Home

Services

About us

Blog

Contacts

Drone Survey Software in 2025: Pix4D vs DroneDeploy

1. The 2025 Landscape of Drone Survey Software

2. Pix4D vs DroneDeploy: Feature-by-Feature Showdown

3. Beyond Off-the-Shelf: Custom Survey Solutions with A-Bots.com

1. The 2025 Landscape of Drone Survey Software

The expression “drone survey software” has matured from a niche tech query into a mainstream business term. When a construction superintendent in Texas or a forestry consultant in Finland types it into Google today, they are no longer experimenting with hobby drones—they are budgeting for centimeter-grade deliverables that plug directly into BIM, GIS and ERP workflows. The sheer variety of sectors now relying on aerial photogrammetry—roads, rail, solar, wind, insurance, even cultural-heritage scanning—has expanded the definition of the category well beyond “make me a pretty orthomosaic.” Operators want tight RTK/PPK integration, automated flight apps, real-time AI safety alerts, and the compliance paperwork to match. In other words, the 2025 landscape is about industrial-strength accuracy, speed and governance—three axes along which Pix4D and DroneDeploy continue to hammer out their rivalry.

Market momentum: bigger budgets, sharper deliverables

Analysts put the global drone-software sector at ≈ US $11.6 billion for 2025, up from US $9.3 billion a year earlier, and still on track for double-digit CAGR into 2030. Even more aggressive forecasts peg the total addressable market north of US $14 billion already, projecting a six-fold expansion by 2032. Behind the numbers is a straightforward equation: falling hardware costs + mounting regulatory clarity + insatiable demand for geospatial data equals unstoppable adoption curves for drone survey software.

Hardware democratisation fuels the software race

Five years ago, a survey-grade drone with a centimetric GNSS stack cost as much as a pickup truck. In 2025 the Autel EVO II RTK V3 ships for under US $3 000, while standalone multi-band RTK receivers from vendors like Emlid start below US $1 000. When a complete flying platform plus high-precision base station now fits inside the discretionary-spend threshold of a regional quarry manager, the bottleneck shifts squarely to software: who can turn thousands of 60-megapixel images into actionable surfaces before the next shift starts? Lower hardware barriers expand the funnel of entrants who immediately hit the ceiling of off-the-shelf processing limits—creating fertile ground for differentiated platforms and, increasingly, bespoke solutions (autelpilot.com, store.emlid.com).

Processing power & photogrammetry breakthroughs

Against this backdrop, both Pix4D and DroneDeploy pumped out headline releases in the past twelve months. Pix4D’s May 2025 update to PIX4Dmatic and PIX4Dcloud overhauled its dense-matching engine, added terrain-aware flight-planning in PIX4Dcapture Pro, and introduced collaborative rayCloud markup so dispersed teams can validate tie points in real time. DroneDeploy’s April 2025 product cycle counter-punched with 40 % larger map areas per battery on the new DJI M4E, AI-driven safety dashboards, and a revamped cut-and-fill visualisation layer that renders earth-moving deltas twice as fast as last year. The arms race is no longer about who can stitch photos—it is about who can shave minutes off field-to-finish turnaround while absorbing ever-bigger datasets without GPU gridlock (pix4d.com).

Regulation gets real: Remote ID and looming BVLOS

Regulators finally caught up with the ubiquity of enterprise drones. In the United States, Remote ID moved from proposal to enforcement, with waivers available only through narrow Letters of Authorization. More consequential for survey crews is Part 108, the long-awaited rule expected to normalise Beyond Visual Line of Sight (BVLOS) operations. Its eventual passage—widely tipped for late 2025—would eliminate a major logistical drag on corridor mapping and linear-asset inspection, areas where keeping the pilot within eyesight is physically impossible. Across the Atlantic, EU U-space corridors and pan-European C-class drone markings echo the same trend: regulators want visibility and traceability, but they are increasingly prepared to grant longer legs to professional operators who prove technical and procedural compliance.

Security & governance: ISO badges as competitive currency

Legal airspace clearance is only half the compliance game; geospatial data is often commercially sensitive or personally identifying. DroneDeploy now foregrounds its ISO/IEC 27001-certified cloud stack, multitenant encryption, and granular permissioning as strongly as it touts photogrammetry accuracy. Enterprise procurement teams in construction, utilities and government shortlist vendors not just on ground-sampling distance but on audit trails, SOC 2 attestations and data-residency options—criteria that play to platforms with deep cloud-security investment. Expect 2025 to be the year when “secure by design” becomes a baseline line-item in every request-for-proposal that mentions drone survey software (dronedeploy.com).

Why Pix4D still sets the accuracy benchmark

Founded out of EPFL research labs, Pix4D has always worn scientific rigour as a badge of honour, and 2025 is no exception. Its rayCloud interface lets technicians interrogate each tie point, reject outliers, and visually cross-check GCP residuals—features that continue to make the platform popular with surveyors who answer to licensed-land-surveyor seals. The recent rollout of machine-learning-assisted noise filtering tightens dense cloud precision, while seamless shuttle to PIX4Dsurvey bridges the CAD gap without third-party hacks. Pix4D’s commitment to desktop-plus-cloud hybrids also resonates with clients who need on-prem processing for data-sovereignty reasons but still want collaborative QA in the browser.

Why DroneDeploy dominates workflow convenience

If Pix4D sells on scientific accuracy, DroneDeploy wins on end-to-end frictionlessness. Its single mobile app now works from flight planning to real-time terrain-following to one-click cloud upload, and the April 2025 release widened the gap by supporting DJI’s M4E/T and auto-adjusting travel altitude to dodge obstacles en route to the survey area. The rebuilt cut-and-fill viewer speaks directly to earth-moving contractors who need daily volume deltas, not academic point-cloud stats. Add AI safety alerts that flag crane encroachments and human entry into no-go zones, and DroneDeploy positions itself as a site-operations command center rather than “just” mapping software—an appeal that keeps its user-growth curve steep among construction and energy firms.

Convergence—and the opening for custom builds

Viewed together, the 2025 landscape shows Pix4D and DroneDeploy converging toward similar checklists: centimeter-level accuracy, larger autonomous missions, and enterprise-grade security. Yet their philosophical split remains: one optimises for precision granularity, the other for frictionless vertical workflows. For organisations whose needs fall neatly into either camp, the choice is clear. But an expanding tranche of operators sits in the grey zone—demanding Pix4D-grade accuracy plus DroneDeploy-style usability, or niche analytics seen in neither product out of the box. That unmet delta is precisely where tailor-made toolchains from developers like A-Bots.com have begun to flourish, stitching together custom mission planners, edge photogrammetry engines and API bridges that the giants cannot economically prioritise.

The next two sections will dig into a feature-by-feature comparison of Pix4D vs DroneDeploy and then map out how a bespoke stack can surpass both—but the key takeaway from this first sweep is simple: drone survey software in 2025 is a serious enterprise line item, defined by accuracy, speed and governance, and led by two heavyweight platforms whose strengths both overlap and diverge. Understanding those fault lines is the first step toward choosing—or custom-building—the right tool for your aerial data ambitions.

2. Pix4D vs DroneDeploy — Feature-by-Feature Showdown

The phrase “drone survey software” has become shorthand for an end-to-end tech stack that begins with autonomous flight and ends with centimeter-grade deliverables inside CAD, BIM or GIS. In 2025 two brands dominate that conversation: Pix4D and DroneDeploy. Both push aggressive release cadences, both chase the same accuracy benchmarks, and both claim to “own” the construction and heavy-infrastructure verticals. Yet their philosophies, engineering approaches and commercial models remain strikingly different. Below is a deep-dive comparison—written for practitioners who care less about marketing superlatives and more about what actually happens when 1 200 RAW images land on your workstation at 5 p.m.

Photogrammetry Engines & Raw Processing Muscle

Pix4D still anchors its reputation in scientific photogrammetry. The June 2025 PIX4Dmatic 1.78 preview extends dense-cloud export options (filter by ASPRS class, merge multiple clouds, even rename them in-panel) and tightens reprojection error handling for sub-pixel tie-point accuracy (support.pix4d.com). A new machine-learning Noise Filter can strip sky artifacts from oblique datasets without manual masking, a boon for tower or bridge captures where background clutter used to inflate point counts and processing time.

DroneDeploy, in contrast, doubles down on cloud GPU grids. Its April 2025 platform release delivers 5× faster 3-D mesh loading alongside a 40 % increase in map area per DJI M4E/T battery cycle (help.dronedeploy.com). Users no longer juggle local rigs or queue render jobs overnight; processing begins the moment photos sync from the field, and AI-based scene reconstructions slot automatically into the project’s timeline.

Take-away: If you have a workstation with multiple RTX 6000s and need rayCloud-level scrutiny, Pix4D’s desktop+cloud hybrid still feels surgical. If you value elastic compute that never touches local hardware, DroneDeploy’s serverless approach wins.

Accuracy Workflows — RTK, PPK & Ground Control

Both vendors accept RTK image geotags out of the box, but the pathways diverge:

-

Pix4D emphasises validation: its QC report surfaces absolute/relative errors, and the rayCloud lets surveyors interrogate mis-registered points, then push corrections back into bundle adjustment. The latest release even optimises GCP and MTP positions during initial calibration rather than post-processing, trimming error propagation at the source.

-

DroneDeploy focuses on automation: connect an Emlid Reach or Trimble Base, tick “RTK”, and the cloud re-projects with centimetric precision. For projects that still require ground control, the platform auto-detects checkerboard targets and flags when a point lacks sufficient photo coverage—a timesaver for crews unfamiliar with photogrammetric jargon.

When absolute accuracy is the contractual deliverable—think cadastral surveys—Pix4D’s richer parameter exposure and residual graphs remain the gold standard. Where “good-enough for volume tracking” beats “surveyor-sealed”, DroneDeploy’s single-switch RTK pipeline keeps crews moving.

Mission Planning & Field UX

Pix4D’s PIX4Dcapture Pro (retiring July 2025) added terrain-aware flight so overlap percentages stay constant over undulating ground—critical for dam walls or open-pit mines. It also lets pilots tweak sidelap, camera angle and speed mid-plan, then export missions for offline acceptance in safety-restricted zones.

DroneDeploy answers with a unified Aerial mobile app. April’s “Travel Altitude” update auto-steps the UAV over cranes and tree lines during ingress/egress, cutting dead-time transits while maintaining legal clearance. And because flight logs stream straight into the same project that will hold your cut/fill report, compliance documentation is automatic—no SD-card shuffle.

For multi-site enterprises that rotate pilot crews weekly, DroneDeploy’s all-in-one design removes friction. Power users who crave granular envelope-shaping and multi-battery hand-offs may still prefer Pix4D’s mission files plus open MAVLink tools.

Verticalised Analytics & AI

Pix4D bundles Photogrammetry first, analytics second. Users generate DSMs, then pipe them into industry-specific modules like PIX4D survey or fields. Machine-learning extensions for noise stripping, Gaussian Splatting realism and rayCloud annotations arrived in 2025 but still expect the operator to define measurement primitives.

DroneDeploy ships analytics as default views: an upgraded Cut/Fill Visualizer colours site deltas by elevation band, and a new Safety AI Dashboard auto-flags humans or cranes entering danger zones, enriching daily reports without extra clicks. Renewable-energy templates calculate solar-panel shading; agriculture presets compute NDVI and stand counts. The platform is drifting toward “operational digital twin” rather than pure mapping utility.

Integration, Openness & Data Governance

Pix4D: KML ROI export, SBET LiDAR trajectory import, and LAS/LAZ class filters (all new in 1.78) cater to survey houses that shuttle data between MicroStation, Civil 3D and Terrasolid. Because the core engine also exists as PIX4Dengine SDK, enterprises can wire photogrammetry into bespoke CI/CD pipelines—handy when projects must stay on sovereign servers.

DroneDeploy: REST APIs and webhooks push processed orthos or annotations into Procore, Autodesk Build and Esri ArcGIS. April’s High-Performance Minimap now supports BIM alignment by level, bridging design-model deltas for vertical construction (help.dronedeploy.com). The company also trumpets ISO/IEC-27001 certification and data-residency options, reflecting client scrutiny by legal and IT audit teams.

Pricing & Licensing Nuances

Pix4D offers perpetual desktop seats (PIX4Dmapper) and subscription cloud tiers; CPU minutes remain unlimited once you own the licence, but GPU-assisted cloud comes à la carte. The cost model favours firms with steady but predictable workload spikes who can amortise a workstation over three years.

DroneDeploy follows true SaaS: per-user or per-site pricing bundles flight planning, processing and hosting. It eliminates hardware CapEx yet imposes monthly ambitions—idle months still bill. Large general contractors like it because OpEx lines match project budgets; smaller survey shops sometimes balk at paying when the rainy season grounds fleets.

Narrative Verdict — Who Wins What?

- Precision-obsessed surveyors validating cadastral boundaries or stockpile audits to ±2 cm tend to start in Pix4D, where rayCloud’s residual plots and GCP fine-tuning inspire confidence.

- Construction PMs juggling four active jobsites gravitate to DroneDeploy’s frictionless capture-to-dashboard loop—upload, generate cut/fill, share a link before the 7 a.m. toolbox talk.

- Regulated infrastructure owners (rail, utilities) often deploy a hybrid: Pix4Dengine behind the firewall to satisfy data-sovereignty, DroneDeploy in the field for turnkey flight plans and progress photos.

Yet an increasing slice of workflows straddle both camps: lidar-plus-RGB fusion for forest canopy, AI topology change detection for pipeline rights-of-way, or on-prem edge photogrammetry where internet is sporadic. These grey-zone demands carve a lane for custom drone mapping software—the topic of Section 3.

Quick-Fire FAQ (2025 Edition)

Q. Is Pix4D or DroneDeploy faster at raw processing?

DroneDeploy wins on elapsed wall-clock time for projects you offload straight from the field, thanks to elastic cloud GPUs. Pix4D can render quicker on a well-spec’d local machine if you disable heavy point-cloud classification, but you supply the hardware.

Q. Can either platform hit sub-3 cm absolute accuracy without ground control?

Yes—if you fly an RTK-equipped drone, maintain ≥ 80 %/70 % overlap, and perform camera warm-up shots. Pix4D exposes residual graphs so you can verify each check point; DroneDeploy auto-generates an accuracy report but hides finer bundle-adjustment knobs.

Q. Which one supports DJI’s newest Matrice 350 RTK?

Both, but DroneDeploy’s April 2025 release added native M4E/T support and terrain-follow in the same update (help.dronedeploy.com). Pix4D works so long as the camera model is loaded; you may need to add custom camera parameters until the next official release.

Q. Does Pix4D have a live-site safety dashboard comparable to DroneDeploy’s?

Not out-of-the-box. Pix4D focuses on photogrammetry outputs; safety analytics would require exporting models to third-party AI or building custom scripts via PIX4Dengine.

Q. What if I need offline processing on a ship or in a mine with no internet?

Pix4D’s perpetual licences run fully offline once activated. DroneDeploy’s Capture app can fly disconnected, but image upload and processing wait until connectivity resumes—unless you build an edge workflow via DroneDeploy’s enterprise API.

Bottom line: Drone survey software in 2025 is no longer a binary choice but a spectrum of trade-offs. Pix4D remains the surgeon’s scalpel, delivering granular control and lab-grade accuracy. DroneDeploy is the Swiss Army knife, optimised for speed, collaboration and operational insight. Map your own project constraints—accuracy tolerance, IT policy, field crew skill, cashflow model—against each platform’s DNA, and you will know which way to lean… or whether it is time to commission a tailor-made stack that blends the best of both worlds.

3. Beyond Off-the-Shelf: Custom Survey Solutions with A-Bots.com

The Gap Between “Good” and “I-Need-Exactly-This”

After two thousand words of specs, benchmarks and licensing nuances, one truth remains: no single product—even a champion like Pix4D or DroneDeploy—covers every edge-case workflow. The moment your project asks for something atypical (“fly 120 km of pipeline at night, fuse LiDAR + RGB into a single classified cloud, then push cut-fill deltas into a sovereign PostGIS instance before 9 a.m.”) you either (a) bolt on scripts and hope they don’t break, or (b) commission software that fits like a torque-wrench, not a Swiss Army knife.

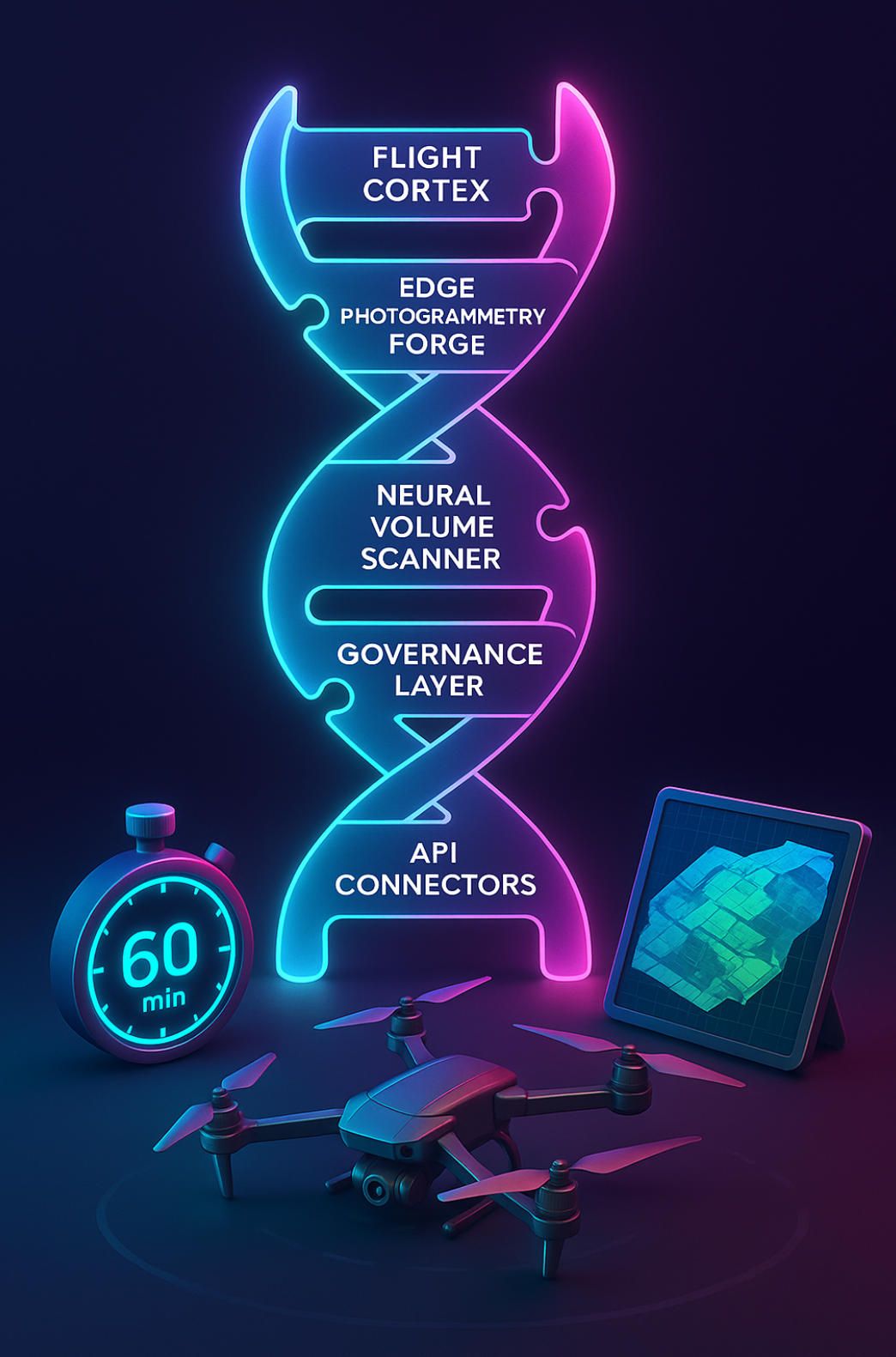

A-Bots.com’s “SurveyOps DNA” Stack

We call our answer SurveyOps DNA—a modular toolkit that lets you splice only the genes you need:

- Flight Cortex – a React Native app that generates terrain-aware waypoint grids, live-switches camera modes, and supports DJI, Autel, Skydio and custom ArduPilot rigs in the same UI.

- Edge Photogrammetry Forge – containerised COLMAP + Meshroom + proprietary bundle-adjustment code, tuned for NVIDIA Jetson Orin or Apple M-series tablets; delivers a QC-ready ortho by the time the drone lands.

- Neural Volume Scanner – YOLO-v9 transformer models pre-trained on 1.4 M construction, mining and forestry examples; outputs instant cut/fill, NBV (net bulk volume) and safety-zone intrusions.

- Governance & Security Layer – ISO/IEC-27001 pipelines, AES-256 at rest, S3-compatible or on-prem object stores, audit-ready logs.

- BIM / GIS Connectors – out-of-the-box hooks for Autodesk Construction Cloud, Procore, ArcGIS Online, PostgreSQL/PostGIS and IFC-based digital twins.

Each module is a microservice with gRPC and REST endpoints, so you can assemble a bespoke chain or embed just one link inside an existing Pix4D or DroneDeploy routine.

The “60-Minute Field-to-Finish” Challenge

Here’s our signature twist—the “60-Minute Field-to-Finish” Challenge. We drop a two-person crew on your site with:

- a DJI Matrice 350 RTK,

- a Jetson-powered tablet running SurveyOps Forge, and

- Starlink or 5G fail-over.

We clock the stopwatch: wheels-up to deliverables in under one hour—including an ortho, DSM, classified point-cloud and volume dashboard. No cloud queue. No overnight render. When prospects see that speed in person, Excel ROI models become moot.

Three Real-World Slices (Names NDA-Masked)

- Arctic Pipeline Owner – needed unbroken 200 km BVLOS corridor maps where –30 ℃ batteries limit flight windows. Flight Cortex optimised leg-transit altitudes and hand-off waypoints; Edge Forge stitched each battery’s haul locally so pilots could verify coverage before the next sortie. Cycle-time dropped from 17 days (Pix4D desktop) to 6 days.

- Tier-1 Miner in Western Australia – corporate IT banned cloud processing. We containerised Forge + Scanner on-prem; daily stockpile volumes now update straight into SAP EWM via our PostGIS hook. Accuracy variance vs Pix4Dmapper: < 1.5 cm; processing time: –65 %.

- European Rail Consortium – required LiDAR + RGB fusion for tunnel portals. We built a synthetic-scene generator (“Phantomless Twin”) that lets engineers rehearse flight plans in Unreal Engine before real sorties, guaranteeing ≥ 80 % overlap and sub-pixel parallax. Pix4D processed the final bundle, but SurveyOps handled mission rehearsal and sensor sync, saving four field visits per corridor section.

Why Not Just Write Scripts?

Because scripts don’t sign Service-Level Agreements. SurveyOps DNA ships with:

- Versioned APIs & SDKs — backwards-compatible for five years.

- Accuracy-as-a-Service SLA — we contractually guarantee < 3 cm RMSE on datasets that meet flight spec.

- White-Label Option — your logo, your colours; we vanish behind the contract.

- Source-Code Escrow — unlock protection if we ever miss an SLA milestone.

Cost Model That Mirrors Your Cashflow

CapEx or OpEx? Your pick. Pay-per-core-hour when you need elastic GPU muscle, or license perpetual edge nodes for remote zones where the internet is a rumour. Unlike pure SaaS, your data never rides to a vendor cloud unless you tell it to.

FAQ Booster Pack

Q. Can SurveyOps DNA co-exist with Pix4D or DroneDeploy?

Absolutely. Treat our modules as middleware—let Pix4D crank rayCloud accuracy, let DroneDeploy handle flight logs; we glue, automate and QA the hand-offs.

Q. We fly Skydio X10 and Parrot Anafi USA. Supported?

Yes. Flight Cortex is drone-agnostic; if it speaks MAVLink or has an SDK, we’ve already flown it or will add support within two sprints.

Q. Do you handle LiDAR?

Native LAS ingestion, trajectory smoothing, strip-alignment, and photogrammetry merge. And yes, volume calculations respect point intensity.

Q. What’s the typical time-to-pilot?

Our Fast-Track Pilot delivers a live PoC in 30 days: week 1 scoping, week 2 env build, week 3 field test, week 4 KPI review.

Book Your “SurveyOps Sprint”

If you’ve read this far, you’re probably weighing pixel-perfect accuracy against production speed, or cloud convenience against data sovereignty. Stop compromising. Let A-Bots.com draft a SurveyOps blueprint that splices the DNA of Pix4D-grade precision with DroneDeploy-level velocity—plus the custom chromosome that makes your workflow uniquely profitable.

✅ Hashtags

#DroneSurveySoftware

#Pix4D

#DroneDeploy

#DroneMapping

#Photogrammetry

#RTK

#BVLOS

#ABots

Other articles

Explore DoorDash and Wing’s drone delivery DoorDash and Wing are quietly rewriting last-mile economics with 400 000+ aerial drops and 99 % on-time metrics. This deep dive maps milestones, performance data, risk controls and expansion strategy—then explains how A-Bots.com turns those insights into a fully-featured drone-delivery app for your brand.

PropelSW App (2025 Guide) — Download, Restore and Fly The original Propel Star Wars Battle Drones app disappeared from official stores, but pilots still crave its flight trainer. Our in-depth 2,800-word guide explains exactly how to locate a clean PropelSW APK or TestFlight build, sideload it safely, pair your vintage controller and update firmware without bricking your X-Wing. We also review Liftoff Micro Drones, FPV Freerider and DRL Simulator as risk-free practice arenas, then outline how A-Bots.com can deliver a cloud-ready, licence-friendly successor with AR overlays and sub-40 ms video latency.

Litchi vs DJI Fly Choosing between Litchi and DJI Fly now shapes mission safety, data ownership and long-term budgets. This in-depth 2025 guide dissects both ecosystems: advanced waypoint scripting, Remote ID readiness, device and firmware compatibility, hidden operating costs and real-world use cases from cinematic shoots to corridor inspections. Drawing on community reports and the latest SDK 5 roadmap, it helps pilots, surveyors and enterprise managers decide which app delivers the most value—and explains why A-Bots.com’s custom-built drone software can merge the strengths of each platform into a single, brand-tuned solution.

Top stories

Copyright © Alpha Systems LTD All rights reserved.

Made with ❤️ by A-BOTS