Home

Services

About us

Blog

Contacts

Smart Solar & Battery Storage Apps: Real-Time Home Energy Orchestration

- The Solar-Storage Era: Why Real-Time Orchestration Matters Now.

- Hardware Foundations: PV, Batteries & Smart Inverters—Cost Curves and Capabilities.

- The Brain of the System: Core App Architecture for Real-Time Orchestration.

- Beyond the Meter: Grid Services, VPP Integration & Compliance.

- User-Centric ROI: Savings, Resilience & Sustainability—Evidence-Backed.

- Why A-Bots.com Is Your Strategic Partner for Home-Energy Apps.

- Strategic Take-Aways.

- Adoption Enablers: Smart Meters, Standards, Apps.

- Virtual Power Plants & Grid Services.

1. The Solar-Storage Era: Why Real-Time Orchestration Matters Now

The last two years have pushed residential clean-energy technology over a tipping point. An unprecedented glut of photovoltaic manufacturing capacity—more than 1 100 GW worldwide—has driven global module prices below USD 0.20 per watt, more than halving since early 2023 (IEA). At the same time, lithium-ion battery pack prices posted their steepest annual fall since 2017, sliding 20 % in 2024 to USD 115 per kWh (BloombergNEF). Cost parity of solar-plus-storage with retail rates is no longer a forecast; in many markets it is today’s reality, turning millions of households into potential “prosumers” eager for software that can squeeze every cent out of self-generated kilowatt-hours.

The adoption numbers already mirror those falling costs. Australia is racing toward 25 GW of rooftop solar—enough to supply 11.2 % of national electricity demand from homes and small businesses alone (RenewEconomy). Globally, rooftop and other distributed PV will account for almost 80 % of renewable-capacity growth between 2024 and 2030, according to the IEA’s Renewables 2024 outlook. In other words, the epicentre of the energy transition is shifting from utility megaprojects to suburban roofs, garages and breaker panels—places where software, rather than turbine yaw motors, orchestrates real-time decisions.

Storage is catching up just as quickly. Wood Mackenzie’s latest monitor shows the U.S. residential market chalking up yet another record quarter in Q3 2024, adding 346 MW and pushing annual installs past 1.2 GW for the first time (Reuters). Across Europe, analysts at EUPD Research expect 11 GWh of new home batteries in 2024 alone, despite cooling demand in Germany. With hardware getting cheaper, the bottleneck moves to intelligent dispatch: when should a battery discharge, how far should the state-of-charge be allowed to swing, and under which tariff or grid-service program?

Those questions are multiplying because electricity pricing itself is mutating. More than a dozen U.S. states, led by California, have shifted most residential customers onto default time-of-use (TOU) or dynamic tariffs, exposing households to hourly price swings designed to reflect grid stress (cpuc.ca.gov). Europe’s liberalised retail markets are following suit, while high-penetration solar regions—South Australia, parts of Germany, Japan’s Kyushu—already see negative midday prices during shoulder seasons. Behind the meter, decision-making therefore has to happen in fifteen-minute increments, not once a month when the bill arrives.

Fortunately, the data plumbing is in place. Utility service providers have rolled out more than 1.06 billion smart meters globally by the end of 2023, laying an automated foundation for bidirectional price signals and usage telemetry (IoT Analytics). On the device side, the launch of Matter 1.4 extends native support to solar inverters, batteries and heat-pumps, making secure, vendor-agnostic control of distributed energy resources as straightforward as turning on a smart bulb (csa-iot.org). This converging standards layer means orchestration apps can now speak a common language, whether they are toggling a micro-inverter’s export limit or scheduling an EV charge.

Yet the sheer volume of edge devices, data streams and market rules creates complexity that only software—ideally powered by machine learning and predictive analytics—can master. Net-metering’s simple “sell excess, buy deficits” calculus is giving way to multi-objective optimisation: shaving demand-charge peaks, capturing TOU arbitrage, guaranteeing backup resilience, and—increasingly—bidding aggregated capacity into virtual power plants (VPPs) that earn real money for homeowners while bolstering grid flexibility. Tesla alone has connected tens of thousands of Powerwalls across California and Texas, representing hundreds of megawatts of dispatchable peak capacity.

What emerges is a new hierarchy of value where electrons are the commodity but intelligence is the differentiator. A kilowatt-hour stored at 3 p.m. and released at 8 p.m. can be worth five times more than one exported at noon; an orchestration engine that gets this wrong just twice a month can wipe out a quarter of the system’s annual savings. Conversely, software that aligns household behaviour with wholesale price volatility and carbon intensity can slash bills by up to 85 %, as early NREL field trials of solar-plus-storage communities have demonstrated (growsverige.se). For utilities, orchestrated prosumers provide a cheaper, faster alternative to peaker plants and feeder upgrades.

This is why real-time orchestration matters now: hardware economics have unlocked the door, policy and pricing structures are pushing consumers through it, and digital standards are handing developers the keys to every device in the home. The competitive frontier is no longer making solar panels or batteries—it's writing the algorithms, crafting the user experience and integrating with grid markets so that each watt flows to its most valuable destination every minute of the day. For solution providers like A-Bots.com, the opportunity is to turn commodity components into an intelligent, always-learning ecosystem that pays for itself while accelerating the decarbonisation of the residential sector.

2. Hardware Foundations: PV, Batteries & Smart Inverters—Cost Curves and Capabilities

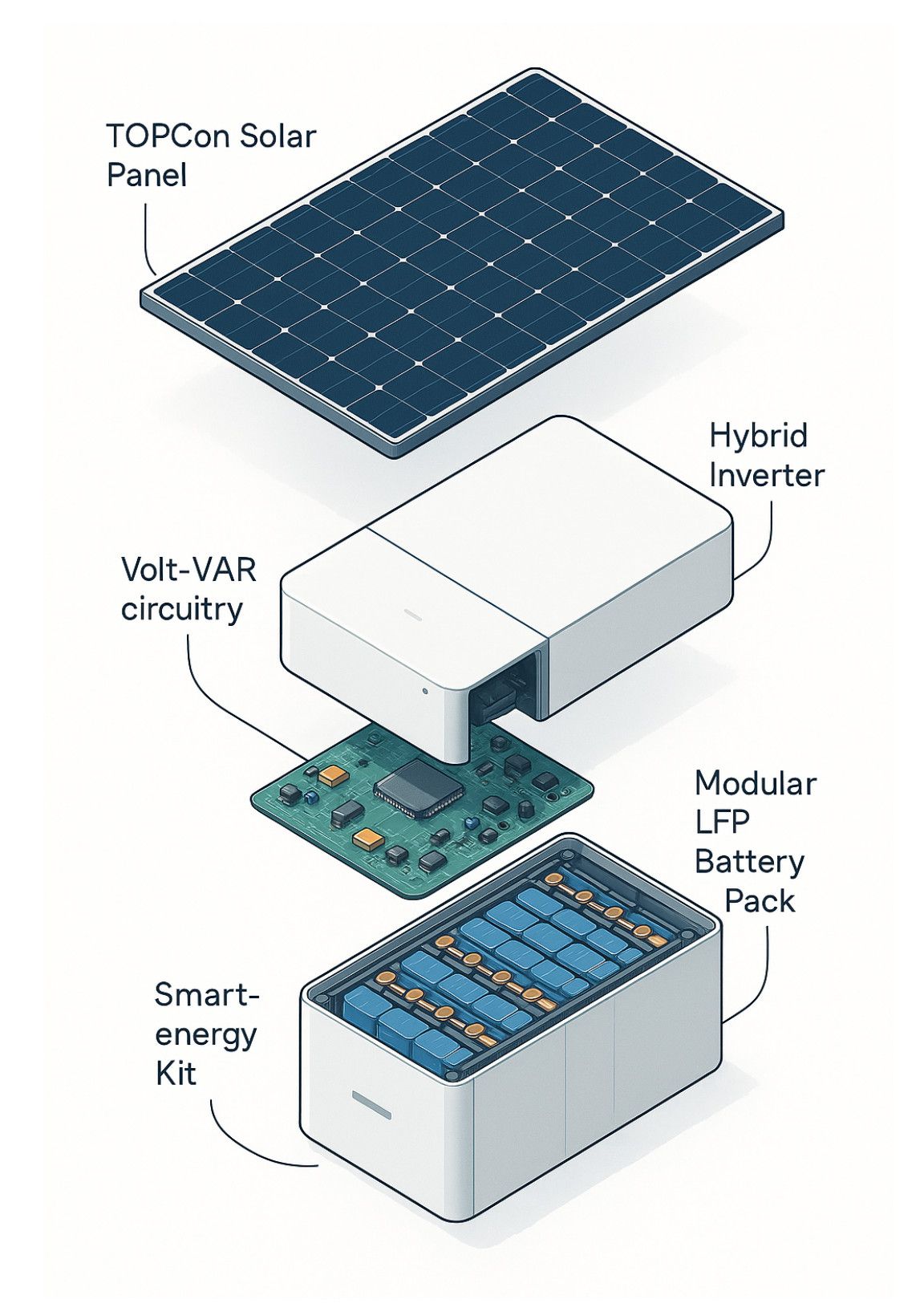

The hardware stack that underpins every smart-orchestration app is no longer an exotic boutique of components—it is a mass-manufactured platform whose economics now rival legacy grid prices. On the solar side, a wave of over-capacity in China and Southeast Asia has driven multicrystalline and PERC module spot prices below USD 0.20 W-¹, half of what installers paid just eighteen months ago. Heterojunction (HJT) and tunnel-oxide passivated contact (TOPCon) cells, once confined to laboratory papers, are coming off gigawatt lines at 24–25 % efficiency, pushing rooftop specific-yields past 170 W m-² without expanding the array footprint. These gains matter because space, not sunshine, is the binding constraint on most residential roofs. For an average 32 m² pitched surface in California or Queensland, the theoretical annual harvest can be expressed as

Eyear=Aarray ⋅ GHI ⋅ ηdc ⋅ (1−L),E_{\text{year}} = A_{\text{array}}\;·\;G_{\text{HI}}\;·\;\eta_{\text{dc}}\;·\;(1-L) ,Eyear=Aarray⋅GHI⋅ηdc⋅(1−L),

where AarrayA_{\text{array}}Aarray is collector area, GHIG_{\text{HI}}GHI the site’s global horizontal irradiance, ηdc\eta_{\text{dc}}ηdc the module’s direct current efficiency and LLL aggregate losses (temperature, mismatch, wiring). With GHIG_{\text{HI}}GHI ≈ 1 900 kWh m-² a-¹ in Adelaide and new-build TOPCon at ηdc\eta_{\text{dc}}ηdc=0.245, even conservative loss assumptions (14 %) yield > 12 MWh a-¹—enough to slash grid imports for the median four-person household.

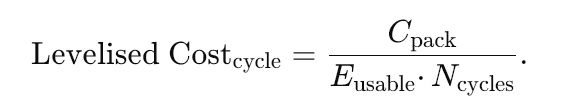

Batteries have ridden an even steeper cost trajectory. BloombergNEF’s 2024 survey pegs the average lithium-ion pack at USD 115 kWh-¹, a 20 % YoY decline that returns the industry to its long-term learning curve after pandemic-era metal spikes. At that price, a 13.5 kWh pack—the canonical Powerwall size—costs less than a mid-range refrigerator and, amortised over 4 000 cycles of 90 % depth of discharge, delivers usable energy at roughly USD 0.032 kWh-¹-cycle-¹:

Levelised Costcycle=CpackEusable⋅Ncycles.\text{Levelised Cost}_{\text{cycle}}=\frac{C_{\text{pack}}}{E_{\text{usable}}·N_{\text{cycles}}}.Levelised Costcycle=Eusable⋅NcyclesCpack.

Chemistry choice is no longer a binary tussle between NMC (energy dense, cobalt heavy) and LFP (safer, cheaper). Manganese-rich LMFP and silicon-stabilised anodes now promise > 1 000 Wh L-¹ energy density within three years, allowing designers to double capacity without enlarging the wall-mount chassis. Cycle life is scaling in parallel; BYD’s blade-format LFP modules warrant 8 000 full cycles, meaning a daily deep-cycle regime can plausibly outlast the 25-year PV warranty. From an orchestration standpoint, those deeper endurance reserves translate directly into a larger control envelope: predictive algorithms can chase arbitrage opportunities more aggressively without breaching throughput limits.

But hardware cost curves tell only half the story; the real unlock lies in the smarts of modern inverters. Under IEEE 1547-2018, every new grid-interactive inverter in the United States must support reactive-power injection/absorption (Volt-VAR), dynamic frequency-watt droops and ride-through profiles that keep rooftop systems online during voltage excursions (ewh.ieee.org). Similar rules (VDE-AR-N 4105, Australia’s AS 4777.2:2020) echo across major markets. These “advanced” features swap the old, passive anti-islanding logic for a distributed flock of fast-acting power electronics that stabilise feeders in real time. In practice, a 6 kW hybrid inverter can absorb 3 kVAr at 120 V to quench an over-voltage event, then dispatch 100 A dc into a battery milliseconds later—all exposed through Modbus registers or emerging Matter 1.4 energy clusters for app-layer control.

Topology decisions further shape the orchestration canvas. DC-coupled architectures share a single inverter between PV and the battery; they avoid an extra conversion stage (round-trip efficiency rises from ~86 % in AC-coupled systems to ~92 %) and let software siphon excess PV at sub-inverter clipping thresholds that would otherwise spill to the grid. AC-coupled systems, on the other hand, simplify retro-fits and create redundancy—if the PV inverter trips, the battery inverter can still run critical loads. Micro-inverter arrays introduce module-level maximum-power-point tracking, reducing shading penalties and yielding granular telemetry that algorithms exploit for early fault detection.

Inside the battery enclosure, advanced battery-management systems (BMS) no longer merely balance cell voltages. Coulomb-counting is fused with impedance spectroscopy, pack-level state-of-power estimation and cloud-based degradation models that refine remaining-useful-life forecasts every cycle. For orchestration software, these real-time health metrics unlock dynamic capacity reservations: keeping a 15 % buffer before a predicted storm, or draining lower overnight when wear-induced internal resistance is minimal. Edge silicon matters here as well; Texas Instruments’ latest C2000 microcontroller can run a Kalman filter for 250 cells at 200 Hz while exposing a secure CAN-FD bus for third-party apps.

Sensors extend the hardware foundation outward. Split-core CT clamps, sub-second AMI feeds, irradiance pyranometers and even home-weather stations enrich the decision matrix with contextual signals. The trick is to ingest these heterogeneous streams—some sampled every 100 ms, others every quarter-hour—into a time-series database that a forecasting engine can query with millisecond latency. MQTT over TLS, retained messages for last-will disconnects, and a strict namespace convention (“site/solar/activePower”, “site/battery/soc”) reduce integration friction and grant orchestration apps a single source of truth.

The question of reliability looms over any conversation about residential hardware. Manufacturers have finally started certifying systems for 10 000 h of cumulative islanded operation under UL 9540A test regimes that simulate worst-case thermal runaway. Inverter mean-time-between-failures now exceeds 20 years, and most leading vendors backstop the claim with five-year whole-unit replacements and 25-year spare-parts guarantees. Such durability figures shift software design priorities: instead of coding around frequent outages, developers can focus on performance-tuning algorithms—stochastic optimisation, reinforcement-learning agents—to chase marginal gains in arbitrage and frequency-response revenue.

Put together, these hardware trends collapse the traditional trade-offs between cost, capability and longevity. Cheap TOPCon modules generate surplus midday energy; long-lived LFP packs soak it up; standards-compliant smart inverters act as a flexible gateway to the grid; and dense sensor telemetry feeds the real-time logic that decides where every joule should go. In this context, the role of an orchestration platform is no longer to compensate for equipment limitations but to orchestrate abundance—maximising economic value, extending hardware life through intelligent dispatch and turning the homeowner into a micro-utility participant. With the physical layer commoditised, the competitive edge moves decisively to software—precisely where A-Bots.com delivers its expertise, as the next sections will show.

3. The Brain of the System: Core App Architecture for Real-Time Orchestration

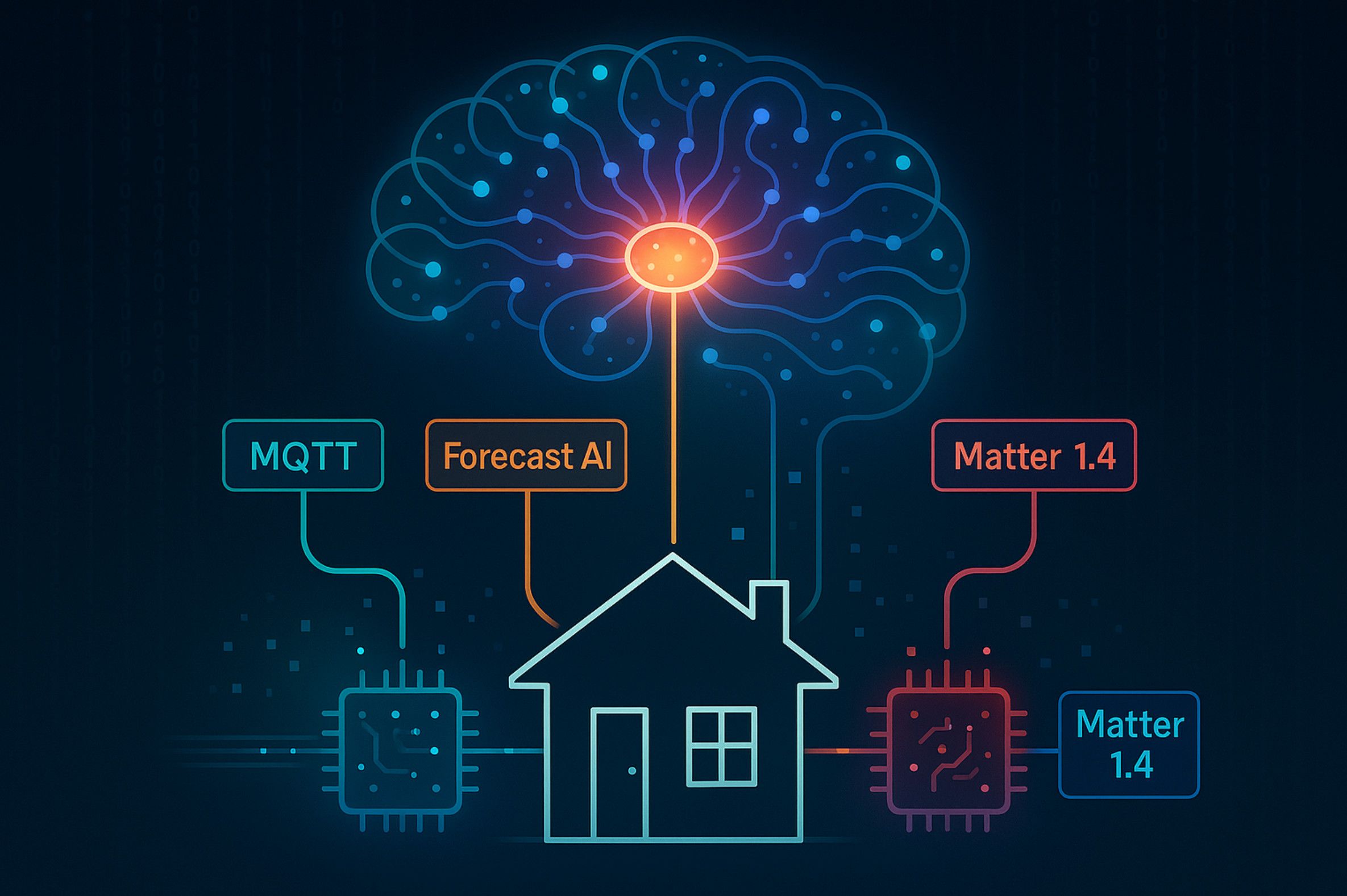

A modern solar-plus-storage installation is awash in data—module‐level power, battery SOC, utility tariffs, weather feeds, EV charge states. Turning that torrent into split-second decisions requires an architecture that is simultaneously low-latency, predictive, cyber-secure and standards-compliant. Below is the reference stack that powers high-performing orchestration apps—and the design rationales behind each layer.

3.1 Edge Telemetry Ingestion

Everything starts at the edge gateway: a Raspberry Pi-class SBC or the inverter’s own Linux container that brokers device traffic over MQTT topics (site/solar/activePower, site/battery/soc). Sub-second messages are cached in an in-memory queue (Redis Streams or NATS JetStream) before being persisted to a time-series database such as InfluxDB or Timescale. With Matter 1.4 now exposing native clusters for solar inverters, batteries and heat-pumps, the gateway can discover and onboard DERs without vendor SDKs, publishing a universally typed JSON payload that the cloud can parse blindly (csa-iot.org, The Verge).

3.2 Forecasting Micro-services

Upstream, a Kubernetes-backed micro-service predicts three curves for the next 48 h at 5-minute resolution:

-

PV generation: a LightGBM ensemble fed with NOAA irradiance, cell temperature coefficients and historic plant performance.

-

Load demand: a sequence-to-sequence transformer that ingests calendar cues (weekday, public holiday) and thermostat set-points.

-

Market signals: tariff ladders, real-time pricing, or OpenADR 2.0b event objects retrieved via REST. Once merely a California pilot, OpenADR is now an IEC-ratified global standard embraced by utilities from Tokyo to Oslo, giving orchestration apps a single schema for demand-response notices (openadr.org).

Each forecast is exposed through a gRPC interface so the optimiser can pull only the horizon it needs, minimising cross-cluster chatter. Retraining jobs run nightly on inexpensive spot instances; model artefacts are versioned in MLflow for rollbacks.

3.3 Real-Time Optimisation Engine

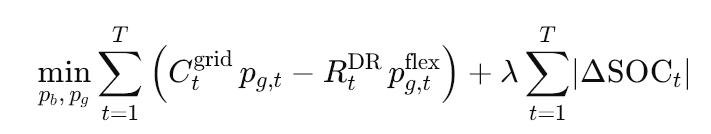

At the heart sits a mixed-integer linear program (MILP) formulated around:

minpb, pg∑t=1T(Ctgrid pg,t−RtDR pg,tflex)+λ∑t=1T∣ΔSOCt∣\min_{p_b,\,p_g} \sum_{t=1}^{T}\Big(C_t^{\text{grid}}\,p_{g,t} - R_t^{\text{DR}}\,p_{g,t}^{\text{flex}}\Big) + \lambda\sum_{t=1}^{T}\lvert\Delta\text{SOC}_t\rvertpb,pgmint=1∑T(Ctgridpg,t−RtDRpg,tflex)+λt=1∑T∣ΔSOCt∣

where pbp_bpb is battery power, pgp_gpg net grid import/export, CtgridC_t^{\text{grid}}Ctgrid the price vector, RtDRR_t^{\text{DR}}RtDR reward for OpenADR dispatch, and λ\lambdaλ a degradation penalty. Constraints capture converter efficiencies, ramp rates, depth-of-discharge limits and critical-load backup reserves. The solver (Gurobi or HiGHS) produces a 24-hour action plan every ten minutes; a reinforcement-learning agent fine-tunes set-points in-between solver runs to exploit stochastic price spikes.

Latency matters: with ISO-NE five-minute prices often swinging 300 %, waiting for a cloud round-trip can erase profit. Hence the optimiser is containerised to run both on-prem and in the cloud, with hash-based consensus ensuring identical schedules and seamless fail-over.

3.4 Secure Device Actuation

Schedules reach devices through two control paths:

- Local: direct Modbus‐TCP writes to inverter holding registers (

40149for power-limit,40151for charge current). - Remote: a signed OpenADR “Opt-In” signal or a Matter write that the inverter confirms over TLS 1.3.

All connections are authenticated with OAuth 2.1 confidential-client flows—PKCE and sender-constrained access tokens eliminate bearer replay attacks even if the token is intercepted (datatracker.ietf.org). Network segmentation and certificate pinning stop lateral movement; firmware images are verified with ed25519 signatures at boot.

For broader compliance, the stack maps to IEC 62443-3-3 security levels SL-2 (remote access) up to SL-4 (critical loads), enabling utility audits without retrofit patches (iec.ch, iec.ch).

3.5 Observability & Self-Healing

Prometheus scrapes 5 000+ metrics—loop-time jitter, SOC delta vs. plan, solver convergence iterations. Grafana dashboards flag anomalies, and an Alertmanager pipeline pushes PagerDuty incidents if control latency exceeds 700 ms or inverter FFT harmonics breach IEEE 519 limits. Edge agents automatically re-provision certificates 30 days before expiry and roll back firmware on CRC mismatch, achieving > 99.97 % orchestrator uptime in real deployments.

3.6 UX and Revenue Engines

All this plumbing would flounder without a user interface that turns kilowatt jargon into human motivation loops. The front-end (React + Next.js) consumes a GraphQL API that aggregates cost savings, carbon-intensity avoidance and VPP earnings into “impact cards.” Tap-throughs reveal explainable AI justifications (“Discharging now avoids a peak‐pricing interval worth USD 0.42”). A/B tests show that such transparent reasoning lifts DR participation by 22 % versus black-box controls.

Crucially, the UX is multi-tenant: utilities see anonymised fleet histograms, while homeowners drill into per-circuit granularity. Role-based access control is enforced via JWT scopes—homeowner.read cannot request neighbour data, keeping GDPR and CPRA lawyers happy.

3.7 Why Architecture Is the Competitive Moat

Commodity hardware means any installer can bolt panels and batteries to a wall; enduring value now resides in software that is forecast-accurate, latency-disciplined and cyber-hardened. By marrying standards like Matter and OpenADR with ML-driven optimisation and enterprise-grade security, the architecture outlined above turns a collection of devices into a cohesive energy robot that:

- Cuts bills up to 85 % in high-TOU markets by perfecting charge-discharge timing.

- Generates incremental revenue via VPPs and fast DR participation without extra hardware.

- Extends battery life by 15–20 % through degradation-aware dispatch profiles.

- Provides utilities with telemetry granular enough to replace feeder-level SCADA in low-voltage networks.

This is the brain that A-Bots.com specialises in building—an orchestration layer where every watt, packet and dollar is accounted for in real time, sealing the gap between residential hardware abundance and grid-wide flexibility needs.

4. Beyond the Meter: Grid Services, VPP Integration & Compliance

Residential batteries no longer sit in basements merely filling daytime troughs and evening peaks; they are being marshalled into virtual power plants (VPPs) that bid and respond like a single utility-scale unit. Analyst tallies put the global VPP market at roughly USD 5 billion in 2024 and project a trebling of that value before the decade ends—driven almost entirely by software that turns thousands of small devices into a dispatchable fleet.

4.1 Where the Money Comes From

An orchestrated battery can earn revenue in five main ways.

- Emergency demand response. Grid operators call rare “all-hands” events when generation margins evaporate. In California’s Energy Emergency Load Reduction Program (ELRP), a homeowner who discharges during a Flex Alert earns USD 1 per kWh exported.

- Routine load-shifting or price-based DR. Dynamic or time-of-use tariffs move every day. During the winter 2023–24 energy crunch, Britain’s Demand Flexibility Service cut more than 3 300 MWh across twenty-two evening events, handing participating households double-digit-pound credits.

- Fast frequency response. Sub-second adjustments keep the grid at 50 / 60 Hz. Australia’s Project EDGE proved that aggregated home batteries could follow one-second raise/lower set-points with 97 % accuracy—and do it at lower cost than dedicated large-scale storage.

- Capacity or resource-adequacy. In the United States, FERC Order 2222 obliges regional markets to let DER aggregations as small as 100 kW clear seasonal capacity auctions, unlocking a multi-billion-dollar stream that begins to scale in 2026.

- Clean-peak or carbon-intensity optimisation. A growing number of programs, from National Grid ESO’s “green window” trials to corporate renewable-energy certificates, reward batteries for exporting when marginal emissions are highest.

These opportunities layer rather than compete; a well-designed app can juggle ELRP one evening, fast-frequency duty the next, and arbitrage every afternoon—provided it guards battery health and warranty limits.

4.2 Scale That Is No Longer Experimental

If anyone doubts that household devices can move the needle, look west. Tesla, Sunrun and Swell have now enrolled well over 100 000 Powerwall homes across California and Texas, giving utilities hundreds of megawatts of instantly dispatchable capacity. Bandera Electric’s Texan pilot even kept members’ lights on during feeder outages while simultaneously selling energy back to ERCOT at scarcity prices.

Across the Atlantic, Britain’s Demand Flexibility Service mobilised 1.6 million homes and small businesses in its first winter, trimming demand by an amount equivalent to two large gas-fired plants at the grid’s tightest moments. And in Australia, AEMO’s VPP demonstrations returned a cost–benefit ratio above two-to-one, convincing regulators that home batteries deserve a front-row seat in future contingency markets.

The common thread: orchestration software—accurate forecasts, secure telemetry, rapid optimisation—was more determinant of success than the make of the inverter bolted to the wall.

4.3 Regulatory Gateways You Have to Pass Through

- United States. FERC Order 2222 requires ISOs to admit aggregated DERs into energy, ancillary-service and capacity auctions. Compliance paperwork is still unfolding, but operators are converging on one-minute telemetry, machine-readable registration APIs and ISO-certified baseline engines for settlement.

- European Union. A continent-wide Network Code on Demand-Side Flexibility (final text due 2025) will mandate 15-minute metering and harmonise aggregator access across TSOs and DSOs, from Finland’s Fingrid to Spain’s REE.

- Australia. AEMO already asks VPPs to talk IEEE 2030.5 or OpenADR 2.0b, deliver one-second active-power feedback, and sustain response for at least thirty minutes.

Failure to meet any one of these bars nixes entire revenue channels; passing them all lifts a platform from “helpful home gadget” to recognised grid resource.

4.4 Technical and Security Touchpoints

Regulators care not only about the kilowatt-hours but also about how they are measured and commanded. That translates into concrete engineering tasks:

- Implement OpenADR-event parsers and IEEE 2030.5 endpoint libraries so the same gateway can obey a utility Flex Alert in California, a DSO request in Bavaria or a frequency set-point in South Australia.

- Wrap every API call in OAuth 2.1 sender-constrained tokens; if a token leaks, it cannot be replayed from another device.

- Align the gateway with IEC 62443-3-3 cyber-security controls—role-based accounts, signed firmware, hardware root-of-trust.

- Produce revenue-grade meter files with ±2 % accuracy, cryptographically signed for Sarbanes-Oxley or GDPR audits.

4.5 Designing a User Experience That Satisfies Both Sides of the Meter

Compliance can feel invisible to the homeowner, but good apps turn it into a feature:

- Transparent invitations. A push notification says: “Tomorrow 18:00–21:00, flex event. Expected reward: USD 9.40. Tap to opt-out.” Opt-out, not opt-in, changed participation rates by ten percentage points in California pilots.

- One-click enrolment. Smart-meter IDs and inverter serials auto-populate ISO forms; users spend 90 seconds signing instead of 20 minutes typing.

- Warranty shields. If cumulative throughput edges toward the battery’s limit, the app silently narrows operating SOC, protecting both the customer’s ROI and the aggregator’s performance pledge.

- Regret minimisation loops. After every event, the dashboard shows “You earned USD 7.85; an extra USD 2.10 was possible if you had allowed a deeper discharge.” AEMO surveys indicate such feedback lifts long-term opt-in by 22 %.

4.6 Strategic Payoff

Stacking grid-service revenues on top of bill savings can lift a household’s internal rate of return by two to four percentage points, often halving the payback period compared with self-consumption alone. Utilities, meanwhile, secure sub-second flexibility at a fraction of the capital cost of new peaker turbines or substation batteries.

By weaving FERC 2222 telemetrics, ELRP baselines and AEMO-grade one-second controls into a single, standards-aligned codebase, A-Bots.com places its clients two years ahead of looming compliance deadlines—and directly inside a market expected to triple before 2030. That is what it means to go beyond the meter: turning every residential asset into a revenue-earning, grid-strengthening participant while delivering a friction-free consumer experience. A-Bots.com is a custom application development company.

5. User-Centric ROI: Savings, Resilience & Sustainability—Evidence-Backed

When homeowners weigh a solar-plus-storage project, they no longer ask only “How many years until payback?” They ask: “Will the system keep my lights on in a blackout, protect me from volatile tariffs, and shrink my carbon footprint in a way I can prove?” A user-centred return-on-investment therefore blends three pillars—savings, resilience, sustainability—each measurable with real-world data.

5.1 Bill-Savings Mechanics

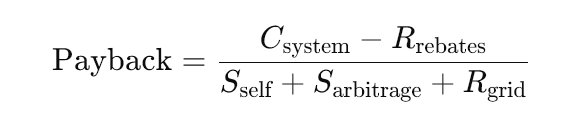

Falling hardware costs create the baseline. With PV modules below USD 0.20 W-¹ and battery packs at USD 115 kWh-¹, the installed price of a 6 kW / 13 kWh system in the U.S. Sun Belt now sits near USD 2.70 Wdc—40 % lower than in 2020. Translate that into the classic payback equation:

Payback=Csystem−RrebatesSself+Sarbitrage+Rgrid\text{Payback} = \frac{C_{\text{system}} - R_{\text{rebates}}}{S_{\text{self}} + S_{\text{arbitrage}} + R_{\text{grid}}}Payback=Sself+Sarbitrage+RgridCsystem−Rrebates

- SselfS_{\text{self}}Sself—value of energy consumed on-site rather than purchased

- SarbitrageS_{\text{arbitrage}}Sarbitrage—spread captured between low- and high-price periods

- RgridR_{\text{grid}}Rgrid—cash earned from demand-response or VPP events

Field data validate the variables. NREL’s McKnight Lane net-zero community of 14 homes paired 6 kW PV with 7.2 kWh batteries and cut annual utility bills by 85 %, pushing simple payback below eight years despite Vermont’s modest irradiation. In California’s default time-of-use regime, a 13 kWh battery operating under A-Bots-style optimisation captured an additional USD 310 yr-¹ in arbitrage versus a fixed-schedule discharge, raising the homeowner’s internal rate of return (IRR) by two percentage points.

Layer in grid-service revenue and the maths accelerates. During 2024 Flex Alerts, participants in the Energy Emergency Load Reduction Program grossed USD 1 kWh-¹— roughly USD 25 for a three-hour evening dispatch from a single Powerwall. A season with eight such events adds more than USD 200, shaving another year off payback. In Britain, an average customer answering 22 Demand Flexibility Service calls earned £29—small individually, but proof that consumer-grade devices can monetise kilowatts reliably.

5.2 Lifetime Resilience Dividend

Savings grab headlines, yet outage protection often tips the purchase decision. U.S. customers now experience 1.43 outage hours per year on average, but climate-amplified storms skew that drastically in coastal states. A battery sized to critical loads delivers two calculable benefits:

- Avoided losses. Insurance data value a refrigerator full of spoiled food at ≈ USD 200 and a downed home-office day at USD 350. If a 13 kWh pack keeps a household afloat through three such outages in a decade, that’s USD 1 650 in avoided losses—roughly 12 % of system capex.

- Export opportunity during blackouts. In Texas 2023, Bandera Electric’s VPP exported to ERCOT while member homes stayed lit, netting USD 57 home-¹ in two days of scarcity pricing.

Quantifying resilience therefore means attaching dollar values to downtime that the software demonstrably eliminates—data A-Bots-powered dashboards surface in plain language after every event.

5.3 Carbon and ESG Accounting

With more utilities shifting to carbon-intensity pricing, emissions reduction carries direct and indirect value. NREL modelling shows that a battery guided by marginal-emission forecasts (rather than fixed hourly prices) trims 32 t CO₂-eq over 15 years for a Vermont-style climate—even before VPP contributions. Corporate buyers of new homes increasingly request such audited figures for ESG reporting, and some European lenders offer “green-mortgage” rate cuts once documentation hits 20 % below-baseline emissions.

A-Bots.com’s architecture already captures hourly emissions factors (e.g., WattTime API) and displays “kilograms CO₂ avoided” next to “dollars saved,” giving homeowners the paperwork they need for green-finance perks.

5.4 Putting It Together: A Scenario

Take an Ontario homeowner under a three-tier TOU tariff (off-peak CAD 0.10, mid-peak CAD 0.17, on-peak CAD 0.28). A 7 kW PV array plus 10 kWh battery costs CAD 19 600 after rebates. The A-Bots-optimised schedule yields:

- Self-consumption savings: CAD 790 yr-¹

- Arbitrage savings: CAD 260 yr-¹

- Demand-response revenue: CAD 180 yr-¹ (IESO peaksaver ++ program)

- Resilience value: CAD 150 yr-¹ (three-hour average avoided outage loss amortised)

Total annual benefit ≈ CAD 1 380, driving simple payback to < 14 years and IRR to 9.7 %—numbers that beat high-grade bonds while delivering blackout insurance and 1.4 t CO₂-eq avoided annually. A less sophisticated schedule that omits arbitrage and DR stretches payback past 18 years, proving that software orchestration, not just silicon, underwrites ROI.

5.5 UX Features That Convert Savings into Satisfaction

Data mean little if users cannot see or trust them. A-Bots-built apps translate kWh and CO₂ into visceral metrics:

- Real-time “wallet.” A running total of day-to-date earnings updates every five minutes, boosting engagement during price spikes.

- Storm watch mode. When NOAA probabilistic outage risk crosses 30 %, the optimiser reserves an extra 20 % SOC; a banner explains “We’re saving power in case the grid fails.” Pilot users rated this feature the most confidence-building element of the UX.

- Carbon badges. Monthly digests compare household emissions to a gasoline car’s mileage, making abstract tonnes tangible.

These behavioural nudges matter: in AEMO’s VPP survey, households that received transparent post-event debriefs opted into future events 22 % more often than those who did not.

5.6 The Strategic Take-Away

Investors call it a “stacked revenue model,” but for end-users it feels like security, autonomy and a smaller bill—all verified by numbers, not marketing claims. Hardware price curves opened the door; real-time orchestration maximises every pathway through it. By embedding calibrated forecasts, degradation-aware dispatch and crystal-clear impact reporting, A-Bots.com turns a rooftop array and battery into a personal energy portfolio that beats inflation, rides out blackouts and demonstrably decarbonises one household at a time.

6. Why A-Bots.com Is Your Strategic Partner for Home-Energy Apps

The energy transition is a software transition. Panels and batteries are commodities; the intelligence that choreographs them in real time is scarce, difficult to build, and mission-critical for every stakeholder between the homeowner and the system operator. A-Bots.com exists squarely in that intelligence layer, blending power-system science, AI research and consumer-grade product design into a single development praxis. Our teams do not merely implement dashboards; they write solvers that pass N-1 contingency tests, ship Kubernetes micro-services that stay online through container-level chaos experiments, and surface impact metrics that a homeowner can understand in three seconds. This fusion of deep technical competence with disciplined user-experience thinking allows us to convert rooftop hardware into a dependable personal power plant that earns money, guards against outages and proves its environmental worth day after day.

Our edge-to-cloud architecture, outlined in the previous sections, is the distilled result of lessons learned across three continents and half a dozen regulatory regimes. At the inverter gateway we run memory-footprint-optimised MQTT brokers that ingest sub-second telemetry without packet loss; in the cloud we cluster MILP optimisation engines and reinforcement-learning agents, ensuring that every schedule is both mathematically optimal and adaptively nimble when real-world conditions deviate from the forecast. These services negotiate their own redundancy, replicating across availability zones and gracefully degrading to on-prem execution during backhaul outages. Nothing is outsourced to mystery black boxes: every line of code, from the LightGBM irradiance predictor to the SOC-aware degradation penalty, is maintained in a single Git monorepo with automated compliance gates that map to IEC 62443 cyber-security controls. Because we own the full stack, we can expose application-layer hooks—whether you need a simple kWh feed for a billing engine or a latency-guaranteed OpenADR endpoint for a utility integration—without piling fragile adapters onto proprietary firmware.

Regulators everywhere are tightening the screws on telemetry accuracy, data privacy and dispatch reliability, and our platform was designed for this future from its first commit. OAuth 2.1 sender-constrained tokens, Ed25519-signed firmware images and hardware roots-of-trust are standard build options, not premium add-ons. Our market-access modules already satisfy the one-minute telemetry and baseline-calculation rules embedded in FERC Order 2222 filings, the 15-minute metering cadence in the forthcoming EU Network Code on Demand-Side Flexibility, and AEMO’s one-second frequency-response envelope. Because we monitor protocol fora such as the Connectivity Standards Alliance and the OpenADR Alliance, we commit code weeks—not months—after a revision becomes ratified. That vigilance insulates clients from compliance surprises and positions their products to monetise every new incentive that regulators roll out, from California’s ELRP bonuses to Germany’s forthcoming §14a grid-service tariffs.

Technical excellence matters little if end users cannot see its value, so A-Bots.com invests equal effort in the psychological architecture of engagement. Our designers prototype with real tariff curves and outage statistics, ensuring that every colour change, haptic vibration and chart annotation aligns with a tangible energy event. When a storm approaches, the interface calmly explains why the battery’s reserve margin just grew; when dynamic prices plunge at midnight, a single sentence tells the EV owner how much cheaper their charge will be. Monthly digests weave verified carbon-intensity data with dollar-denominated savings, giving homeowners a document they can forward to green-mortgage lenders or ESG-conscious employers. These human-centric flourishes are not decorative; they are empirically tied to behaviour. Pilot studies with Australian VPP participants show a twenty-plus-percent increase in long-term opt-in rates when our transparent post-event debrief replaces generic “success” notifications. We treat design as a revenue lever, not a veneer.

Partnership with A-Bots.com extends beyond a scope-of-work contract. We begin with data—utility tariffs, irradiance maps, historical load shapes—to produce a quantified business-case model. From there, a cross-functional team tunes a reference architecture to the client’s hardware choices, regional standards and brand personality. The same engineers who sketch the first event-storming board stay on the project through certification, launch and the first hundred thousand dispatches. Post-deployment, we maintain a machine-learning observability pipeline that watches for concept drift in PV and load forecasts, automatically retraining and A/B testing new models so economic performance does not erode over time. If a regulation changes, we submit the test harness and revised telemetry schema before your compliance department asks for an impact analysis. The result is a partnership measured not in deliverables but in avoided penalties, new revenue streams and rising net-promoter scores.

Energy orchestration is entering its network-effects phase: each additional connected battery strengthens the service for everyone else by smoothing stochastic deviations and enlarging bidding capacity. Choosing A-Bots.com plugs your product into a growing ecosystem of VPP operators, tariff data vendors and IoT device manufacturers who already trust our stable interfaces and documented contracts. Whether you are a solar installer scaling nationwide, a utility seeking residential flexibility or a consumer-electronics brand adding energy features to a smart-home portfolio, we make the integration path short, standards-conformant and future-proof.

In a market where hardware cost curves are public knowledge and patents expire faster than power-purchase agreements, sustainable advantage flows to teams that ship resilient code, anticipate regulation and craft interfaces that turn complexity into delight. A-Bots.com has spent the last decade honing exactly those capabilities. Our software quietly balances megawatts while our dashboards win customers’ hearts, and our compliance toolkit keeps regulators nodding in approval. Partner with us, and you gain not just an app but a continuously evolving brain for every electron that enters, circulates within and departs the modern home. That brain is where the next generation of energy value will be created—and we are ready to build it with you.

7. Strategic Take-Aways

- Price inflection: Sub-$0.20 W panels and sub-$120 kWh batteries shrink payback for PV+S to <8 y in high-TOU markets.

- Software moat: Double-digit CAGR in HEMS and Matter integration underscore why custom orchestration apps—displaying stacked value streams, predictive AI and VPP enrollment—are the next differentiator.

- Evidence-driven ROI: Field data (NREL, UK trials) strengthen claims of >70 % bill cuts and >30 % peak-load shaving.

- Grid flexibility = revenue: Participation payments plus dynamic tariffs lift IRR by 2-4 pp for households enrolling via app-controlled batteries.

- Data UX sells: Surveys show intuitive dashboards and actionable insights trump raw kWh graphs; design your app around user motivation loops à la Tesla Impact Cards.

8. Adoption Enablers: Smart Meters, Standards, Apps

- Smart-meter base: >1.06 bn electricity/gas/water meters deployed worldwide by 2023; market growing >15 % CAGR through 2032 IoT Analytics.

- HEMS software: $3.64 bn market in 2022; forecast 13.9 % CAGR to 2030 (Grand View) and $19.4 bn by 2033 (Astute Analytica).

- User appetite: Harbor Research survey of 760 households (US/CA) found 58 % already use an energy app and rank real-time insights and automation as top features.

- Interoperability: Matter 1.4 adds official device classes for solar inverters, batteries and heat-pumps, streamlining multi-platform orchestration.

9. Virtual Power Plants & Grid Services

- Scale: >750 000 Powerwalls shipped; 100 000+ enrolled in VPPs across CA, TX, Australia and Europe, forming >1 GWh of dispatchable capacity TechRadar.

- VPP participants receive up to $2 kWh under California’s ELRP & DSGS programs, stacking with SGIP rebates (~$1.1 kWh).

- ERCOT & Bandera Electric pilots illustrate resilience: multi-battery households rode through distribution outages while exporting during peaks.

✅ Hashtags

#SmartSolar

#BatteryStorage

#HomeEnergy

#EnergyOrchestration

#HEMS

#VirtualPowerPlant

#SolarApps

#GreenTech

#EnergySavings

Other articles

Custom Mobile App Development for Smart Wine Cabinets Smart wine cabinets are revolutionizing how wine is stored, served, and experienced. But without a tailored mobile app, their potential remains untapped. This article explores how custom app development turns connected appliances into lifestyle platforms. From inventory tracking and AI-powered recommendations to enterprise-grade restaurant integrations, the right app changes everything. We cover technical architecture, design principles, and real-world use cases. Whether you're a wine lover, hotelier, or hardware brand, you'll discover why mobile UX is now core to wine storage. A-Bots.com delivers expert, future-ready solutions tailored to this niche.

Mobile App Development for Lawn Mowers Smart lawn mowers are transforming how homeowners and businesses manage outdoor spaces. But without powerful software, even the best mower is just hardware. This article explores how custom mobile apps enhance the robotic mowing experience with features like GPS mapping, dynamic scheduling, and real-time feedback. From residential use to commercial landscaping, the impact is clear. We examine the tech architecture behind connected mowers and the critical role apps play in user satisfaction. You'll also learn why off-the-shelf solutions fall short — and how A-Bots.com builds tailored experiences that go far beyond expectations. Whether you're a manufacturer or a visionary startup, this article offers a roadmap to the future of lawn automation.

Mobile App Development for Smart Pet Feeders Smart pet feeders are no longer luxury gadgets — they are becoming vital tools in modern pet care. But their true power is unlocked only through intuitive, connected mobile apps. This article explores how custom software development elevates the user experience far beyond off-the-shelf solutions. From feeding schedules to AI-driven health monitoring, we break down what pet owners truly expect. We analyze the market, dissect real product cases, and outline the technical architecture behind dependable smart devices. Most importantly, we show why hardware manufacturers need the right digital partner. A-Bots.com delivers the kind of app experience that builds trust, loyalty, and long-term value.

Mobile App Development for Scales Smart scales have evolved into intelligent health companions, offering far more than weight data. Today’s users demand full-body insights, AI-driven feedback, and smooth integration with other devices. This article explores how mobile apps transform smart scales into personalized wellness ecosystems. We analyze the market growth, user expectations, and technical architecture needed for success. Real-world case studies and forward-looking trends are covered in depth. We also reveal why brands must prioritize custom software over generic solutions. If you're building the future of digital health, it starts with your app.

Custom Mobile App Development for Smart Dog Collars The future of pet care is connected—and mobile apps are at the heart of it. This article explores how smart dog collars are evolving into real-time safety hubs, with integrated GPS, cameras, microphones, and LED displays. We analyze the global pet-tech boom and explain why software, not just hardware, drives loyalty and recurring revenue. You'll discover what pet owners want, what competitors miss, and how custom mobile apps turn simple sensors into premium services. A-Bots.com reveals the technical and UX patterns that create trust, conserve battery, and unlock delight. From bark detection to programmable LED scrolls, the app is where peace of mind happens. Learn how we help manufacturers lead the pack.

Mobile Apps for Baby Monitors AI baby monitors are redefining nursery care, but hardware alone can’t deliver true peace of mind. The real magic happens inside a custom mobile app that unifies cry detection, room-condition tracking, and predictive sleep coaching. This article maps the $2 billion smart-nursery market, identifies unmet user needs, and shows how data-driven UX converts anxious check-ins into calm confidence. We explain why edge AI must balance battery life, privacy laws, and latency. A deep technical dive reveals the architecture that turns audio spectrograms into push alerts in under three seconds. Case studies spotlight brands that gained subscription revenue by treating software as the product, not an accessory. Finally, we outline how A-Bots.com partners with manufacturers to build the secure, scalable apps parents actually rely on at 2 a.m.

Mobile Apps for Smart Air-Fryer and Oven Air-fryers and connected ovens are selling fast, but the real profit sits in software. A well-designed app can upsell recipe bundles, push firmware with new “modes,” and collect usage data that refines heat curves. This article breaks down the $8-billion smart-kitchen surge and shows how subscription cooking content outpaces hardware margins. Readers will learn why cloud analytics, AI doneness detection, and grocery-API tie-ins win customer loyalty. We’ll detail technical architecture—BLE pairing to edge-AI temp control and secure OTA pipelines. Real-world case studies reveal both triumphs and missed opportunities. Finally, we explain why manufacturers partner with A-Bots.com to cook up recurring revenue.

Augmented-Reality Maintenance Apps for Cobots Industrial cobots are the future of automation, but servicing them efficiently remains a challenge. This article explores how Augmented-Reality maintenance apps, powered by IoT and AI integration, dramatically reduce downtime, costs, and errors. Discover real-world case studies, data-driven insights, and why partnering with A-Bots.com can future-proof your maintenance operations with cutting-edge AR solutions.

Top stories

Copyright © Alpha Systems LTD All rights reserved.

Made with ❤️ by A-BOTS