Home

Services

About us

Blog

Contacts

BEAUTY SOCIAL COMMERCE APPS: BUILDING THE NEXT GENERATION OF INFLUENCER-DRIVEN SHOPPING PLATFORMS

The beauty industry stands at the intersection of social media influence and instant purchasing power, creating unprecedented opportunities for brands that can harness the momentum of social commerce. Beauty social commerce applications combine video content, influencer marketing, and seamless transaction capabilities into unified platforms where discovery, engagement, and purchase occur within seconds. These applications have fundamentally altered how consumers find, evaluate, and buy beauty products, with social and e-commerce channels now driving more than 50 percent of global beauty sales.

A-Bots.com specializes in developing custom beauty social commerce applications that integrate livestream shopping capabilities, influencer affiliate systems, user-generated content management, and advanced e-commerce functionality. The company's mobile app development expertise spans social video platforms, real-time payment processing, content moderation systems, and creator monetization frameworks. A-Bots.com builds beauty social commerce applications from the ground up, incorporating augmented reality try-on features, AI-powered product recommendations, live shopping event management, and comprehensive analytics dashboards that track engagement metrics, conversion rates, and influencer performance in real time.

For brands entering the beauty social commerce space, A-Bots.com delivers complete platform development including video streaming infrastructure, integrated payment systems, inventory management, affiliate commission tracking, and customer relationship management tools. The company's development approach accounts for the specific technical challenges of beauty social commerce: handling high-volume concurrent livestreams, processing rapid transaction spikes during viral moments, managing complex creator payment structures, and maintaining content quality standards across thousands of user-generated videos. A-Bots.com's testing services ensure platform stability during peak traffic events, validate secure payment processing, verify content moderation effectiveness, and confirm accurate commission calculations for affiliate networks.

Beyond new platform development, A-Bots.com provides comprehensive testing services for existing beauty social commerce applications. The company's quality assurance specialists examine livestream video quality across varying network conditions, test checkout flows under stress conditions, validate recommendation algorithm accuracy, and assess mobile app performance on diverse device configurations. For established platforms, A-Bots.com conducts security audits of payment systems, evaluates user authentication mechanisms, tests data privacy compliance, and validates content delivery network performance. This specialized testing capability ensures beauty social commerce applications maintain reliability and security as they scale from initial launches to millions of active users.

A-Bots.com's experience with IoT integration extends naturally into beauty social commerce applications, where connected devices increasingly play roles in personalized shopping experiences. The company develops integrations between beauty tech devices and social commerce platforms, enabling smart mirrors to share product recommendations directly to shopping apps, connecting skin analysis tools to curated product feeds, and linking smart makeup applicators to tutorial content. These IoT capabilities transform beauty social commerce from simple shopping into comprehensive beauty ecosystems where device data, influencer recommendations, and purchase opportunities converge seamlessly.

The company's blockchain development capabilities support emerging requirements in beauty social commerce, particularly around authenticity verification, transparent supply chains, and creator compensation. A-Bots.com implements blockchain solutions for verifying product authenticity, tracking creator commissions through smart contracts, managing limited edition product releases, and creating transparent transaction records for brand partnerships. These blockchain integrations address growing consumer demands for product transparency and fair creator compensation within social commerce ecosystems.

A-Bots.com's chatbot development services enhance beauty social commerce platforms with AI-powered customer support, product recommendation engines, and personalized shopping assistants. These conversational AI systems answer product questions during livestreams, provide ingredient information, suggest complementary products, and guide users through purchase processes. The company's chatbots integrate with existing social commerce platforms, accessing real-time inventory data, processing natural language queries about product specifications, and offering personalized recommendations based on user preferences and purchase history.

For beauty brands and entrepreneurs planning social commerce platforms, A-Bots.com provides strategic technical consulting that evaluates platform requirements, recommends optimal technology stacks, designs scalable architectures, and creates implementation roadmaps. The company's consulting services address critical decisions around video infrastructure providers, payment gateway selection, content delivery networks, database architectures, and security frameworks. This expertise helps clients avoid costly technical mistakes and build platforms capable of supporting rapid growth as social commerce adoption accelerates.

THE BEAUTY SOCIAL COMMERCE REVOLUTION: MARKET DYNAMICS AND GROWTH TRAJECTORY

The global social commerce market reached 877.03 billion dollars in 2025, expanding at a compound annual growth rate of 14.7 percent from the previous year's 764.49 billion dollars. Within this massive market, beauty and personal care products dominate transaction volumes, with platforms like TikTok Shop selling a beauty product every two seconds during peak periods. Beauty's natural fit with visual social media, combined with consumer demand for authentic product demonstrations, has positioned the category as the leading driver of social commerce growth worldwide.

Social commerce now accounts for 22 percent of global beauty product sales, with three percent of all e-commerce transactions occurring directly through social media platforms. This represents a fundamental shift in beauty retail, where traditional pathways from awareness to purchase have compressed into single-session journeys on social platforms. TikTok's influence particularly stands out: the platform contributed to a 22 percent year-over-year increase in beauty product sales across all social commerce platforms in 2024, according to Euromonitor International. TikTok Shop alone generated 1.34 billion dollars in health and beauty sales in the United States during 2024, accounting for 79.3 percent of the platform's total U.S. sales volume.

The United States social commerce market demonstrates explosive growth potential, with revenue projected to reach 79.64 billion dollars by 2025, representing 5.2 percent of total e-commerce sales. More than 100 million Americans made social commerce purchases in 2024, representing 46 percent of all social media users in the country. Among these buyers, beauty products rank consistently as the most purchased category, driven by the visual nature of cosmetics and skincare, the influence of beauty content creators, and the effectiveness of video demonstrations in conveying product benefits that static images cannot capture.

Beauty-focused social commerce platforms face intense competition from major technology companies, as evidenced by the market consolidation that occurred throughout 2023 and 2024. Flip, a beauty social commerce startup that raised 144 million dollars in Series C funding and achieved a 1.05 billion dollar valuation in April 2024, abruptly shut down in August 2025 after failing to compete with TikTok Shop's algorithmic advantages and massive user base. Similarly, Supergreat, which raised 9 million dollars and built a community around authentic beauty reviews, closed operations in November 2023 and merged its team into Whatnot, a broader livestream shopping platform. These market exits underscore the winner-take-most dynamics of social commerce, where platform effects, network liquidity, and algorithmic efficiency create substantial barriers to entry for specialized platforms attempting to compete with established social media giants.

Despite these challenges, opportunities remain for specialized beauty social commerce applications that serve specific niches, geographic markets, or brand ecosystems. The closure of standalone platforms like Flip and Supergreat created demand for white-label solutions and brand-owned social commerce experiences that don't depend on third-party platform policies or algorithm changes. Beauty brands increasingly seek proprietary platforms where they control the customer relationship, own the transaction data, and avoid revenue-sharing arrangements with platform providers. This trend toward owned social commerce platforms creates opportunities for custom development companies to build tailored solutions that integrate with existing brand ecosystems while incorporating proven social commerce features.

INFLUENCER MARKETING: THE ENGINE DRIVING BEAUTY SOCIAL COMMERCE

Influencer marketing represents the fundamental value proposition of beauty social commerce, with 70 percent of beauty purchases influenced by social media and influencer recommendations. This influence operates at scale: approximately 44.7 percent of TikTok consumers make purchase decisions based on paid influencer recommendations, while 42 percent of consumers aged 18 to 24 report that social media platforms directly inspire their beauty product purchases. The authenticity and relatability of influencer content creates trust that traditional advertising struggles to achieve, particularly among Gen Z and millennial consumers who have developed sophisticated filters for recognizing promotional content.

The economics of influencer marketing have matured substantially, with U.S. brands spending 1.25 billion dollars on TikTok influencer marketing in 2024, up 26.7 percent from the previous year. Total TikTok influencer marketing spending is estimated to reach 2.35 billion dollars in 2025, representing an 87.4 percent increase from 2024 levels. These investments reflect documented returns: TikTok affiliate links generate a 5.2 percent engagement rate, 160 percent higher than comparable Instagram affiliate content. The platform's algorithmic advantage becomes evident in engagement metrics across influencer tiers, with TikTok influencers with fewer than 50,000 followers achieving a 30.1 percent engagement rate for affiliate links, 1,570 percent higher than comparable Instagram influencers.

The beauty social commerce ecosystem currently includes 15.3 million TikTok influencers globally, with 851,000 actively selling products through videos or livestreams, representing 5.57 percent of the total influencer base. While this small percentage generates sales, the concentration of revenue among top performers remains extreme: only 291 influencers exceeded one million dollars in gross merchandise value during the first half of 2025, while the majority generated under 10,000 dollars. This power law distribution creates both opportunities and challenges for beauty social commerce platforms, which must attract high-performing creators to drive platform liquidity while also enabling monetization for mid-tier and micro-influencers who collectively represent substantial transaction volume.

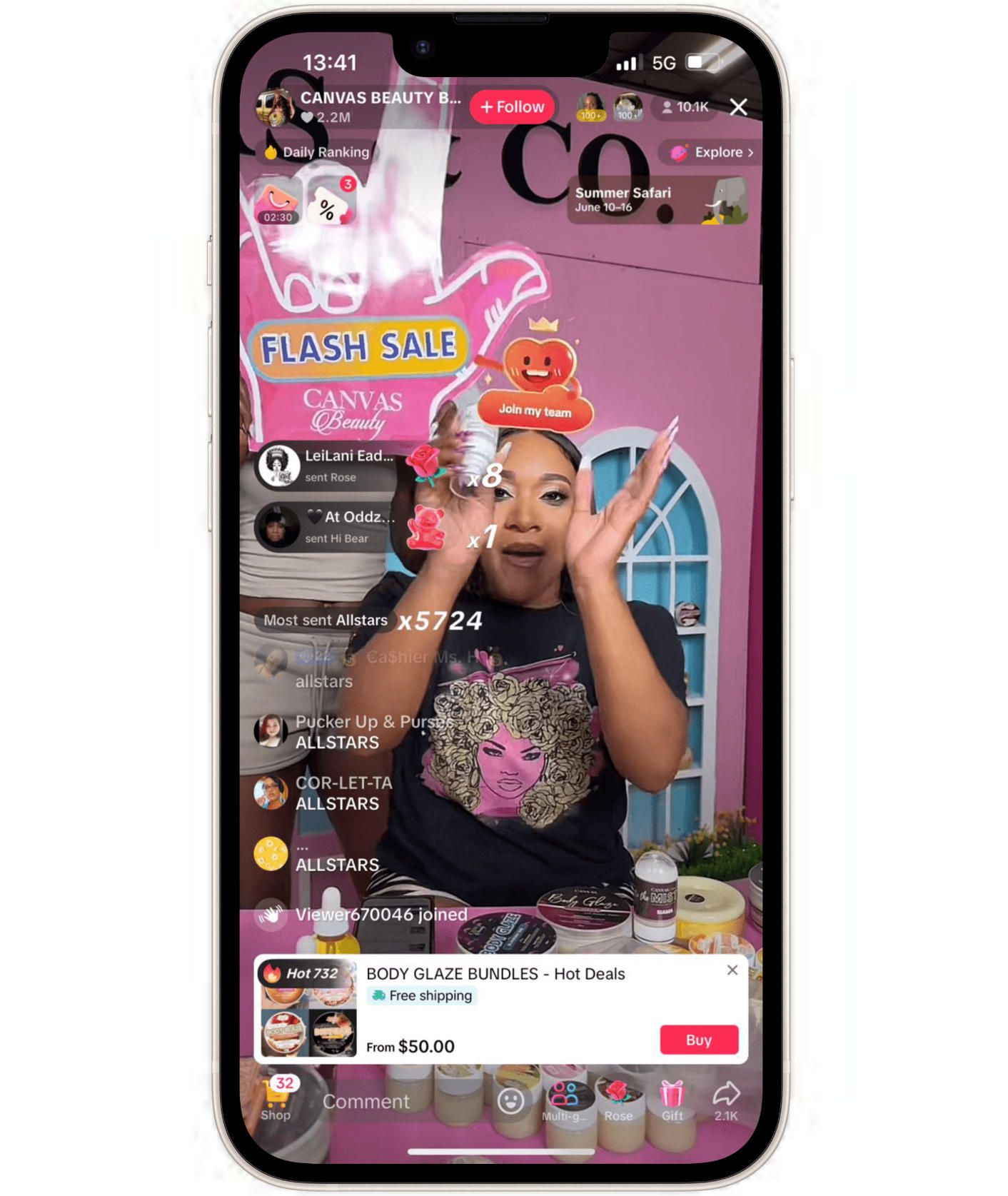

Livestream shopping represents the pinnacle of influencer-driven social commerce, with conversion rates reaching 30 percent during live events, approximately 10 times higher than conventional e-commerce. During Black Friday 2024, brands and creators hosted over 30,000 shopping events on TikTok Shop, generating more than 100 million dollars in sales in a single day. Individual brand success stories demonstrate the format's potential: Canvas Beauty founder Stormi Steele reported generating two million dollars in sales during a single day of livestream events on TikTok Shop. These exceptional results stem from livestreaming's unique combination of entertainment, authenticity, real-time interaction, and limited-time urgency that compels immediate purchase decisions.

The shift toward micro and nano influencers reflects evolving consumer preferences for authenticity over production value. In 2024, 44 percent of brands utilized nano-influencers with between 1,000 and 10,000 followers, up from 39 percent in 2023. These smaller creators typically generate engagement rates two to three times higher than larger influencers, while maintaining stronger community connections and perceived authenticity. For beauty social commerce platforms, this trend suggests that creator diversity and community cultivation matter more than celebrity partnerships, with successful platforms enabling monetization pathways for creators at all audience levels rather than concentrating on established influencer talent.

Beauty influencer content on TikTok encompasses diverse formats beyond traditional product reviews, including "get ready with me" videos, makeup tutorials, ingredient education, brand comparisons, and "de-influencing" content that actively discourages purchases of overhyped products. This content diversity keeps beauty content fresh and maintains user trust by including both positive and critical product evaluations. Platforms that support this content diversity while maintaining commerce functionality position themselves advantageously, as users increasingly value authentic opinions over uniformly positive promotional content.

TECHNOLOGY ARCHITECTURE: BUILDING ROBUST BEAUTY SOCIAL COMMERCE PLATFORMS

Building a beauty social commerce application requires integrating multiple complex technical systems into a cohesive user experience. The core architecture typically consists of video streaming infrastructure, e-commerce transaction processing, user authentication and profiles, content recommendation algorithms, creator management systems, and analytics platforms. Each component must operate reliably at scale while maintaining low latency, as user expectations for instant video loading and seamless checkout have been set by major social platforms.

Video Streaming Infrastructure

Video streaming infrastructure represents the most technically demanding component of beauty social commerce applications. Platforms must support both pre-recorded video content and live streaming, with each requiring different technical approaches. Pre-recorded content benefits from content delivery networks that cache videos geographically close to users, reducing latency and bandwidth costs. Live streaming requires real-time encoding, adaptive bitrate streaming to accommodate varying network conditions, and sub-second latency to enable genuine real-time interaction between hosts and viewers. The most successful platforms utilize specialized livestream video providers like Agora, Dolby.io, or custom WebRTC implementations that balance video quality, latency, and operational costs.

For live shopping events with thousands of concurrent viewers, platforms must handle significant infrastructure challenges. A single popular livestream can generate peak traffic equivalent to normal daily loads, requiring elastic scaling capabilities that spin up additional server capacity within seconds. Payment processing systems must handle transaction spikes during flash sales or limited drops, often processing hundreds of transactions per second without errors or delays. Database architectures must support both the heavy write loads from new orders and real-time inventory queries that prevent overselling popular products.

Recommendation Algorithms

Recommendation algorithms form the competitive moat for beauty social commerce platforms, determining which content surfaces to which users and directly impacting engagement and conversion rates. These algorithms analyze user behavior including watch time, engagement patterns, past purchases, search queries, and demographic data to predict which products and creators will resonate with individual users. The most sophisticated platforms incorporate collaborative filtering that identifies similar users and recommends content that performed well with comparable audiences. Real-time algorithm updates ensure that trending content surfaces quickly, capitalizing on viral moments before they peak.

Creator Management Systems

Creator management systems handle the complex operational requirements of managing thousands of influencers, including content submission workflows, compliance checking, commission tracking, and payment processing. These systems validate that content meets platform guidelines, automatically detect prohibited content types, track which products appear in which videos, and attribute sales to specific creators for commission calculation. Payment systems must support diverse payout structures including flat fees for sponsored content, percentage commissions on attributed sales, and hybrid models that combine base payments with performance bonuses.

Mobile App Development

Mobile app development for beauty social commerce requires native iOS and Android applications that deliver smooth video playback, quick checkout flows, and offline capability for basic browsing. Native development enables features that web applications cannot match, including push notifications for livestream starts, background video playback, biometric authentication for quick checkout, and deep integration with platform sharing capabilities. The most successful beauty social commerce applications achieve sub-three-second app launch times and instant video playback, recognizing that users will abandon experiences that don't meet the performance standards set by TikTok and Instagram.

Augmented Reality Integration

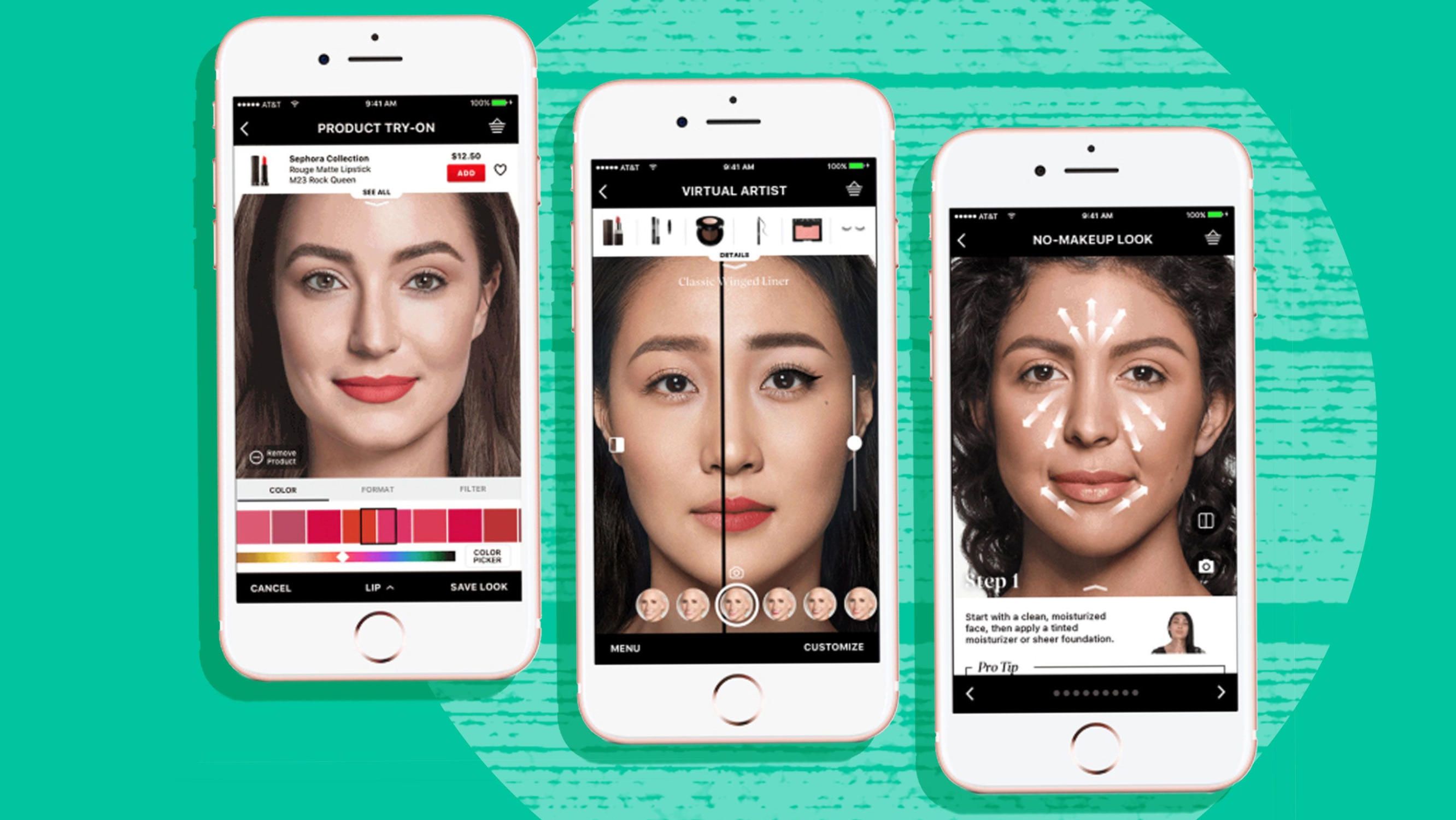

Augmented reality integration represents a key differentiator for beauty social commerce platforms, enabling virtual try-on experiences that help users visualize how products will look before purchase. AR try-on technology uses computer vision to detect facial features, map product textures onto user images, and render realistic previews of makeup products in real time. Leading platforms partner with specialized AR providers like Perfect Corp, ModiFace, or Banuba to deliver these features, or develop proprietary solutions using ARKit for iOS and ARCore for Android. The effectiveness of AR try-on features in reducing return rates and increasing conversion rates justifies the development investment, particularly for color cosmetics where shade matching represents a primary purchase barrier.

Artificial Intelligence

Artificial intelligence enhances beauty social commerce platforms across multiple dimensions including product recommendations, content moderation, customer service, and inventory optimization. AI-powered recommendation engines analyze user behavior to predict product preferences, while content moderation systems automatically detect prohibited content, copyright violations, and policy breaches. Customer service chatbots handle common questions about shipping, returns, and product specifications, reducing support costs while maintaining 24/7 availability. Inventory optimization algorithms predict demand for products based on trending content and historical patterns, helping brands avoid stockouts on viral products and reducing excess inventory on slower-moving items.

Payment Infrastructure

Payment infrastructure must support diverse transaction types including direct purchases, affiliate commissions, creator payments, and refund processing. Integration with major payment processors like Stripe, Adyen, or Square provides access to global payment methods, fraud detection, and regulatory compliance. For international platforms, multi-currency support and local payment method integration become essential, as payment preferences vary significantly across markets. The checkout experience itself requires extensive optimization, with successful platforms achieving conversion rates above 70 percent from cart to completed purchase through streamlined flows, saved payment methods, and one-click buying capabilities.

Data Analytics

Data analytics infrastructure provides the insights necessary for platform optimization, creator performance tracking, and business intelligence. Real-time dashboards track key metrics including concurrent viewers, transaction rates, average order values, and conversion funnels. Creator analytics show which content drives sales, which products perform best with specific audiences, and how engagement metrics correlate with purchase behavior. These insights enable data-driven optimization of recommendation algorithms, content strategies, and creator partnerships.

Security and Privacy

Security and privacy considerations pervade every aspect of beauty social commerce platform development. Payment systems must comply with PCI DSS standards for handling credit card data. User data collection and usage must align with GDPR in Europe, CCPA in California, and similar privacy regulations worldwide. Content moderation systems must prevent the spread of harmful content while respecting free expression. Age verification prevents minors from making purchases or accessing age-restricted content. Two-factor authentication protects creator accounts from takeover attempts. Regular security audits and penetration testing identify vulnerabilities before malicious actors can exploit them.

THE RISE AND FALL OF STANDALONE BEAUTY SOCIAL COMMERCE PLATFORMS

The rapid growth of beauty social commerce has attracted significant venture capital investment in standalone platforms attempting to carve out market share before major social networks dominate the space entirely. These platforms generally followed similar models: combining TikTok-style short video feeds with integrated e-commerce capabilities, focusing exclusively on beauty content, and monetizing through transaction fees and brand partnerships. While the vision appeared sound, execution challenges and competitive dynamics from established platforms led to the closure of several prominent startups.

Flip: The Billion-Dollar Failure

Flip represented the most ambitious attempt at building a dedicated beauty social commerce platform. Founded in 2019 by serial entrepreneur Noor Agha, Flip raised 31.5 million dollars by 2021, including a 28 million dollar Series A round led by Streamlined Ventures. The platform's core concept positioned it as "TikTok meets Sephora," where every video focused on beauty products and included built-in shopping links. Users could post video reviews of purchases and earn commissions based on sales generated from their content, democratizing influencer earnings beyond established creators. The platform attracted over 200 brands including Hourglass, RMS Beauty, and E.l.f. Cosmetics, growing to 1 million downloads and processing over 30,000 orders by August 2021.

Flip's apparent momentum continued through 2024, when the company raised a 144 million dollar Series C round in April, achieving a 1.05 billion dollar valuation. The funding round included the acquisition of social commerce company Curated for 300 million dollars in stock, signaling aggressive expansion plans. However, Flip's growth tactics became increasingly aggressive and ultimately unsustainable. The platform rolled out referral programs offering up to 150 dollars in credit to both referrers and new users, causing customer acquisition costs to spike while attracting deal-seekers rather than genuine community members. The platform also incentivized users to upload phone contacts in exchange for rewards, raising privacy concerns and damaging brand reputation.

By August 2025, just four months after its Series C round, Flip abruptly shut down. Users opening the app encountered a closure message noting the platform's mission to provide authentic product reviews and genuine creator videos, thanking participants for their involvement. The shutdown left creators and brand partners without warning, with many having outstanding balances for commissions and inventory. Flip's failure stemmed primarily from its inability to compete with TikTok Shop's algorithmic advantages, established user base, and lower customer acquisition costs. As TikTok Shop exploded in the United States, Flip found itself unable to maintain user growth despite burning capital on unsustainable incentive programs.

Supergreat: Community-First Approach

Supergreat followed a similar trajectory with a different approach to community building. Founded in 2018 by Tyler Faux and Dan Blackman, Supergreat positioned itself as a community-based app where beauty enthusiasts could review products, share routines, and shop exclusive drops from brands. The platform raised 9 million dollars total, including a 6.5 million dollar Series A round led by Benchmark in December 2020. Supergreat's community created over 180,000 videos reviewing more than 30,000 products, with video watch time tripling during a six-month period in 2021.

The platform employed a gamification strategy through "Supercoins," an in-app currency that users earned by creating content, inviting friends, and participating in challenges. These coins could be redeemed for full-size beauty products during daily "rewards drops" at 7 p.m. Eastern time. Supergreat launched livestream shopping features in February 2021, hosting events with brands like Glow Recipe, Supergoop, and Starface. Top live events generated more than 60 dollars per minute of broadcast time, with typical events attracting 600 to 700 concurrent viewers and generating 2,500 comments in 30 minutes.

Despite engaged community metrics and brand partnerships with retailers like Ulta Beauty, Supergreat struggled to achieve the scale necessary for venture-backed returns. The platform never disclosed precise transaction volumes, but industry observers estimated annual gross merchandise value in the low millions of dollars, far below the growth trajectory required to justify its 9 million dollar funding. In November 2023, Supergreat announced its closure and the merger of most team members into Whatnot, a larger livestream shopping platform covering multiple categories beyond beauty. The acquisition represented an acqui-hire rather than a successful exit, with Whatnot primarily interested in Supergreat's team and technology rather than its user base.

Lessons from Platform Failures

The failures of Flip and Supergreat illuminate the structural challenges facing standalone beauty social commerce platforms in competition with integrated social networks. TikTok Shop benefits from TikTok's existing user base of over 1.37 billion global users and 135 million U.S. users, eliminating customer acquisition costs that burdened standalone platforms. TikTok's recommendation algorithm, trained on billions of user interactions, surfaces relevant content with precision that smaller platforms cannot match. The seamless integration of entertainment and commerce within TikTok's existing user habits creates lower friction than requiring users to download separate shopping applications. These platform advantages, combined with TikTok's willingness to subsidize early merchant and creator adoption, created a competitive environment where specialized platforms struggled to achieve sufficient scale.

TIKTOK SHOP: THE DOMINANT FORCE IN BEAUTY SOCIAL COMMERCE

TikTok Shop has emerged as the unambiguous market leader in beauty social commerce, leveraging ByteDance's sophisticated recommendation algorithms, massive user base, and deep integration with the TikTok social experience. Launched in the United States in September 2023, TikTok Shop reached 9 billion dollars in gross merchandise value during 2024, representing 650 percent growth from the previous year. Beauty and personal care products account for 22 percent of global TikTok Shop sales, generating 2.49 billion dollars in gross merchandise value during the first half of 2025. The platform sells a beauty product every two seconds during peak periods, demonstrating the velocity of transactions when algorithmic content discovery combines with frictionless in-app checkout.

TikTok Shop's success in beauty stems from several structural advantages. The platform's "For You" algorithm surfaces beauty content to users based on their engagement patterns, demographics, and past behavior, ensuring that product demonstrations reach audiences predisposed to purchase. The algorithm's effectiveness shows in conversion metrics: 68 percent of TikTok Shop purchases are impulse buys, driven by the immediate emotional engagement of video content combined with one-click purchasing. This impulse-driven behavior contrasts sharply with traditional e-commerce where users research products across multiple sessions before purchasing.

The economics of TikTok Shop favor both merchants and creators through relatively low take rates and attractive commission structures. TikTok charges merchants approximately 6 percent commission on sales, competitive with traditional marketplace platforms while lower than the 15 to 30 percent typical of affiliate networks. Creators earn 10 percent commission on sales generated during live shopping events, with over 100,000 creators actively participating in the TikTok Shop affiliate program. The best-performing creators achieve substantial revenue: one top livestream session generated 2.1 million dollars in sales over 14 hours, though such results remain exceptional, with only four out of four million livestreams exceeding one million dollars in sales.

Brand performance on TikTok Shop varies dramatically, with success dependent on content strategy, creator partnerships, and product-market fit. The Label, a Korean skincare brand, led TikTok Shop skincare sales from March 2024 to February 2025 with over 26 million dollars in sales. Korean beauty brand COSRX channeled 72 percent of its e-commerce sales through Amazon in 2024, but maintains significant TikTok Shop presence through influencer partnerships. Digitally native brands particularly benefit from TikTok Shop, as their social-first marketing strategies align naturally with the platform's content-driven discovery model.

Livestream shopping on TikTok Shop represents the platform's most powerful commerce format, combining entertainment, authenticity, and urgency into conversion machines. During typical live events, hosts demonstrate products, answer viewer questions in real time, and offer limited-time discounts that create immediate purchase motivation. The interactive format allows viewers to influence content direction through comments, request specific product demonstrations, and receive personalized recommendations from hosts. This interactivity, combined with social proof from other viewers' purchases and comments, creates powerful psychological triggers for impulse buying.

The platform's infrastructure handles exceptional scale during peak events. Black Friday 2024 saw over 30,000 shopping events hosted on TikTok Shop, collectively generating more than 100 million dollars in sales. The infrastructure automatically scales to accommodate traffic spikes, maintains sub-second latency for live interactions, and processes payment transactions without degradation during peak loads. This technical reliability, built on ByteDance's extensive experience operating at global scale, represents a substantial competitive advantage over platforms built by startups with limited infrastructure experience.

TikTok Shop's impact extends beyond direct sales to influence broader beauty industry trends. Products that achieve viral status on TikTok experience demand spikes that stress brand supply chains, sometimes selling out within hours. The "TikTok made me buy it" phenomenon has launched numerous beauty brands and products into mainstream awareness, with retailers like Sephora and Ulta Beauty stocking products primarily based on TikTok popularity. This trend-setting power makes TikTok Shop essential for beauty brands regardless of whether they achieve substantial direct sales on the platform, as TikTok virality drives demand across all retail channels.

Despite its dominance, TikTok Shop faces several challenges. The platform's reputation suffers from concerns about product authenticity, with some consumers wary of purchasing beauty products through social platforms rather than authorized retailers. Content quality varies widely, with some creators providing genuine reviews while others prioritize affiliate commissions over honesty. The platform's aggressive growth tactics, including heavily subsidized shipping and generous creator commissions, remain unproven as sustainable business models. Regulatory scrutiny of TikTok's Chinese ownership creates ongoing uncertainty about the platform's long-term viability in the United States market.

INSTAGRAM AND FACEBOOK: META'S SOCIAL COMMERCE EVOLUTION

Meta's Instagram and Facebook platforms collectively reach 71 percent and 59 percent of social beauty buyers respectively, making Meta's social commerce capabilities essential for beauty brands despite trailing TikTok Shop in transaction volumes. Instagram Shopping and Facebook Shops integrate commerce functionality directly into existing social experiences, allowing users to discover products through posts, stories, and reels, then complete purchases without leaving Meta's apps. This integration leverages Instagram's position as the primary platform for beauty content, with brands preferring Instagram for 57 percent of influencer campaigns according to Sprout Social data.

Instagram's strength in beauty social commerce stems from its visual nature and established beauty community. Beauty influencers on Instagram have cultivated followings over years, building trust and engagement that translates into purchasing influence. Instagram Stories and Reels provide native formats for product demonstrations, tutorials, and reviews, with 58.2 percent of U.S. marketers planning to use Instagram Reels for influencer marketing in 2024. The platform's shopping features allow brands to tag products in posts and stories, creating shoppable content that maintains the visual aesthetic users expect while adding commerce functionality.

However, Instagram's social commerce features have underperformed expectations relative to TikTok Shop. The platform discontinued Instagram Live Shopping in 2023, just two years after launch, citing low adoption rates among both creators and consumers. Facebook Shops similarly failed to achieve significant transaction volumes, with Flip App capturing more social commerce gross merchandise value than Instagram Checkout and Facebook Shop combined as of February 2024. These failures suggest that bolting commerce onto existing social platforms proves less effective than building integrated social commerce experiences from the ground up, as TikTok Shop has done.

Meta's advantage lies in its massive user base and extensive data on user preferences, demographics, and behaviors. Instagram reaches 1 billion monthly active users globally, providing scale that standalone beauty platforms cannot match. The platform's recommendation algorithms, while less effective than TikTok's for short video content, excel at surfacing relevant products within users' existing feeds. For beauty brands, maintaining strong Instagram presence remains essential regardless of direct commerce results, as Instagram content drives discovery that leads to purchases through other channels.

The platform's move toward Reels represents Meta's response to TikTok's dominance, prioritizing short video content over static images. This shift benefits beauty brands accustomed to demonstrating products through video, though Instagram's Reels algorithm has struggled to match TikTok's engagement rates. Beauty content performs strongly on Reels when creators adapt TikTok-native formats to Instagram, though cross-posting identical content typically underperforms platform-specific creation optimized for each platform's unique culture and format preferences.

AMAZON LIVE: E-COMMERCE GIANT'S LIVESTREAM SHOPPING PLAY

Amazon Live represents the e-commerce leader's entry into livestream shopping, combining Amazon's unmatched product catalog, fulfillment infrastructure, and Prime membership base with interactive video content. The platform hosts daily livestreams from brands and creators across categories including beauty, fashion, gaming, fitness, and electronics. Beauty brands use Amazon Live to demonstrate products, offer exclusive deals to livestream viewers, and drive traffic to their Amazon storefronts. The seamless integration with Amazon's existing checkout and fulfillment systems eliminates friction between discovery and delivery, with Prime members receiving same-day or next-day delivery on purchases made during livestreams.

Amazon Live's primary advantage stems from purchase intent: users visiting Amazon already intend to buy products, creating higher conversion probabilities than social platforms where users primarily seek entertainment. Livestream shopping on Amazon serves users in active shopping mode, using video content to aid purchase decisions rather than creating purchase intent from scratch. This distinction makes Amazon Live particularly effective for considered purchases where users seek detailed product information before buying, though less effective for impulse purchases driven by entertainment and social proof.

The platform struggles with discoverability, as livestreams compete for attention with Amazon's product-centric interface rather than benefiting from algorithmic content recommendation like TikTok. Users must actively navigate to Amazon Live or discover livestreams while browsing product pages, creating a high barrier compared to TikTok where shopping content appears organically in entertainment feeds. This discoverability challenge limits Amazon Live's reach primarily to users already considering specific product categories, reducing its effectiveness for product discovery and brand awareness compared to social-native platforms.

For beauty brands, Amazon Live works best as a complement to broader Amazon marketing strategies rather than a standalone social commerce channel. Brands use livestreams to launch new products, clear seasonal inventory, and drive traffic during Prime Day and other promotional periods. The format proves particularly effective for complex products requiring explanation, skincare regimens with multiple steps, and educational content about ingredients or application techniques. However, the platform has not achieved the cultural impact or transaction velocity of TikTok Shop, suggesting that e-commerce platforms struggle to generate the entertainment value and social dynamics that drive social commerce success.

BUILDING BEAUTY SOCIAL COMMERCE ECOSYSTEMS: STRATEGIC CONSIDERATIONS

Beauty brands evaluating social commerce strategies face fundamental decisions about platform selection, owned versus third-party infrastructure, and integration with existing e-commerce operations. These strategic choices impact everything from development costs and time to market through customer data ownership and long-term platform dependence. The most successful approaches typically combine presence on major social platforms with owned commerce experiences that provide platform independence and customer relationship control.

Platform Strategy

Platform strategy requires balancing reach, control, and economics. TikTok Shop provides unmatched reach and algorithmic discovery but surrenders customer relationships to TikTok and subjects brands to platform policy changes beyond their control. Instagram Shopping leverages existing communities but offers limited transaction volumes and uncertain platform commitment to commerce features. Amazon Live reaches purchase-ready customers but faces discoverability challenges and high competition from marketplace sellers. These trade-offs suggest that beauty brands benefit from multi-platform presence, meeting customers where they already spend time while avoiding dependence on any single platform.

Owned Platforms

Owned social commerce platforms provide maximum control and customer data ownership but require significant development investment and ongoing customer acquisition costs. Brands building proprietary platforms gain direct customer relationships, complete control over user experience, freedom from platform policies, and ownership of transaction data valuable for marketing optimization. However, owned platforms must compete for attention with established social networks, requiring substantial marketing investment to drive downloads and active usage. The economics typically favor owned platforms for established brands with existing customer bases, while emerging brands benefit more from leveraging existing platform audiences.

White-Label Solutions

White-label social commerce solutions offer middle-ground approaches, providing pre-built commerce functionality that brands customize with their identity and content. These solutions reduce development costs and time to market while maintaining more control than third-party platforms. However, white-label platforms still face customer acquisition challenges and typically lack the sophisticated recommendation algorithms that make TikTok Shop effective. The approach works best for brands seeking to own customer relationships while avoiding full custom development costs.

Integration Architecture

Integration architecture determines how social commerce fits within broader e-commerce ecosystems. Headless commerce architectures separate front-end experiences from back-end commerce systems, enabling brands to maintain consistent inventory, pricing, and customer data across multiple shopping touchpoints. API-first platforms allow social commerce applications to access real-time inventory data, process orders through existing fulfillment systems, and sync customer information with existing CRM platforms. These integrations prevent operational nightmares like overselling products, maintaining inconsistent customer records, or manually reconciling orders across systems.

Data Strategy

Data strategy affects every aspect of social commerce optimization. Platforms must track which content drives purchases, which creators generate sales, how users navigate from discovery to checkout, and where friction points reduce conversion rates. This data enables algorithm optimization, creator performance evaluation, and continuous improvement of user experiences. Privacy regulations like GDPR and CCPA restrict data collection and usage, requiring explicit consent for tracking and providing users with data access and deletion rights. Balancing data collection for optimization with privacy compliance requires thoughtful architecture and transparent user communication.

Creator Management

Creator management represents a critical operational challenge for beauty social commerce platforms. Systems must onboard creators, manage content submission, enforce quality standards, track performance, calculate commissions, and process payments. Automated systems handle scale but require human oversight for edge cases and dispute resolution. Commission structures must balance creator motivation with platform economics, typically ranging from 5 to 20 percent of attributed sales depending on product margins and competitive dynamics.

Content Moderation

Content moderation protects brand reputation while managing the operational challenges of user-generated content at scale. Automated systems detect prohibited content including counterfeit products, dangerous usage claims, copyright violations, and offensive material. Human moderators review flagged content and handle appeals from creators whose content faces removal. Moderation policies must balance protecting users and brands with maintaining creator trust and avoiding accusations of arbitrary censorship.

THE FUTURE OF BEAUTY SOCIAL COMMERCE: EMERGING TRENDS AND OPPORTUNITIES

Beauty social commerce continues evolving rapidly as technologies mature, consumer behaviors shift, and competitive dynamics reshape market structures. Several trends promise to define the next generation of beauty shopping experiences, creating opportunities for platforms that successfully implement emerging capabilities while maintaining the core social commerce value proposition of authentic influencer recommendations combined with frictionless purchasing.

Augmented Reality Integration

Augmented reality integration will transform beauty social commerce from static product images to interactive try-on experiences that reduce purchase hesitation. AR beauty filters already enable virtual makeup application through platforms like Snapchat and Instagram, with dedicated beauty brands like L'Oréal and Sephora offering branded AR experiences. Social commerce platforms incorporating AR try-on directly within shopping flows will reduce return rates, increase conversion rates, and provide competitive differentiation. The technology remains computationally expensive and requires ongoing improvement to render realistic results across diverse skin tones and facial features, but costs continue declining as mobile processors gain power and AR algorithms improve.

Artificial Intelligence Enhancement

Artificial intelligence will enhance every aspect of beauty social commerce from content recommendation through customer service. AI-powered recommendation engines will achieve superior personalization by analyzing viewing patterns, purchase history, and demographic data to surface products matching individual preferences. Content generation AI will enable creators to produce higher quality content more efficiently, automatically editing videos, suggesting optimal posting times, and even generating captions that maximize engagement. Customer service chatbots powered by large language models will handle common questions, provide product recommendations, and resolve issues without human intervention.

Livestream Commerce Growth

Livestream commerce will continue growing as production quality improves and formats evolve beyond simple product demonstrations. The global livestream e-commerce market is projected to reach 258.76 billion dollars by 2034, expanding at a 33.01 percent compound annual growth rate from 2025 to 2034. Beauty will maintain its position among top livestream categories, with brands investing in professional production capabilities, celebrity host partnerships, and exclusive product releases timed to livestream events. AI-generated avatars may enable brands to conduct 24/7 livestreams with virtual hosts, reducing costs while maintaining consistent availability.

Blockchain Technology

Blockchain technology promises to address authenticity concerns that plague beauty social commerce. Counterfeit beauty products represent significant safety hazards, particularly for color cosmetics and skincare containing active ingredients. Blockchain-based product authentication will allow consumers to verify product authenticity by scanning codes or NFC tags, accessing tamper-proof records of manufacturing, distribution, and sale. Smart contracts will automate creator commission payments, ensuring transparent and immediate compensation without manual reconciliation. These blockchain integrations will build consumer trust while reducing operational overhead.

Multi-Device Experiences

Social commerce will expand beyond mobile applications into emerging platforms including virtual reality, augmented reality headsets, and smart home devices. Beauty tutorials viewed through AR glasses could overlay product application guidance directly onto users' faces, while voice-activated smart mirrors could enable hands-free shopping during morning routines. These multi-device experiences require platforms to maintain consistent user profiles, shopping carts, and recommendations across touchpoints, creating technical complexity but also competitive moats for platforms that execute well.

Sustainability Focus

Sustainability and ethical sourcing will increasingly influence beauty purchasing decisions, particularly among Gen Z consumers who prioritize environmental and social impact. Social commerce platforms will integrate sustainability information directly into product displays, showing carbon footprints, ingredient sourcing, packaging materials, and brand certifications. Creator content will increasingly emphasize these factors, with "conscious beauty" becoming a distinct content category. Platforms that surface sustainable options and make ethical information easily accessible will capture preference among values-driven consumers.

Regulatory Environment

The regulatory environment will shape beauty social commerce development as governments address data privacy, platform liability, creator compensation, and consumer protection. Stricter age verification requirements may limit access to beauty products containing active ingredients like retinoids. Disclosure requirements for sponsored content will become more stringent, requiring clearer labeling of paid partnerships and affiliate relationships. Platforms operating internationally must navigate varying regulatory requirements across jurisdictions, adding complexity but also creating barriers to entry for smaller competitors.

CONCLUSION: BUILDING THE NEXT GENERATION OF BEAUTY SOCIAL COMMERCE

Beauty social commerce represents one of the most dynamic sectors in technology, combining social media, influencer marketing, e-commerce, and mobile applications into integrated experiences that have fundamentally altered how consumers discover and purchase beauty products. The market's explosive growth, driven by TikTok Shop's success and the broader trend toward social discovery, creates substantial opportunities for custom development that serves specific market niches, geographic regions, or brand ecosystems unable to depend entirely on third-party platforms.

A-Bots.com delivers the complete technical capabilities required to build competitive beauty social commerce applications from the ground up. The company's expertise spans mobile app development for iOS and Android, backend infrastructure for livestream video and transaction processing, recommendation algorithms that surface relevant content, creator management systems that handle complex commission structures, and quality assurance testing that ensures reliability at scale. For brands planning beauty social commerce platforms, A-Bots.com provides strategic consulting that evaluates technical options, recommends optimal architecture, and creates implementation roadmaps that align technology decisions with business objectives.

The success of TikTok Shop demonstrates that algorithmic content discovery combined with frictionless in-app purchasing creates conversion rates substantially higher than traditional e-commerce. The failures of Flip and Supergreat underscore the challenges of competing with integrated social networks that benefit from existing user bases and sophisticated algorithms trained on billions of interactions. These market dynamics suggest opportunities for differentiated approaches including owned brand platforms, geographic-specific solutions, and niche applications serving specific beauty categories like clean beauty, K-beauty, or men's grooming.

The technical foundation for beauty social commerce continues evolving as augmented reality, artificial intelligence, blockchain, and livestream technologies mature. Platforms incorporating these emerging capabilities while maintaining core social commerce principles will achieve competitive advantages over legacy implementations. The most successful platforms will balance sophisticated technology with authentic community building, recognizing that beauty social commerce ultimately succeeds or fails based on the trust consumers place in creator recommendations and the friction they experience converting interest into purchases.

For beauty industry stakeholders evaluating social commerce opportunities, the strategic imperative remains clear: meet consumers where they spend time, provide authentic product information through trusted voices, and eliminate friction between discovery and purchase. Whether through presence on major social platforms, development of owned commerce experiences, or hybrid approaches combining both, beauty brands must embrace social commerce as a primary channel rather than an experimental add-on. The companies that successfully implement these strategies will capture the substantial growth opportunities as social commerce continues expanding its share of total beauty sales worldwide.

✅ Hashtags

#BeautySocialCommerce

#LivestreamShopping

#InfluencerMarketing

#TikTokShop

#BeautyAppDevelopment

#SocialCommerceApps

#BeautyTech

#MobileCommerce

#CreatorEconomy

#BeautyEcommerce

Other articles

Boise App Development: Mobile Solutions for Idaho's Capital Professional Boise app development guide exploring mobile technology opportunities in Idaho's capital. A-Bots.com delivers comprehensive iOS, Android, and cross-platform solutions backed by 70+ completed projects. Article features in-depth ParkMobile analysis demonstrating parking management applications serving 1 million annual Boise visitors. Examines outdoor recreation app potential supporting $4.8 billion local tourism industry, including Bogus Basin resort and Boise River Greenbelt systems. Explores healthcare technology opportunities with St. Luke's Health System implementing AI-powered patient care solutions. Includes expert quotes from Steve Jobs and Bill Gates, real market statistics, technical implementation details, and business guidance for selecting development partners.

Custom Beauty App Development Services: Learning from Shark Beauty's $20B Market Success Discover how Shark Beauty achieved number 1 market position in skincare devices within 11 months through strategic mobile app development. Learn why beauty technology devices require sophisticated applications for IoT connectivity, AI personalization, and AR features. A-Bots.com provides custom mobile app development services for beauty device manufacturers. With expertise in IoT integration, artificial intelligence, augmented reality, and comprehensive testing, we help beauty tech companies build complete ecosystem solutions.

Sephora Mobile App Success Story: Complete Guide to Beauty App Development in 2026 This comprehensive analysis explores the Sephora mobile app phenomenon and its implications for beauty app development. From humble French origins in 1969 to a global digital powerhouse with over 40 million loyalty members, Sephora transformed beauty retail through strategic technology investments. The article examines Virtual Artist AR capabilities, Beauty Insider program mechanics, target audience demographics, and marketing strategies that drive 80% of North American sales through app-engaged customers. Entrepreneurs and product managers will discover practical frameworks for building competitive beauty applications, including IoT integration opportunities and personalization techniques. A-Bots.com offers custom beauty app development services to bring similar visions to life.

IoT Devices Skincare Industry The beauty tech industry is experiencing unprecedented growth, with the global market projected to reach $130 billion by 2029. This comprehensive guide explores how IoT-enabled skincare devices are transforming the industry and why excellence in beauty app development has become essential for success. Using Medicube's remarkable journey from Korean startup to $6 billion powerhouse as a case study, we examine the technical architecture behind smart beauty devices, the role of companion apps in creating seamless user experiences, and practical insights for entrepreneurs entering this space. From Bluetooth connectivity and AI-powered skin analysis to viral TikTok marketing strategies, discover what it takes to build the next generation of beauty technology.

Hair Salon App Development: AR Try-On, Booking and CRM Platform This comprehensive guide explores hair salon app development for modern beauty businesses seeking digital transformation. The article covers AR-powered virtual hairstyle try-on technology that allows clients to preview cuts and colors before booking. It details three-sided platform architecture serving clients, stylists, and administrators with integrated booking, CRM, and management tools. Key market statistics reveal the $247 billion global salon industry opportunity and compare USA versus European markets. The guide addresses no-show reduction through automated reminders, multi-location scalability, security compliance, and MVP development strategies. A-Bots.com demonstrates expertise in building custom salon applications with AR integration, appointment scheduling, and comprehensive business management features.

Top stories

Copyright © Alpha Systems LTD All rights reserved.

Made with ❤️ by A-BOTS