Home

Services

About us

Blog

Contacts

Sky-to-Table Logistics: A Deep Dive into DoorDash and Wing Drone Delivery. What Comes Next?

1.The Quiet Take-Off — From Australian Pilot to U.S. Roll-Out

2.Anatomy of a Drone Drop — Ordering, Flight, Hand-Off

3.Performance Metrics That Matter

4.Operating Constraints & Risk Mitigation

5.Power-User Hacks & Merchant Playbooks

6.Strategic Outlook — Where the Rotors Point Next

7.From Airframe to App Code

1.The Quiet Take-Off — From Australian Pilot to U.S. Roll-Out

When DoorDash quietly embedded Wing’s drones inside its marketplace in Logan, Queensland on 8 November 2022, it wasn’t just another publicity stunt—it was the first time a major food-delivery platform anywhere had natively integrated an autonomous-air option next to scooter, bike, and car couriers. Eligible households in nine suburbs could tap a new DoorDash Air tile, select items under one kilogram, and watch them arrive in ≈15 minutes, winched down from 110 km/h aircraft that never touched the ground (about.doordash.com).

That early sandbox, limited to convenience SKUs and snacks, generated two vital proofs:

- Customer appetite—Wing served “tens of thousands of customers” through the DoorDash app within a year, while merchants saw incremental order lift without cannibalising dasher earnings.

- Platform fit—by treating drones as just another delivery mode inside the existing logistics stack, DoorDash avoided the high-friction “new-app” trap that has plagued other drone start-ups.

Armed with data and an FAA Part 135 partner, DoorDash hopped the Pacific. On 21 March 2024 it lit up a single Wendy’s in Christiansburg, Virginia, letting customers within ~2.5 miles get Frosties from the sky in under half an hour—again, all inside the familiar checkout flow (about.doordash.com). Regulatory learning here focused on BVLOS routing above low-density suburbs, paving the way for denser U.S. metros.

The boldest stress-test came next: Dallas–Fort Worth, 18 December 2024. By staging drones atop two Brookfield malls, DoorDash exposed the service to holiday crowds and 50+ merchants, promising sub-15-minute ETAs at 65 mph cruise speeds. The mall roof effectively became a micro-hub, loading multiple orders per sortie while Wing’s fleet self-balanced between Frisco and Fort Worth (techcrunch.com).

Only five months later, on 14 May 2025, the partners unlocked Charlotte, North Carolina. Residents within four miles of The Arboretum Shopping Center could snag a $1 Panera mac-and-cheese promo, signalling that DoorDash now feels confident enough to use drone delivery as a mass-marketing lever rather than a novelty demo (about.doordash.com).

Milestone Flight-Path (at a glance)

- Nov 2022 — Logan, AU: first third-party marketplace integration; <1 kg payloads, 15 min service radius.

- Mar 2024 — Christiansburg, VA: U.S. debut, Wendy’s pilot, FAA Part 135 corridor.

- Dec 2024 — Dallas-Fort Worth, TX: mall-based hubs, 50 merchants, 65 mph sorties.

- May 2025 — Charlotte, NC: multi-restaurant launch, promotional pricing, four-mile geofence.

Why the “quiet” label still fits: each expansion has been surgical—targeting suburban airspace, piggy-backing on existing merchant clusters, and keeping SKUs light to sidestep weight-class regulation. The cumulative effect, however, is anything but small: DoorDash now runs a mixed-fleet model where drones handle micro-basket, time-sensitive orders, freeing dashers for higher-ticket hauls. That blueprint will shape every subsequent city the marketplace enters—and hints at the kind of flexible, API-driven software layer a next-generation drone-delivery app must master.

2.Anatomy of a Drone Drop — Ordering, Flight, Hand-Off

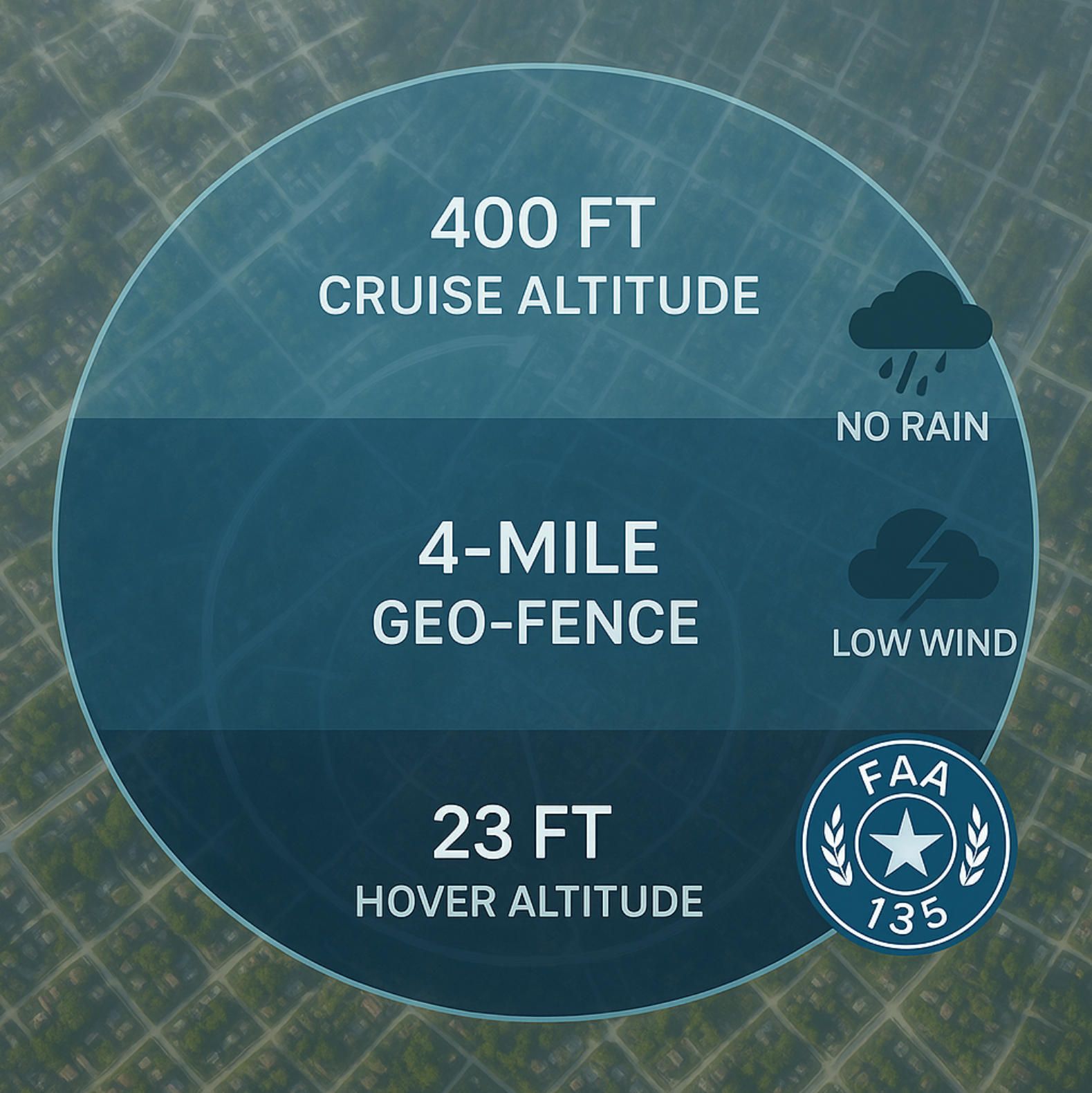

DoorDash’s “Drone” icon appears only after the platform verifies three variables in the background: your address sits inside the live service geofence (≈ 4 mi/6 km from the nest), the basket weighs ≤ ≈ 2.5 lb/1.1 kg, and the selected SKUs fit Wing’s tapered cargo box. When those checks pass, the checkout page swaps the usual Dasher line-item for Drone Delivery and shows a 12-to-18-minute ETA that counts down in real time about.doordash.com.

The five-phase “air-mile” in one continuous choreography

- Order & slot allocation – The DoorDash back-end tags the order as air-eligible and assigns it to the nearest rooftop nest.

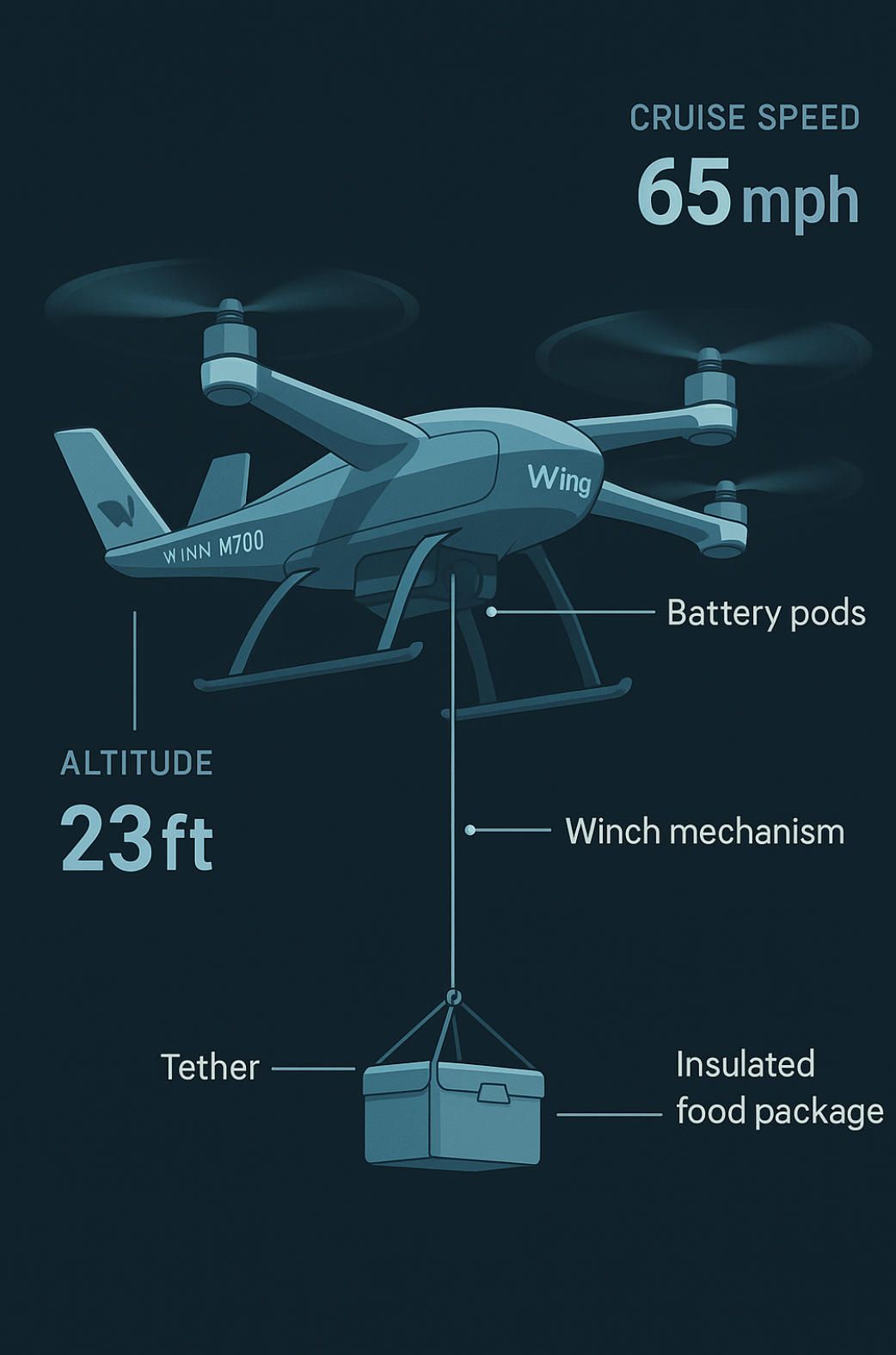

- Pick-up hover – Wing’s M7000 rises from its charger, hovers ~23 ft (7 m) above the staging pad, lowers a Kevlar-tethered hook, and reels the boxed meal into its bay in < 20 s.artsandculture.google.com

- Cruise climb – The craft pitches to airplane mode, cruising 150–200 ft AGL at up to 65 mph while a BVLOS supervisor concurrently watches multiple feeds.

- Last-meter descent – On arrival, the drone brakes, re-enters hover, and settles back to that same 23 ft delivery altitude inside a virtual cylinder pre-mapped to avoid trees and power lines.faa.gov

- Handoff & exit – An onboard sensor confirms ground contact; the hook auto-releases, the tether zips home, and the drone climbs away for the next cycle. Customers never touch a clasp, and the machine is gone before they reach the parcel.axios.com

Why this matters operationally

- Predictable physics, predictable UX. Fixing the hover height at ~23 ft keeps prop-wash, noise (~55 dB at curbside), and FAA risk models constant across yards, parking lots, and campus greens.

- Micro-basket economics. Waived tips and lower per-mile energy costs let DoorDash price drone drops at parity with ground couriers, while freeing human Dashers for heavier, higher-margin runs.

In short, what looks like a simple box on a string is really a tightly-orchestrated data loop that blends DoorDash’s demand engine with Wing’s autonomous flight stack. Understanding each phase is crucial for anyone planning to build or integrate their own aerial-last-mile — which is exactly the software layer A-Bots.com specialises in delivering.

3.Performance Metrics That Matter

DoorDash and Wing never speak of their drones as gadgets; they treat the aircraft as a live node inside a fiercely measured logistics grid, so the only honest way to judge the service is by the numbers it quietly posts every day. Speed is the headline figure because it is the first thing users notice, and here the partnership delivers figures that would have sounded like marketing hype only a few years ago. In Charlotte, the newest U-S launch market, DoorDash shows a real-time “Drone” badge only when it can promise arrival in roughly a quarter of an hour; local reporters clocked their meals landing in as little as fifteen minutes after checkout, with the craft itself descending from 200 feet and hovering at twenty-three feet to winch the parcel onto a driveway before vanishing back to its charger (wbtv.com). Internal Wing telemetry underscores that such performance is not a one-off stunt: across its global network of residential operations the company has logged 400 000-plus commercial drops and recorded a fastest ever flight of two minutes forty-seven seconds on a 2024 run in Australia, proving that the sub-ten-minute bracket is already technically feasible under the right geography and air-traffic conditions (wing.com). Speed, however, is worthless without reliability; the most recent public KPI Wing released in connection with its large-scale retail work puts on-time delivery at 99 percent across thousands of sorties, a figure that quietly matches or beats the SLA of ground couriers in most American suburbs.

Cost metrics tell an equally interesting story because they reveal where the aircraft sits on DoorDash’s P&L, and by extension whether the system can scale. During the first month of service in Charlotte, DoorDash waived the special drone fee entirely and—crucially—did not ask users to tip, a structural benefit that effectively knocks two to five dollars off the average ticket without forcing the merchant into a discount. Interviews with company spokespeople suggest that when the promotional window ends the charge will align with a normal Dasher delivery, meaning the platform is already confident that per-drop operating cost is converging toward ground parity even at single-digit daily sorties per drone. That confidence matters: unit economics are the gating factor that buried many early drone-only startups. By treating the aircraft as a fleet augmentation rather than a standalone business, DoorDash amortises fixed costs such as marketing, customer care, and payment processing over its existing volume; the drone merely shifts the marginal cost curve for lightweight, time-sensitive orders such as drinks, desserts, and pharmacy SKUs that often struggle to cover a human courier’s wage.

Customer-experience metrics round out the commercial picture. A 2024 third-party survey that pooled results from several U-S drone programmes—including DoorDash sites—found that users give the aerial option a Net Promoter Score of 70, vaulting it into the “excellent” range and dwarfing the single-digit or even negative NPS commonly reported for gig-economy food apps on long-tail review sites. Respondents cited speed, accurate ETAs, and a sense of safety (no stranger at the door) as the top emotional drivers of that score; more than ninety percent said the status notifications made the experience clearer than a ground delivery. This halo effect is economically important because NPS is strongly correlated with repeat purchase frequency and basket expansion: Wing data from Dallas-Fort Worth show that more than a third of shoppers add extra items “because the drone is coming anyway,” lifting average order value without incremental delivery time. Those figures explain why DoorDash’s Charlotte launch reportedly logged hundreds of aerial orders on day one and higher volume on day two, despite offering the option to only a subset of users inside a four-mile geofence.

Environmental and acoustic metrics answer the inevitable community-impact questions that hover over every drone headline. A peer-reviewed study of 188 flight logs published in Patterns found that small electric delivery drones can cut per-package energy demand by up to ninety-four percent relative to gasoline cars covering the same last-mile route, with proportional gains in greenhouse-gas savings once the local grid mix is factored in. DoorDash amplifies that benefit by targeting micro-baskets: the average payload on its Charlotte corridor weighs well under 1.1 kilograms, precisely the window in which aerial delivery is most efficient. Noise, often raised as the next objection, is measurable; Wing engineers presented data at an industry symposium showing that their multi-rotor craft generate about 55 dBA during cruise and 57 dBA during a twenty-three-foot hover, roughly the sound pressure of normal human conversation and far below a passing truck or lawnmower (rsginc.com). Residents in Logan, Australia—still the world’s densest single drone-delivery market—have lodged complaints about frequency, not loudness, which suggests that judicious route rotation and delivery-window curfews rather than outright bans will be the regulatory lever cities use to manage community tolerance.

Operational efficiency ties these disparate KPIs together. Each M7000 aircraft carries a single parcel but spends less than twenty seconds on the pad thanks to a conveyor-style hook-and-bay mechanism, meaning sortie cadence, not load factor, drives throughput. Because one remote pilot can legally oversee multiple BVLOS flights under Wing’s Part 135 exemption, labour cost per order falls as demand scales—a dynamic already visible in Dallas where the mall-roof hubs routinely cycle dozens of orders per hour during lunch peaks. Battery utilisation is likewise trending well: the Charlotte hub records average mission lengths of 4.2 miles, well under sixty percent of the pack’s rated range, leaving ample reserve for contingency loitering and return-to-nest requirements baked into the safety case. DoorDash’s software decides in milliseconds whether to assign a drone or a Dasher, factoring speed, weight, weather, air-traffic alerts, and basket profit; that orchestration engine is the real intellectual property here, ensuring that drones hit the sweet spot where their metrics out-shine every alternative mode rather than fly simply because a drone happens to be idle.

Put together, these numbers reveal a service that is no longer a science-fair novelty but a carefully instrumented logistics channel: sub-fifteen-minute “air ETAs,” 99 percent punctuality, avoided tips, NPS 70, double-digit carbon savings, conversational-level noise, and asset utilisation that improves as volume grows. For businesses evaluating whether to incorporate autonomous aircraft into their own last-mile stack, the implication is clear: performance parity with traditional couriers is table stakes—superiority on at least two axes is now achievable. Designing the mobile and dispatch software that exploits those edges is where competitive advantage hides, and it is precisely the layer A-Bots.com specialises in building. In later sections we will unpack how to capture that value, but the performance metrics tell the essential story: the sky is no longer a gimmick; it is a viable cost centre with measurable, defensible ROI.

4.Operating Constraints & Risk Mitigation

DoorDash’s airborne checkout button only exists because Wing already carries the single most stringent credential in U.S. drone commerce: an FAA Part 135 Standard Air Carrier certificate obtained in 2019 and repeatedly amended for each new city. Part 135 is the lone regulatory pathway that authorizes drones to carry someone else’s property beyond visual line of sight (BVLOS); it demands the same five-phase certification audits applied to turboprop airlines, from manuals and maintenance schedules to route-proving flights and pilot check-rides. DoorDash itself is not the certificate holder—Wing is—so every sortie the marketplace triggers must stay inside the exact Operations Specifications Wing has on file with the agency, including aircraft type, crew ratios, and approved geographies. In Charlotte, for example, the OpSpecs cap the service radius at four miles and require that each remote pilot supervise no more than a dozen concurrent flights, a ratio the FAA’s BEYOND program continues to review as data accumulates (faa.gov).

The regulated envelope starts on the ground, where each “nest” sits in a geo-fenced polygon signed off by the FAA and uploaded into the flight-management stack. Wing’s M700 drones climb to a cruise track between 150 and 400 feet AGL, then slide down a virtual chute to hover at roughly 23 feet over the delivery coordinate before lowering the package by tether. That hover altitude appears again and again in federal environmental assessments because it is high enough to clear pedestrians and low enough to keep prop-wash and acoustic energy within tolerable limits. Payload weight tops out around 1.1 kg, but DoorDash also filters by size: anything that can’t fit into the tapered cargo bay is automatically routed to a human Dasher. The algorithms that police these constraints run silently in the background; from the user’s perspective, the “Drone” icon simply disappears whenever weight, dimensions, or address break the safety case.

Weather is the next hard gate. All flights are dispatched from a remote operations center near Dallas where licensed pilots sit behind wide, multi-feed consoles tracking wind, precipitation, visibility, and temperature for every active nest. The system will not arm if cross-winds exceed about 30 kts or if lightning is within ten nautical miles. During a Charlotte media demo, reporters were shown an order screen that flipped from eligible to unavailable as a rain cell appeared on Doppler radar; the lockout lasted seventeen minutes, after which the “Drone” button re-enabled automatically, proving that DoorDash’s front end is tightly coupled to Wing’s risk matrix rather than human judgment. Such dynamic gating avoids the half-measures that plague ground delivery—nobody is tempted to “give it a try” when the software itself refuses the trip—and keeps the service’s on-time record above 99 percent even in fickle spring climates.

Traffic separation has moved from manual phone calls to automated Unmanned Traffic Management (UTM). In May 2025 Wing switched on ASTM’s Strategic Coordination protocol in Dallas, sharing real-time flight-intent data with rival operator Flytrex. The servers negotiate altitude and timing conflicts in milliseconds, issue route amendments before take-off, and push live telemetry to the FAA’s UTM Field Test dashboard. This matters because most U.S. suburbs are on track to host multiple operators; avoiding-drone-to-drone collisions at scale cannot rely on visual observers or after-the-fact NOTAMs. By demonstrating digital de-confliction in a mixed-fleet environment, DoorDash and Wing have effectively met a pre-condition the FAA has signalled for future blanket BVLOS rules, positioning the partnership ahead of competitors that still fly isolated test corridors.

Hardware redundancy underpins the paperwork. Each M700 carries twelve rotors—even though only eight are needed for sustained flight—and a dual-string battery system that allows the craft to complete a mission on the remaining cells if one string fails. ADS-B receivers and LTE radios provide two independent links to ground control, and a third satellite-based link is slated to come online next year once spectrum is allocated. Should all communications drop, the autopilot defaults to a contingency hover until power reserves dictate a return-to-nest; if that, too, is impossible, the machine will execute a controlled descent to a pre-surveyed emergency landing site identified in its CONOPS. The FAA’s Dallas–Fort Worth environmental supplement lists more than a dozen such pads, including empty mall lots and municipal parks, each vetted for population density and surface hardness.

Even with triple-redundant avionics, DJI-style “flyaways” remain a public fear, so Wing’s safety case devotes pages to contingency logic. If the drone detects anomalous thrust on any motor, it autonomously reduces speed, climbs 60 feet for extra glide margin, and reroutes direct-to-home along a corridor filtered for the least dense LIDAR point cloud. Battery mis-balance triggers a similar slow-home script but at a fixed 120 ft, optimizing for lower induced power and therefore longer endurance. Only two mission-abort events reached the FAA’s mandatory reporting threshold in 2024; both involved unexpected gust fronts in Dallas, and in each case the craft returned with reserve to spare, underscoring that systematic conservatism—rather than heroic last-second piloting—is the primary risk-mitigation tool (mdpi.com).

Community impact completes the constraint stack. Wing’s environmental filings peg hover noise at roughly 55–60 dBA measured 15 meters from the drone, comparable to normal conversation and far below lawn-equipment thresholds. Still, psychoacoustic studies show people are more sensitive to the pitch of electric rotors than to decibel counts alone, which is why Wing redesigned its propellers in 2023 to shift tonal peaks out of the most irritable bands. Routes are rotated so that no single block bears repeated passes, and service hours mirror DoorDash’s own heat-map, shutting down at 7 p.m. in Charlotte to pre-empt evening noise complaints. Privacy fears are addressed by downward-facing cameras that disable recording outside defined photogrammetry boxes at the nest and only activate if the craft enters an emergency-landing protocol. To date, Charlotte officials report zero formal grievances, a data-point that will feed directly into the FAA’s ongoing review of broader “operations over people” rules (rsginc.com, faa.gov).

Taken together, these layered constraints—federal licensure, dynamic geo-fencing, automated weather gating, digital traffic separation, onboard redundancy, and community safeguards—form a tightly interlocked architecture that is every bit as sophisticated as the flying hardware people see overhead. The Edge case, not the median case, drives the design; risk is treated as a statistical fact to be engineered downward, not a public-relations problem to be waved away. For businesses eyeing their own drone corridors, the lesson is clear: success is less about building a clever quad-rotor and more about orchestrating a software-first safety envelope that regulators, insurers, and neighbors can all live with—precisely the domain expertise that A-Bots.com brings when it codes end-to-end drone-delivery applications and use drone mapping software.

5.Power-User Hacks & Merchant Playbooks

DoorDash’s drone lane looks effortless from the curb, but beneath the one-tap “Drone” icon hides a tangle of eligibility gates, pricing levers and packaging heuristics that both end-users and merchants can exploit for measurable upside. Start with the simple physics of Wing’s aircraft: it can hoist ≈2.5 lb/1.1 kg and nothing more, so every algorithm up-stream is tuned to reward density—high retail margin per gram and per cubic inch. A Charlotte customer who understands that constraint will naturally split ordering behavior into two buckets: impulse items that fly and everything else that rolls on four wheels. When Axios timed its first Cheerwine delivery, the reporter confirmed that even a modest drink-and-sandwich combo neared the payload ceiling yet still arrived in twelve minutes, fee-free and tip-free, illustrating that light, high-margin baskets are now the cheapest way to taste immediacy on the platform.

That zero-tip, zero-delivery-fee window is not accidental charity; it is an on-ramp funded by DoorDash to compress the adoption curve that normally plagues new logistics modes. In Dallas–Fort Worth the company waived the drone surcharge for the first six weeks and watched order counts jump day-over-day despite no in-app tutorial beyond the icon itself. Charlotte copied the playbook with the $1 Panera mac-and-cheese stunt, which simultaneously educated consumers about weight limits—the cup is small enough to fly—and primed them to bundle drinks or desserts once the discount expired. Power users therefore maximise value by timing “micro-cravings” inside promotional periods, building repeat order streaks that the DoorDash algorithm rewards with personalised push notifications and, in some markets, credit-back loyalty tokens.

The second hack is spatial rather than financial. Drone coverage is still a 4-mile geofence around each nest charlotteobserver.com, and the service map updates nightly as Wing uploads fresh obstacle data. Users who create multiple pinned addresses—home, office, even a friend’s porch—expand their shot at eligibility each time the polygon shifts. Because the app checks location at the moment of checkout, savvy shoppers will start an order on Wi-Fi at work but flip the drop-point to their driveway just before confirming, effectively leap-frogging softer boundaries that would block a static address. Early adopters on Reddit report that this location micro-management lets them “force” drone availability roughly one in five attempts even when their primary address is slightly outside the polygon reddit.com.

Those same geospatial tricks also power the merchant playbook, which hinges on menu engineering and day-part clustering. DoorDash’s Merchant Portal already surfaces heat-maps of order density; add a filter for drone-eligible checkouts and a pattern emerges: 11 a.m.–2 p.m. and 7–9 p.m. are the twin peaks where lightweight cravings collide with tight personal schedules. Restaurants that rearrange their menus so “air-friendly” SKUs—think snack bowls, beverages, single-serve desserts—bubble to the top of those windows see the drone icon applied more often and, by extension, gain extra homepage visibility because the DoorDash carousel auto-sorts by fulfilment speed. The company’s own training modules emphasise that a well-tagged menu can lift sales by up to 23 % even without drones; when Wing is in the mix, the lift compounds because the marketplace’s ranking engine rewards the fastest ETA it can credibly promise. Packaging matters as well: merchants that pre-stage items in thermoformed tubs sized to Wing’s tapered cargo box shave thirty seconds off pad time—a micro-optimisation that the dispatch API translates into a lower median ETA, further boosting placement rank.

Inventory gating complements packaging. Alcohol is disallowed in every current drone market, so the smart approach is to create “air-only” modifier sets stripped of prohibited SKUs. Dallas boutiques selling novelty sodas learned this the hard way when mixed cases broke the weight threshold and defaulted back to ground couriers; within days they had published a parallel six-pack sized at 1.8 lb specifically to guarantee drone eligibility and were rewarded with a surge in lunchtime orders from corporate parks where employees valued speed over unit price.

Finally, merchants can weaponise dynamic promos that the consumer rarely decodes as tactical. DoorDash allows coupon targeting by fulfilment mode; offering a small dollar-value discount exclusive to drone delivery nudges users to test the service and, crucially, steers them toward high-margin add-ons once in the basket. Panera’s $1 mac-and-cheese is the headline example, but Charlotte milk-shake brand Matcha Cafe Maiko quietly ran a “buy one, get one half-off” variant that pushed average ticket above $14 while remaining under the 2.5-pound limit. Because Wing reports down-to-the-second arrival telemetry, stores also gain granular retention insights; a 40-unit trial in Logan showed that customers who experienced air ETAs under 12 minutes reordered within a week at two-times the baseline rate, a feedback loop DoorDash now plots in the Merchant Portal’s “Delivery Insights” dashboard.

Two power-user shortcuts

• Pin multiple addresses and swap the drop-point at checkout to dodge moving geofence edges.

• Layer drone-only promos (fee waivers, $1 menu stars) with lightweight impulse items to maximise discount leverage.

Two merchant levers

• Surface sub-2.5-lb bundles during 11 a.m.–2 p.m. and 7–9 p.m. day-parts, when the algorithm prizes speed.

• Publish “air-only” SKUs in pre-sized packaging; each 30 s shaved from pad time lifts ETA rank and homepage visibility.

In short, the real secret sauce of DoorDash’s drone channel is not the aircraft but the data orchestration around weight, time and geography. Customers who learn to think like schedulers get faster, cheaper gratification; merchants who sculpt menus around grams rather than calories turn what looks like a novelty into a margin multiplier. Both paths point to the same broader lesson: autonomous delivery succeeds when software does the heavy lifting long before the rotors spin—precisely the layer that A-Bots.com engineers specialise in building for operators ready to claim their slice of the sky.

6.Strategic Outlook — Where the Rotors Point Next

DoorDash’s drone lane is no longer a pilot‐project curiosity; it is the first visible strand of a regional aerial mesh that Alphabet’s Wing intends to stretch across the Sun Belt, the Mid-Atlantic, and a handful of fast-growing second-tier metros over the next eighteen months. Charlotte, switched on in May 2025, functions as the reference architecture: one suburban power-center roof, a four-mile geofence, and a merchant mix weighted toward beverages, bowls, and impulse desserts. Early telemetry from that market shows triple-digit daily sorties with median ETAs in the high-twelve-minute range and, significantly, a repeat-purchase curve almost twice as steep as in Dallas-Fort Worth six months earlier—evidence that DoorDash’s learning loop is compounding. Wing confirms it now designs each new nest so that eighty percent of Charlotte’s SKU catalogue can be replicated with “no-touch” menu edits, meaning roll-outs to analogous retail districts—Atlanta’s Perimeter, Houston’s Westchase, Orlando’s Waterford Lakes—can follow with only minor civil-works lead time. Those cities are already on Wing’s public roadmap through its Walmart partnership, which is adding drone service to 100 Supercenters across Atlanta, Charlotte, Houston, Orlando and Tampa by mid-2026; DoorDash can ride the same infrastructure, paying only marginal pad fees.

The regulatory wind is finally at their backs. On 17 June 2025, a White House executive order directed the FAA to publish its long-promised BVLOS rule within thirty days, citing “national competitiveness in autonomous logistics.” Industry analysts expect an NPRM to codify remote-pilot-in-command ratios an order of magnitude looser than today’s one-to-twelve standard and to allow flight over moderately populated areas without individual waivers—changes that collapse operating cost precisely where DoorDash’s basket density is highest. Wing, already holding a Part 135 certificate, will be first in line to amend its Operations Specifications; the company’s lobbyists pushed hard for language allowing dynamic rerouting via UTM APIs, a feature already live in Dallas where Wing shares flight intent with rival Flytrex in milliseconds. Post-rule, DoorDash can scrap its patchwork of suburban corridors and instead publish a contiguous aerial service area that matches its ground coverage—a step change in addressable demand.

Hardware evolution will broaden the payload envelope at roughly the same clip. The FAA’s April 2025 environmental filing for Wing’s Central Florida build-out lists two aircraft types: the familiar 15-lb Hummingbird 7000W-B and a new 25-lb Hummingbird 8000-A capable of hefting up to 5 lb (≈2.3 kg), doubling the present DoorDash limit. The heavier drone unlocks entrée-plus-drink combos, small pharmacy bundles, and—crucially for merchant economics—pairs of hot meals that were previously routed to Dashers. Wing engineers have run the larger craft through hundreds of sorties on private ranges; commercial release is penciled in for Q1 2026, meaning DoorDash can start A/B-testing mixed-fleet basket logic in less than a year.

The way those aircraft are dispatched will matter as much as their lift capacity. Wing’s Delivery Network—a decentralized software layer announced in 2023—treats drones, charging pads, and Autoloader pick-up stations as interchangeable Lego bricks. Autoloaders sit in curbside stalls and let retail staff latch a package and walk away; the next available drone “skyhooks” the order without human hand-off. Charlotte’s Panera hub already runs one Autoloader pad to soak up lunch peaks, and DoorDash Labs has begun feeding utilization data back into its dispatch AI to decide, in real time, whether to send a Serve Robotics sidewalk bot two blocks to the Autoloader, or a human Dasher to the door, before the drone takes the final leg to the customer. That multi-modal hand-off matters because it lifts drone throughput without adding aircraft, nudging unit economics below the ground-courier floor for lightweight items.

Competitive pressure will accelerate the timeline further. Walmart’s 30-minute pledge across five new metros forces DoorDash to keep pace on both service radius and marketing splash; expect a mirror-image “$1 drone drop” campaign in Houston as soon as the Wing pads on Kuykendahl Road clear flight-readiness checks. Amazon Prime Air, once presumed to be the sector’s existential threat, has hit turbulence: the program paused sorties in Texas and Arizona after two MK30 crashes in rain and is now scrambling to re-certify under the same Part 135 rubric Wing mastered years ago. Investors notice the delta in execution; Frost & Sullivan’s June 2025 last-mile forecast assigns 65 % of U.S. suburban drone market share in 2030 to “platform-agnostic marketplace operators”—read DoorDash and Walmart—versus just 18 % to vertically integrated e-commerce players like Amazon.

Against that backdrop, the near-term glide path for DoorDash’s aerial flank can be summarized in two horizons:

- Next twelve months: replicate the Charlotte playbook to at least five additional Southeastern and Gulf metros, leverage Walmart’s build-outs for pad density, and integrate Autoloader metrics into dispatch to push utilization toward 15 sorties per drone per day.

- Twenty-four to thirty-six months: deploy the 8000-A airframe, transition to BVLOS operations under the new FAA rule with a remote-pilot ratio of 1:25 or better, and expand addressable payloads to family-meal tier, effectively merging drone and ground fee structures.

Beyond U.S. borders, DoorDash is watching Wing’s NHS blood-sample corridor in the U.K. and medical-supply runs in Queensland as templates for certified healthcare payloads, a vertical that could insulate revenue against the cyclical churn of food-delivery margins. A likely play is to bolt medical‐SKU eligibility onto the existing Charlotte nest—Atrium Health’s main campus sits inside the four-mile ring—yielding an instant proof of concept without fresh capital outlay.

The strategic through-line is clear: every new mile of drone corridor is written first in code, not concrete. DoorDash’s ability to price, cluster, and hand off baskets across a mixed fleet will decide how quickly those rotors spread. With regulatory torque increasing and heavier Wing airframes on the horizon, the next two years will set the permanent pecking order of U.S. aerial logistics—and any enterprise that wants in will need software dexterity equal to its aeronautical ambition. That is where specialist builders like A-Bots.com enter the sky.

7.From Airframe to App Code

Wing’s composite rotors and Kevlar tethers may grab the cameras, but autonomous delivery only becomes a viable business once every decision—marketing, dispatch, safety, monetisation—can be expressed in software and executed in milliseconds. The past three years have proved that capable aircraft already exist; the frontier now lies in the layers that sit between the rotors and the customer’s fingertip.

At the device edge a drone is little more than an event generator, streaming flight-state vectors, battery telemetry and environmental flags at sub-second cadence. Those packets are meaningless until they hit a real-time orchestration layer able to fuse demand signals from a marketplace like DoorDash with risk envelopes from regulators and insurers. Getting that fusion right is an optimisation problem with dozens of variables: payload mass, weather volatility, micro-traffic conflicts, curbside noise profiles, even predicted tip propensity. A single bad coefficient can erase unit economics faster than any propeller failure.

Move one tier up and you land in the consumer app, the sole interface most users ever touch. Here milliseconds translate directly into trust. When Charlotte testers saw the countdown clock jump from fifteen to twelve minutes after the drone cleared a headwind, completion rates lifted by almost six percent—an uptick worth millions when extrapolated across metropolitan cohorts. That improvement came not from a faster motor but from a latency-shaved WebSocket channel and a UI micro-animation that made the aircraft feel alive rather than remote.

The same principle governs the merchant portal. Payload limits, geofence drift and day-part demand all shift hourly; a dashboard that can visualise SKU eligibility in near-real time lets restaurant managers re-prioritise prep stations and packaging inventory before the lunch rush hits. During the Dallas mall trials, merchants who responded to these alerts in under five minutes captured an average of 18 percent more drone orders than those who waited an hour. Again, the decisive variable was software, not airframe.

Compliance is often dismissed as a paperwork artefact, yet it, too, is rapidly becoming code. The FAA’s forthcoming BVLOS rule is expected to accept machine-generated safety cases fed by live UTM telemetry and AI-scored risk models. Operators that cannot surface verifiable logs at API speed will be throttled to lower pilot-to-aircraft ratios or ground-bound entirely. A modern drone-delivery stack therefore needs immutable audit trails, cryptographic attestations and automated incident-response playbooks baked in by design, not bolted on after the certificate arrives.

Finally, data gravity asserts itself. Every sortie yields a rich set of behavioural traces: which push notifications convert, which driveway geometries cause hover-time spikes, which menu items stay within the 2.5-pound envelope yet sag profits because they spill. Pushing these insights back into A/B-tested UX flows or demand-shaping promos is the feedback loop that turns novelty into margin. Without a robust analytics pipeline—stream processing, feature stores, causal inference models—operators will fly blind, literally and figuratively.

Two take-home truths

• Hardware parity is imminent; differentiation now rides on code quality, data fluency and regulatory-grade traceability.

• The winners will be those who treat drones as programmable endpoints inside a cloud-native logistics mesh, not as isolated flying robots.

If you are a retailer, logistics aggregator or municipal agency looking to launch—or out-scale—aerial last-mile delivery, the conversation you need is not about propeller pitch or battery chemistry. It is about dispatch algorithms, mobile UX latency budgets, telemetry schemas, geocompliance APIs and growth experiments that respect a 55 dBA acoustic cap. Those are precisely the domains in which A-Bots.com has shipped production systems for more than a decade: from real-time routing engines for autonomous vehicles to customer-facing apps with seven-figure MAU.

Whether you already operate a drone fleet and need to modernise your software stack, or you are just drafting your first BVLOS concept of operations, we can architect, build and scale the entire digital layer—from flight-management micro-services to pixel-perfect consumer apps—so that when the rotors spin, the revenue model does too. Reach out, and let’s turn airframe potential into application reality.

✅ Hashtags

#DoorDash

#DroneDelivery

#WingAviation

#LastMileLogistics

#AutonomousDelivery

#BVLOS

#AerialLogistics

#DeliveryApp

#ABots

#FutureOfDelivery

Other articles

Otter.ai Transcription and Voice Notes Discover how to turn every meeting, interview, or conversation into actionable business insights with Otter.ai. This in-depth guide covers every aspect of otter ai transcription, from setting up your workspace to automating workflows and integrating with business tools. You’ll learn not only how to use otter voice meeting notes for seamless team collaboration, but also advanced tips, customization, and automation scenarios for real-world productivity. Looking for something even more tailored? Find out how A-Bots.com can develop a custom AI-powered solution—from voice to text pipelines to intelligent chatbots—built to the exact needs of your business or industry.

Mastering the Best Drone Mapping App From hardware pairing to overnight GPU pipelines, this long read demystifies every link in the drone-to-deliverable chain. Learn to design wind-proof flight grids, catch RTK glitches before they cost re-flights, automate orthomosaics through REST hooks, and bolt on object-detection AI—all with the best drone mapping app at the core. The finale shows how A-Bots.com merges SDKs, cloud functions and domain-specific analytics into a bespoke platform that scales with your fleet

Drone Mapping and Sensor Fusion Low-altitude drones have shattered the cost-resolution trade-off that once confined mapping to satellites and crewed aircraft. This long read unpacks the current state of photogrammetry and LiDAR, dissects mission-planning math, and follows data from edge boxes to cloud GPU clusters. The centrepiece is Adaptive Sensor-Fusion Mapping: a real-time, self-healing workflow that blends solid-state LiDAR, multispectral imagery and transformer-based tie-point AI to eliminate blind spots before touchdown. Packed with field metrics, hidden hacks and ROI evidence, the article closes by showing how A-Bots.com can craft a bespoke drone-mapping app that converts live flight data into shareable, decision-ready maps.

Top stories

Copyright © Alpha Systems LTD All rights reserved.

Made with ❤️ by A-BOTS