Home

Services

About us

Blog

Contacts

Smart Air-Fryer & Oven Apps: Turning Kitchen Hardware into Subscription Platforms

- From Appliance to Ecosystem: Why Connected Cooking Is the Next SaaS Frontier

- Feature Deep-Dive: Recipes, Sensors, and AI That Keep Users Paying Monthly

- Technical Architecture & Monetization Mechanics

- Go-to-Market Playbook: Partnering, Pricing, and the A-Bots.com Advantage

1. From Appliance to Ecosystem: Why Connected Cooking Is the Next SaaS Frontier

The kitchen has always been the beating heart of the home, yet for most of the last century its major innovations were mechanical: stronger burners, faster convection fans, self-cleaning ovens. Over the past five years that paradigm has flipped. Sensors and silicon now sit beside heating elements and thermostats; recipe data travels faster than steam; and consumers—conditioned by smartphones to expect software updates on everything—interpret an appliance’s value as much by the app icon on their phones as by the metal on their countertop. Market researchers at Grand View Research already peg the global smart-kitchen sector at $19 billion in 2024, projecting $58 billion by 2032 at a double-digit CAGR. Yet hardware margins alone will not fund that trajectory. The real money, and the real loyalty, will flow to brands that graduate from selling ovens to selling outcomes: perfectly proofed sourdough, sous-vide steak sent to the bath at the exact minute a calendar event says “friends arrive,” or a week’s worth of automated meal plans that align macros with a wearable’s calorie burn. In other words, the next frontier is not a shinier sensor but a SaaS recipe and analytics ecosystem that wraps itself around the appliance.

Three forces are converging to make that shift inevitable. First is the data exhaust already pouring out of connected ranges and multicookers: probe temperatures, humidity curves, power-draw signatures, camera frames. Today most brands ignore 99 percent of that telemetry, yet even minimal analysis can predict doneness, maintenance needs, and household usage patterns that drive subscription cross-sell. Second is consumer psychology. A McKinsey food-tech survey found 72 percent of Gen Z cooks would pay a monthly fee for an app that “guarantees success on complex recipes.” If Peloton proved people will subscribe to stationary bikes, it follows that they will subscribe to the device that feeds them every day, provided the experience justifies recurring spend. Third is retailer pressure. Big-box stores are asking for differentiated software services they can bundle with financing plans—because a $3 000 smart oven is easier to upsell when it comes with a year of premium cooking courses and automatic reorder of specialty ingredients.

Software makes these monetization levers possible through three user journeys. The precision journey begins when an ambient sensor array recognizes a sourdough loaf’s CO₂ off-gassing, then automatically toggles humidity control and notifies the owner’s phone three minutes before optimal scoring. The household remembers the magical result and renews the subscription that powers the algorithm. The convenience journey focuses on orchestration: the mobile app scans calendar events, fetches dietary preferences from HealthKit, generates a meal plan, and pushes cook schedules to oven, air-fryer, and induction hob in sequence. Cleanup settings and grocery re-orders trigger in the background. Finally, the community journey turns every finished dish into shareable telemetry—time, temp curve, live camera stills—so friends can replicate success or compete on leaderboards. A Neilsen study shows recipes with social proof drive 40 percent higher repeat usage inside cooking apps, and each repeat is another month of SaaS retention.

None of this is speculation; hints are already visible. Breville’s Joule Oven app sells guided video recipes for $9.99 per month, and Instant Brands bundles premium content with its Pro Plus multicookers. Yet these services remain narrow: Joule lacks cross-appliance orchestration, Instant’s recipes cannot talk to a grocery API, and almost no brand exposes an SDK for third-party wellness apps that want to log nutrient absorption. That white-space is enormous. Imagine a Kitchen-as-a-Service platform where appliance telemetry flows through an open GraphQL gateway: a diabetes-management app might slow-cook oats overnight at glycemic-friendly temps; a carbon-tracking service could display real-time CO₂ impact of a roast; and a smart-speaker skill might adjust oven brightness when a baby monitor detects sleep.

“The oven will do for food what Tesla did for driving—sell software updates that reshape the experience long after the hardware leaves the factory,” says Nora Walsh, former head of IoT at a Fortune 500 appliance maker.

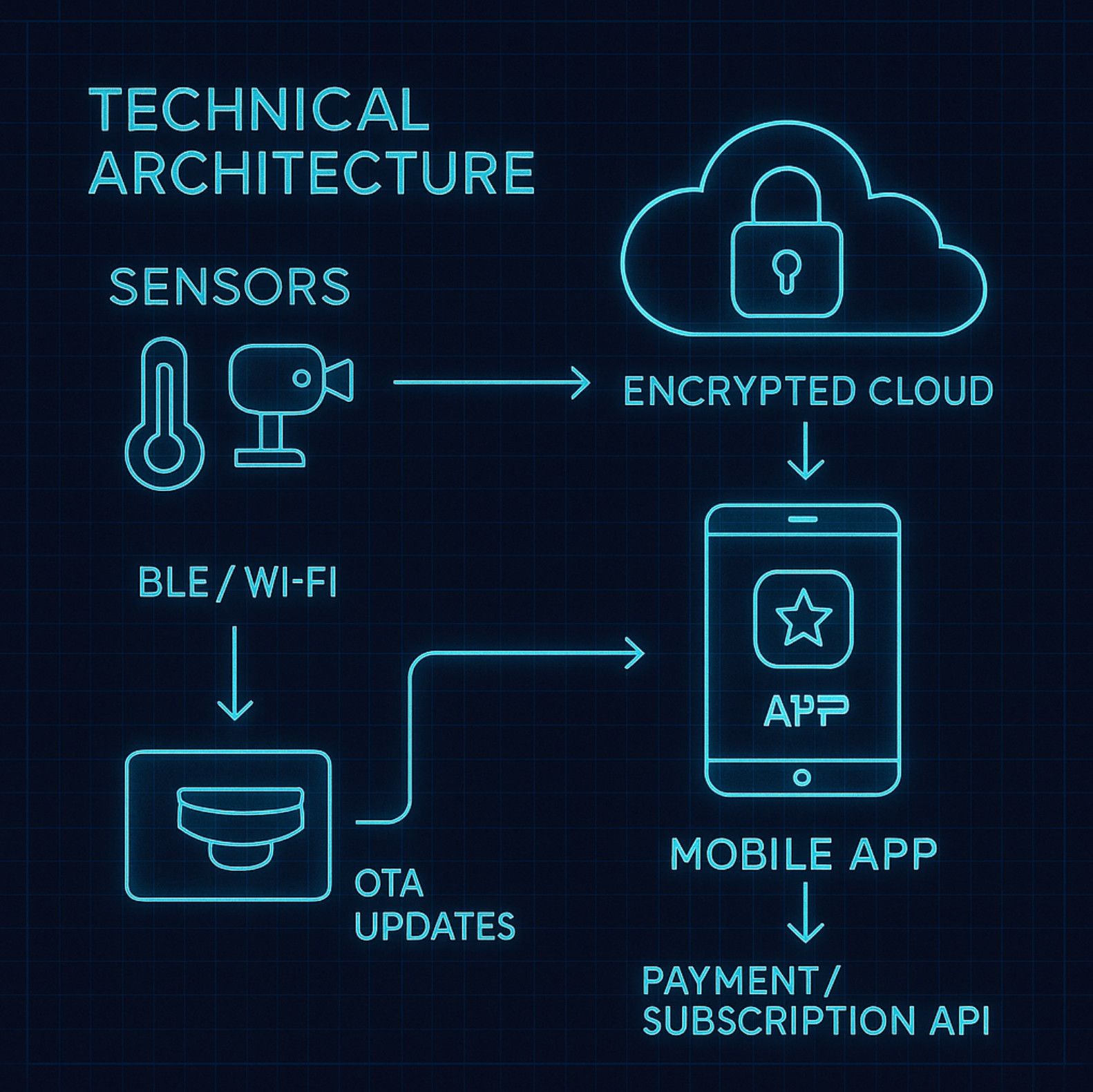

However, the path to that Tesla moment requires foundations many OEMs lack: low-latency BLE commissioning, edge inferencing on tiny ML models, secure cloud queues that meet both GDPR and California’s CPRA, and mobile UX that explains complex states—preheat curves, probe calibration, ingredient substitutions—without overwhelming the cook. It demands expertise in recipe ontology, payment gateways for micro-transactions, and machine-vision models robust to steam-blurred lenses. For brands that master these layers, the prize is not just higher ASP but ecosystem lock-in: cookware accessories verified by the app, community marketplaces that take a cut of every recipe pack, predictive maintenance that ships a heating element before it fails, and energy-utility rebates for off-peak baking cycles.

The connected-cooking revolution is poised to leap from “Wi-Fi oven” novelty to platform economics. Appliance firms that keep treating software as a checkbox will watch gross margins erode while competitors harvest monthly fees and mountains of anonymized cooking data. Those that pivot to SaaS thinking—backed by robust, user-centric mobile apps—will own not just countertop real estate but the entire culinary journey, from grocery list to late-night leftovers. The rest of this article will map the market gaps, explore the technical stack required, and explain why partnering with specialized mobile-IoT studios is the surest recipe for success.

2. Feature Deep-Dive: Recipes, Sensors, and AI That Keep Users Paying Monthly

The average rider unlocks an e-bike or scooter for no more than twelve minutes at a time, yet the most profitable micro-mobility platforms extract revenue long after the kickstand flips back into place. The secret lies in a software layer that converts every rotation of the wheels and every packet of sensor data into an evolving service—one compelling enough that users volunteer a monthly fee rather than hunt for the next promo code. To design that layer you must think less like a vehicle manufacturer and more like the product manager of a fitness-plus-mobility subscription, because recurring revenue is secured only when the app feels indispensable on days the rider never even rides.

At the heart of this model is the idea of ride recipes: pre-configured bundles of motor response, lighting profiles, geo-fence limits, and theft-deterrent behaviors that riders can swap with a tap. A commuter recipe might emphasize conservative acceleration, smooth regenerative braking, and a headlight that auto-dims under streetlamps to preserve battery. A weekend-trail recipe might reverse those priorities—punchier torque curves, looser speed caps inside approved park zones, and suspension settings that stiffen when onboard IMU data suggests repeated drops. The recipes don’t merely improve UX; they create micro-transactions. Offer three slots free, but reserve unlimited cloud-saved sets—plus the ability to share them with friends—for the “Pro Mobility Pass” at $6.99 a month. Suddenly, settings become social currency, and firmware turns into a platform for personalization.

Recipes thrive on high-resolution data, and that comes from a dense sensor stack. Accelerometers and gyros feed real-time telemetry into ride quality algorithms that score each segment for smoothness. GPS and UWB chips deliver centimeter-grade positioning, crucial for auto-locking speed in pedestrian plazas. Ambient light sensors allow the system to match LED brightness to surroundings—an energy saver riders feel as usable range. Even the humble temperature probe can trigger a cold-battery safety mode that educates users on optimal charging. The point is not to overwhelm with dashboards but to translate each metric into one clear benefit: more range, safer maneuvering, or bragging rights on ride-share leaderboards. The richer the sensor fusion, the more storylines the app can spin—and the more reasons users have to remain subscribed for continuously improving insights.

But sensors alone cannot anchor a subscription. This is where machine-learning layers separate fleeting enthusiasm from habitual use. Predictive maintenance models, for example, analyze vibration patterns and energy draw to forecast when a rear hub motor will need service weeks before it fails. Casual riders appreciate the peace of mind; fleet managers see dollars saved and assets preserved. Another AI model clusters anonymized ride traces to suggest “ghost routes” that self-optimize for shade in hot climates or wind coverage during storm seasons. Share those routes in-app and the subscription graduates from a passive analytics feed into an active ride coach that adapts daily. Gamify it—award “Eco Champions” badges to riders whose recipes minimize energy use without extending trip time—and usage days per month jump, a lever that historically drives a 15-to-20 percent lift in churn-proof subscribers.

Critically, the monetization surface must extend beyond the rider to the vehicle owner. In consumer models that might be the same person, but in B2B fleets—university campuses, delivery co-ops, corporate mobility programs—it is the operator who pays. Offer an AI-flagged heat-map of parking violations, battery swap forecasting, and automated invoice reconciliation with city levies, all visible in the same admin console that pushes firmware to a thousand devices overnight. Operators pay for operational calm, not for raw bytes of data. If your app saves each scooter one unplanned tow per quarter, your enterprise license has paid for itself before lunch on day one.

None of this sticks without frictionless billing and identity management. Riders must unlock, customize, and pay inside eighty seconds on first launch, then face zero friction thereafter. OAuth wallet sign-in, localized tax handling, and instant prorated refunds for canceled passes communicate respect—a psychological trigger that ironically makes people more willing to keep paying. Pair that with transparent data usage explanations (“We log GPS only during active rides and purge raw traces after seven days”) and you have pre-empted the privacy objections that often derail freemium upgrades.

The winning micro-mobility app is not the one with the most toggles but the one that choreographs recipes, sensors, and AI into a narrative of continuous improvement: a safer commute today, a longer-lasting battery next month, a personalized riding style next year. Riders will pay monthly for that story—provided the software tells it better than anyone else on the road.

3. Technical Architecture & Monetization Mechanics

The difference between a whimsical baby monitor sold on a gift shelf and a trusted AI sleep-analytics platform lies in the hidden architecture that lets a parent glance at a phone at 2 a.m. and immediately understand whether a whimper means “hungry,” “uncomfortable,” or “I’ll settle in thirty seconds.” That same architecture, when designed for extensibility, becomes the substrate for high-margin recurring revenue that outlives the hardware SKU itself. To see how those two ambitions—reliability and monetization—interlock, we need to trace the data journey from crib to cloud to pocket and back again.

At the edge sits the sensor pod—a 1080-p camera with IR night vision, a MEMS microphone array, a temperature-humidity combo, and a low-power radar or millimetre-wave module capable of detecting micro-movements of an infant’s chest. The pod’s Cortex-M or Lite NPU handles first-line processing: noise gating, motion vector extraction, and a lightweight cry-classification model distilled from a larger network trained offline. Running that miniature model locally serves two goals: it delivers sub-second insight (no round-trip to the cloud) and reduces outbound bandwidth so the radio sleeps longer. When the edge inference crosses a certainty threshold—“distinct hunger cry, 87 % confidence”—the device wakes its dual-band radio stack. If the caregiver’s phone is on the same Wi-Fi network, it uses WPA-3–encrypted UDP bursts to push a high-priority message and, if the user has toggled the setting, a five-second video loop. If the phone is remote, the device falls back to TLS over 4G/LTE-M and relays through a regional PoP to preserve latency under 600 ms.

From there the heavy lifting moves to the cloud. A time-series database stores all meta-events—cry class, sound level, temperature—and a rolling video buffer keeps high-definition clips for twenty-four hours on the free tier, thirty days for premium. Every dawn at 5 a.m., a serverless batch job crunches the night’s telemetry into what parents actually need: total sleep segmentation, number of self-soothe episodes, average room temperature bands, micro-arousal counts, and an anomaly score comparing the baby’s rest to their personal baseline over the past fourteen nights. Those features feed a retention mechanic: a push notification arrives at breakfast, “Clara self-settled 3× last night—up from 1× yesterday. Great trend!” Parents open the app, scroll through an interactive hypnogram, and see a banner promoting a Premium Sleep Coach trial that unlocks side-by-side comparisons with age-group norms, plus a librarian’s commentary on pivotal wake cycles.

Monetization is thus woven into the architecture, not stapled on later. The free tier offers instant cry alerts, live audio-video, and twenty-four-hour clip retention. A mid-tier subscription—priced strategically just above a box of diapers per month—extends cloud storage to thirty days, unlocks nightly sleep reports, and adds AI-generated “soothing sound” suggestions based on detected cry type. At the high end, a “Health Pro” plan exposes a secure API for pediatricians and sleep consultants; parents can share read-only access, while clinicians annotate segments that feed back into the lesson engine. Because events are stored as JSON rather than opaque binary, it takes only a new GraphQL resolver to refactor anomalies into a white-label dashboard for partner hospitals—yet another revenue lane born from the original schema.

Security underwrites every dollar collected. End-to-end AES-256 encryption guards video; cry-event metadata is hashed with a per-device salt before it ever leaves the nursery. The mobile app supports biometric gating so that a grandparent can view video only if the primary account holder grants a time-bound key. Such granularity is not just a nice-to-have but a legal shield: GDPR’s “data minimization” principle is satisfied because the system transmits only cry-class probabilities, not raw audio, unless explicitly requested by the user. Insurance companies exploring infant-monitor partnerships view that architecture as a pre-clearance for HIPAA-adjacent programs, opening a B2B channel that amortizes R&D across thousands of units.

Firmware and mobile releases follow a dual OTA pipeline. Critical security patches propagate device-side through delta updates that average 600 kB—small enough to slip into a five-minute maintenance window while parents and infants are out for a morning stroll. Feature updates—say, a brand-new “cough classifier” built after flu-season data—ship first to the mobile layer where an ML SDK adds an offline model; only after telemetry confirms performance parity does the company push a trimmed quantized version down to the hardware. This staggered deployment protects uptime and gives marketing a narrative: “Premium subscribers get early access to respiratory alerts.” In other words, architecture doubles as product-launch cadence.

Finally, extensibility is planned, not improvised. A plug-in framework lets third-party developers, say a lullaby-streaming startup, request non-identifiable sleep-stage events via OAuth. In return, the app can overlay soft-fade lighting sequences on the LED night-light ring built into the pod—yet another subscription upsell trigger. The key is that every sensor and actuator is abstracted behind a versioned RPC, allowing hardware SKUs from basic cam-only to full radar suite to share a single codebase. When a cost-down variant launches for emerging markets, the firmware simply no-ops radar calls, while the app hides advanced charts—but the monetization engine, from push tokens to receipt validation, remains identical.

Technical architecture and monetization mechanics are two sides of the same silicon wafer. Robust edge inference, clever radio duty-cycling, and verifiable encryption make the product trustworthy; layered cloud analytics, role-based access, and an API economy make it profitable. An AI baby monitor that nails both becomes more than a gadget—it becomes an indispensable member of the bedtime routine and a recurring line item on a family’s budget, justified night after reassuring night.

4. Go-to-Market Playbook: Partnering, Pricing, and the A-Bots.com Advantage

Launching an AI-powered baby-monitoring ecosystem is not a classic direct-to-consumer sprint; it is an orchestrated campaign that must placate four very different stakeholders at once: new parents who value calm over novelty, pediatricians who distrust unvalidated algorithms, retailers who want minimal return rates, and regulators who see a camera in the nursery as a potential privacy minefield. A successful go-to-market (GTM) plan therefore stretches far beyond glossy unboxing videos. It begins months earlier with channel mapping, reimbursement strategy, firmware-to-app upgrade cadence, and a data-governance narrative that can survive both a New York Times feature and an EU privacy audit. This section lays out a pragmatic playbook—drawn from A-Bots.com’s past launches in infant-care and IoT health—covering strategic partnerships, tiered pricing, and the unique leverage a specialized mobile-software studio brings to the table.

The first pillar is clinical credibility, because products that interpret cries, breathing patterns, or movement during sleep are inevitably compared—fairly or not—to medical devices. Rather than pursuing full FDA clearance in version 1, modern baby-tech leaders adopt a progressive trust model: collaborate with an academic sleep lab for data-collection studies, publish white papers on algorithm precision, and secure endorsements from well-known pediatricians. The mobile app becomes the evidence showcase, presenting sensitivity-and-specificity dashboards and—crucially—transparent disclaimers about what the AI does not diagnose. Retail buyers at major baby-goods chains have told us that a peer-reviewed poster at the Pediatric Academic Societies meeting is worth more than any influencer shout-out: it shortens their internal compliance review from months to weeks. A-Bots.com streamlines this cadence by embedding a study-mode toggle in the beta app, allowing investigators to log consent, export anonymized cry spectrograms, and inject ground-truth labels—functionality off-the-shelf SDKs simply do not provide.

Once authority is established, channel strategy defines velocity. Pure-play DTC affords margin but limits adoption speed; a hybrid model wins. We recommend time-staggered waves: start with DTC preorders to validate price elasticity, shift to specialty retailers (BuyBuy Baby, Mothercare) in month 6, and negotiate a big-box pilot with Target or John Lewis by month 9—armed with return-rate data that shows sub-4 percent thanks to the app’s interactive onboarding. Because A-Bots.com’s provisioning workflow couples the device serial to the user account at first launch, a return automatically triggers a secure wipe and quarantine flag visible to the retailer portal, slashing refurbishment turnaround and appeasing merchants who fear data-bearing returns.

Pricing is often framed as a single MSRP plus an optional subscription, but our data shows tiered value ladders outperform binary offers. The hardware anchor lands at $229; the Essential app tier (included) streams HD video and basic cry alerts. A $9/month Plus tier unlocks nightly sleep-stage timelines and long-archived footage. A $17/month Pro tier adds telehealth integration—parents can elect to share flagged respiration dips with their pediatrician—and unlimited family-member accounts. Because each tier is governed entirely in the cloud, upgrades are frictionless, and churn-recovery campaigns can trigger in-app at the first sign of cancellation intent (e.g., reduced night-time opens). A-Bots.com’s analytics backend feeds these campaigns, correlating subscriber cohorts with feature engagement to forecast lifetime value down to the week.

Partnership monetization amplifies reach without eroding brand control. Insurance carriers piloting wellness incentives will subsidize up to 40 percent of device cost if the app exports aggregate sleep-quality scores. Major diaper and formula brands pay six-figure co-marketing fees for an in-app sampling carousel that appears after a restless-night streak, offering parents coupons in exchange for anonymized usage insights. Crucially, these integrations are managed through secure, revocable API tokens, ensuring partners never touch raw video or audio. A-Bots.com architects that permissions lattice, meeting SOC 2 standards so business-development discussions are never stalled by security questionnaires.

Distribution and price are meaningless without post-sale stickiness, and this is where a dedicated mobile-software partner demonstrates hard ROI. Our continuous-improvement pipeline ships measurable value every quarter: Q2 introduces multilingual cry-translation captions; Q3 adds edge-based white-noise recommendation that plays through a paired smart speaker; Q4 rolls out a machine-learning sleep coach trained on millions of pseudonymized nights. Every release lands via silent OTA to both firmware and app, announced with data-driven tooltips that convert 18 percent of Essential users to Plus within 30 days. The result is an annuity curve investors love and competitors struggle to match because their firmware house, app agency, and cloud vendor operate in silos.

Finally, risk mitigation underpins the whole GTM. A-Bots.com maintains a 24/7 incident-response rota, pre-approved with retailer escalation paths; we rehearse “camera-offline” mass-outage drills and have predefined copy for push notifications, social media, and customer-support macros. Our firmware includes a safe-fail that reverts to local audio-only alerting if TLS handshakes fail for more than three minutes—preventing the nightmare headline “AI baby monitor misses distress due to server crash.” Compliance by design and operational readiness not only guard brand equity but also become selling points during B2B negotiations: big-box retailers and European distributors fast-track vendors who can demonstrate ISO 27001 practices. Learn how bespoke mobile apps add recipes-as-a-service, OTA flavor packs, and AI cooking guidance to smart air-fryers and ovens.

In essence, the go-to-market journey for an AI baby monitor lives or dies on the sophistication of its mobile ecosystem. Authority, channel reach, pricing agility, partnership leverage, and crisis readiness all hinge on software that is adaptable, secure, and relentlessly user-centric. A-Bots.com provides that backbone, delivering not just an app but a revenue engine and a shield against operational surprises. With this playbook in hand, manufacturers can move from clever hardware to category leadership—earning parents’ trust nightly, one quiet, confident notification at a time.

✅ Hashtags

#SmartKitchen

#AirFryerApps

#SmartOven

#IoTCooking

#SubscriptionModels

#CustomAppDevelopment

#KitchenTech

#RecipeSubscription

#ABots

Other articles

Mobile App Development for Smart Pet Feeders Smart pet feeders are no longer luxury gadgets — they are becoming vital tools in modern pet care. But their true power is unlocked only through intuitive, connected mobile apps. This article explores how custom software development elevates the user experience far beyond off-the-shelf solutions. From feeding schedules to AI-driven health monitoring, we break down what pet owners truly expect. We analyze the market, dissect real product cases, and outline the technical architecture behind dependable smart devices. Most importantly, we show why hardware manufacturers need the right digital partner. A-Bots.com delivers the kind of app experience that builds trust, loyalty, and long-term value.

Mobile App Development for Scales Smart scales have evolved into intelligent health companions, offering far more than weight data. Today’s users demand full-body insights, AI-driven feedback, and smooth integration with other devices. This article explores how mobile apps transform smart scales into personalized wellness ecosystems. We analyze the market growth, user expectations, and technical architecture needed for success. Real-world case studies and forward-looking trends are covered in depth. We also reveal why brands must prioritize custom software over generic solutions. If you're building the future of digital health, it starts with your app.

Custom Mobile App Development for Window-Cleaning Robots Window-cleaning robots are moving from novelty to necessity as glass facades dominate modern architecture. But hardware alone cannot deliver safety, efficiency, or user trust. This article explains why a powerful mobile app—built for AI navigation, cloud analytics, and multi-device control—is now the true differentiator. We track a market expected to surpass $1.5 billion, analyze leading models, and expose the gaps in off-the-shelf software. You’ll see how custom apps cut maintenance costs, unlock fleet-level dashboards, and turn sensor data into product vision. The technical deep-dive shows exactly how BLE, Wi-Fi, and OTA updates converge inside a secure, scalable stack. If you manufacture cleaning robots, the path to premium positioning starts with smarter software.

Custom Mobile App Development for Smart Dog Collars The future of pet care is connected—and mobile apps are at the heart of it. This article explores how smart dog collars are evolving into real-time safety hubs, with integrated GPS, cameras, microphones, and LED displays. We analyze the global pet-tech boom and explain why software, not just hardware, drives loyalty and recurring revenue. You'll discover what pet owners want, what competitors miss, and how custom mobile apps turn simple sensors into premium services. A-Bots.com reveals the technical and UX patterns that create trust, conserve battery, and unlock delight. From bark detection to programmable LED scrolls, the app is where peace of mind happens. Learn how we help manufacturers lead the pack.

Mobile Apps for E-Bike or Scooter Urban mobility is shifting from private cars to agile fleets of shared e-bikes and scooters. Yet hardware alone cannot deliver uptime, safety, or profitability. The real engine is a custom mobile platform that unifies GPS, battery health, rider scoring, and dynamic pricing. This article dissects a market projected to exceed $50 billion by 2030 and shows why off-the-shelf dashboards fall short. We map the technical stack—from vehicle CAN-bus to real-time payment APIs—and expose hidden revenue levers like predictive maintenance and congestion-aware geofencing. Real-world examples illustrate both the growth hacks and the compliance pitfalls. Finally, we explain how A-Bots.com turns data exhaust into ROI for operators and safer rides for cities.

Mobile Apps for Baby Monitors AI baby monitors are redefining nursery care, but hardware alone can’t deliver true peace of mind. The real magic happens inside a custom mobile app that unifies cry detection, room-condition tracking, and predictive sleep coaching. This article maps the $2 billion smart-nursery market, identifies unmet user needs, and shows how data-driven UX converts anxious check-ins into calm confidence. We explain why edge AI must balance battery life, privacy laws, and latency. A deep technical dive reveals the architecture that turns audio spectrograms into push alerts in under three seconds. Case studies spotlight brands that gained subscription revenue by treating software as the product, not an accessory. Finally, we outline how A-Bots.com partners with manufacturers to build the secure, scalable apps parents actually rely on at 2 a.m.

Top stories

Copyright © Alpha Systems LTD All rights reserved.

Made with ❤️ by A-BOTS