity, inadequate cache sizing, API integration latency—before they cause production outages that generate angry users and lost revenue. For applications like ParkChicago handling hundreds of thousands of users, performance testing isn't optional but mandatory for operational reliability.

Security testing assumes particular importance for parking applications that handle payment information, store user credentials, and process financial transactions worth millions of dollars annually. Penetration testing attempts to exploit common vulnerabilities including SQL injection attacks targeting databases, cross-site scripting attacks compromising user sessions, man-in-the-middle attacks intercepting payment data, and authentication bypass techniques gaining unauthorized account access. Vulnerability scanning identifies outdated software components with known security flaws, misconfigured servers exposing sensitive data, and insecure API endpoints allowing unauthorized data access. Compliance validation confirms that applications meet PCI DSS requirements for payment card data handling, implement data encryption for information in transit and at rest, and follow security best practices including secure password storage, session management, and audit logging.

Usability testing observes real users attempting to complete typical parking tasks, identifying interface confusion, navigation difficulties, unclear terminology, and workflow friction that frustrates users and prevents task completion. What seems obvious to developers intimately familiar with applications often confounds users approaching systems for the first time under time pressure and distraction. For parking applications, usability testing should occur in realistic contexts—users shouldn't sit in quiet labs but rather attempt parking payment while parked on busy streets with limited time before reaching their destinations. This environmental context reveals usability problems that lab testing misses, such as small buttons difficult to tap with cold fingers, text too small to read in bright sunlight, or complex workflows requiring concentration impossible amid traffic noise and parking anxiety.

Integration testing verifies that parking applications correctly interact with the numerous external systems they depend upon: payment gateways processing transactions, PARC systems controlling physical gates, parking guidance sensors reporting space occupancy, citation management systems checking violation history, permit databases validating authorization credentials, mapping services providing geolocation, and push notification platforms delivering alerts. Each integration point introduces potential failure modes—network timeouts, incompatible data formats, mismatched protocol versions, authentication failures, rate limiting, and the myriad problems that emerge when independently developed systems attempt interoperation. Integration testing uses both controlled test environments and production monitoring to detect integration failures before they impact users.

Compatibility testing confirms that parking applications function correctly across the diverse device ecosystem that users actually possess. Rather than testing only on the latest iPhone and Samsung Galaxy models that developers carry, comprehensive compatibility testing includes older devices that budget-conscious users keep for years, various screen sizes from compact phones to large tablets, different operating system versions from users who delay updates, and the accessibility features that disabled users depend upon. Testing must also verify functionality across network conditions from high-speed WiFi to slow cellular connections and even offline operation for features that should cache data locally. The fragmented Android ecosystem presents particular challenges with thousands of device models running various OS versions with manufacturer customizations—thorough testing requires either extensive device labs or cloud-based testing services providing access to hundreds of device configurations.

Regression testing ensures that new features and bug fixes don't inadvertently break previously working functionality—a depressingly common occurrence in software development. As applications evolve through multiple releases, regression testing suites accumulate test cases covering all critical functionality, running automatically whenever developers propose changes. Automated testing tools execute these test suites, comparing actual behavior against expected results, flagging any deviations indicating that new code introduced bugs. For parking applications processing thousands of daily transactions worth significant revenue, regression testing provides insurance that updates won't cause embarrassing outages or revenue-impacting errors.

For parking facility operators, cities, or venue managers experiencing problems with their existing applications—frequent crashes, slow performance, payment failures, user complaints, declining usage—professional testing services diagnose root causes and recommend remediation strategies. A-Bots.com's testing services begin with problem replication to confirm reported issues actually occur and aren't user errors or environmental factors, proceed through systematic testing across likely failure categories, document all identified issues with severity ratings and reproduction procedures, and provide prioritized remediation recommendations with effort estimates. This diagnostic approach enables informed decisions about whether to repair, replace, or restructure troubled applications based on objective assessment rather than anecdotal frustration or vendor sales pitches.

Future Directions: Autonomous Vehicles and Mobility Integration

The parking application sector stands on the cusp of fundamental transformation driven by autonomous vehicle technology, electric vehicle charging infrastructure, and comprehensive mobility-as-a-service platforms that integrate parking with broader transportation systems. While today's parking applications serve human drivers searching for spaces and manually parking their vehicles, tomorrow's systems must accommodate autonomous vehicles that park themselves, coordinate charging during parking sessions, and integrate with transportation networks where vehicle ownership declines in favor of on-demand mobility services. Chicago app development firms building parking applications today must architect systems with flexibility to evolve toward these emerging paradigms rather than optimizing purely for current usage patterns.

Autonomous vehicle parking introduces fundamentally different operational requirements compared to human-driven vehicles. Self-parking cars can utilize denser parking configurations since doors don't need to open, reducing aisle widths and allowing spaces as narrow as 7 feet instead of the 9-foot widths human drivers require. Autonomous vehicles can stack or park in puzzle arrangements where vehicles must move others to create exit paths, dramatically increasing capacity per square foot of parking area. Applications must coordinate vehicle movements, optimize space allocation, schedule retrieval to minimize wait times, and handle the billing complexity when multiple users' vehicles occupy single spaces sequentially throughout the day. SpotHero's announcement that it prepared 500 Chicago parking facilities for autonomous vehicles demonstrates forward-thinking recognition that parking infrastructure must evolve in anticipation of AV adoption rather than reacting after autonomous vehicles achieve significant market penetration.

Electric vehicle charging integration transforms parking from passive space occupancy into active energy delivery, creating both technical requirements and business model opportunities. Applications must coordinate charging station availability, communicate vehicle charging needs to station infrastructure, monitor charging session progress, allocate electrical capacity across multiple simultaneous charging sessions, and bill for both parking and electricity separately or in integrated packages. Dynamic pricing can reflect electricity costs that vary throughout the day based on utility time-of-use rates, incentivizing off-peak charging that reduces grid stress. For parking facilities, EV charging represents revenue opportunity beyond space rental—charging fees can exceed parking fees for long-duration sessions. However, infrastructure investment required for high-voltage charging stations creates significant capital requirements that smaller parking operators struggle to justify without confidence that EV adoption will generate utilization justifying installation costs.

Mobility-as-a-service platforms envision integrated transportation where users purchase journeys rather than individual ride segments, with applications coordinating transit, ride-sharing, bike-sharing, parking, and other modalities into seamless door-to-door experiences. In this model, parking becomes one component of broader trip planning—applications might recommend taking transit downtown, parking at suburban stations, or using ride-sharing for segments where parking is particularly scarce or expensive. Revenue sharing among transportation providers, subscription models covering unlimited metropolitan mobility, and governmental subsidies encouraging sustainable transportation choices all represent business model innovations that parking applications must accommodate. For Chicago, integrating parking applications with CTA transit information, Divvy bike-share systems, and ride-sharing platforms could reduce downtown parking pressure while maintaining convenient mobility for residents and visitors.

The data generated by parking applications provides valuable inputs for comprehensive urban mobility planning. Aggregate parking demand patterns inform transit planning—neighborhoods with high parking demand but limited transit access might justify new bus routes or train stations. Parking price elasticity data reveals how pricing affects mode choice, informing congestion pricing policies that charge for street access during peak periods. Integration between parking applications and traffic management systems enables holistic optimization where parking pricing dynamically adjusts to influence arrival patterns and distribute demand temporally rather than concentrating arrivals that cause traffic gridlock. Cities pursuing smart city initiatives increasingly recognize parking data as essential component of comprehensive urban data platforms that inform evidence-based policy across transportation, economic development, and environmental sustainability.

Privacy considerations grow increasingly important as parking applications accumulate detailed location histories revealing where users work, live, shop, receive healthcare, and attend events. While this data enables valuable services including favorite location saving, payment method selection, and usage pattern analysis, it also creates surveillance concerns and potential misuse risks. Applications must implement strong data governance policies that restrict data access, obtain explicit user consent for data sharing, allow users to delete location history, and prevent data sale to third parties. Regulatory frameworks including California's Consumer Privacy Act and the European Union's General Data Protection Regulation establish user privacy rights that parking applications must respect even when operating in jurisdictions without equivalent regulations. Building privacy protection into applications from initial design rather than bolting it on afterward—the privacy-by-design approach—creates more robust protection and demonstrates commitment to user rights.

For organizations planning parking application development, considering these future directions during architecture design creates systems positioned for evolution rather than premature obsolescence. While autonomous vehicles remain years from mainstream adoption and mobility-as-a-service business models are still emerging, the technical foundations—API-first architectures enabling integration, event-driven designs supporting real-time coordination, flexible data models accommodating new attributes, cloud-native infrastructure enabling elastic scaling—position applications for future enhancements. A-Bots.com's approach emphasizes modular architecture where components can be updated independently rather than monolithic systems requiring complete rebuilds for major changes. This architectural philosophy, combined with the company's track record across diverse technology domains including IoT, blockchain, and machine learning, provides clients confidence that parking applications developed today will evolve effectively as industry requirements transform throughout the coming decades.

Cost Considerations and Development Timelines

Organizations evaluating parking application development naturally want to understand investment requirements and project timelines before committing to initiatives. However, parking application costs vary substantially based on scope, complexity, integration requirements, and deployment scale. A basic mobile app handling payment for a single parking facility might require $50,000-100,000 and 3-4 months development, while comprehensive municipal systems coordinating thousands of meters, enforcement systems, permit databases, and administrative dashboards can consume $500,000-2,000,000+ and 12-18 months. Understanding the factors driving this cost variation helps organizations scope projects realistically and allocate budgets appropriately.