Home

Services

About us

Blog

Contacts

Custom Apps for Personal Micro-Mobility Devices: E-Bike & Scooter Fleet Control

- Introduction: Why Micro-Mobility Needs Custom Apps—Not Just Dockless Vehicles.

- Market Landscape: Why Micro-Mobility Apps Are Moving Faster Than the Vehicles They Serve.

- Capabilities & Use-Cases: What a Custom Fleet-Control App Unlocks.

- From Dashboard to Street-Level Insight: What a Custom Fleet-Control App Really Delivers.

- Technical Architecture: Building a Battery-Smart, Secure & Extensible Fleet-Control Stack.

- From Raw Telemetry to Strategic Advantage.

- Future Viability and the Strategic Case for Custom App Partnerships.

1. Introduction: Why Micro-Mobility Needs Custom Apps—Not Just Dockless Vehicles

Walk through any downtown core at 8 a.m. and you will notice a pattern that barely existed five years ago: commuters gliding past traffic on electric scooters and low-slung e-bikes, scanning barcodes with phones, then parking curbside as the vehicles chirp “ride complete.” What looks effortless on the sidewalk is in fact a choreography of IoT modems, battery telemetry, payment rails, and city-mandated data feeds. Missing from that picture—and too often from boardroom strategy decks—is a recognition that the mobile application has become the true operating system of micro-mobility fleets. Without a robust, purpose-built app, an operator is simply dumping smart hardware into a public right-of-way and hoping for the best.

A Market Too Large for Commodity Software

Investors are betting heavily that this sector still has headroom. The global e-bike market cleared $61.9 billion in 2024, on a trajectory to post 10 percent CAGR through 2030 Grand View Research. Shared e-scooter services, once considered a niche fad, are growing even faster; analysts at The Business Research Company peg the e-scooter sharing market at $1.55 billion for 2025 after expanding 16.8 percent year-over-year thebusinessresearchcompany.com. Roll those segments into the wider micro-mobility umbrella—dockless bikes, seated scooters, compact mopeds—and Grand View Research arrives at $40.6 billion in 2024 with 14.5 percent CAGR through 2030 Grand View Research. When a category is adding billions of revenue every year, incremental UX hacks no longer suffice; competitive advantage shifts to whoever controls data flows, ride logic, and real-time fleet orchestration. All three live inside the app.

From Ride Unlock to City Compliance

Custom software matters because micro-mobility operators must satisfy three masters at once: riders who expect frictionless journeys, city agencies that demand standardized data, and financiers who track per-vehicle unit economics by the hour. Generic white-label apps rarely balance that triangle. Consider the new Mobility Data Specification (MDS) requirements adopted by more than 120 American municipalities: fleets must stream anonymized trip events in real time so planners can curb sidewalk clutter, monitor equity zones, and enforce rebalancing. An off-the-shelf dashboard might meet the letter of the rule, but only a tailor-made app can turn compliance into positive UX—alerting riders that parking is disallowed on a given block before they incur a fine, or nudging them toward incentive zones where a city offers credits.

Security Lessons Written in Tarmac

The stakes go beyond red tape. When researchers at IOActive hacked Segway MiniPro devices and seized throttle control from 30 feet away, the culprit was an unauthenticated Bluetooth link in the companion app WIRED. A similar flaw let attackers disable brakes on Xiaomi’s best-selling M365 scooter WIRED. Both incidents made global headlines, dented brand trust, and forced costly firmware recalls. They also underlined a brutal truth: in micro-mobility, the mobile app is a safety component. Custom development—with signed firmware pipelines, rotating BLE keys, and remote revocation—turns security from a product liability into a selling point for regulators and end users alike.

Fleet Operators Demand Granular Control

At the operations level, a scooter is an asset with a depreciating lithium battery and a revenue clock that stops the moment it tips over, disappears indoors, or hits 20 percent charge. Ryde Technology, which runs 20 000 vehicles across six Norwegian cities, adopted an IoT-driven fleet app and cut vandalism losses and SIM-misuse costs by double digits Asia Growth Partners. Their experience is typical: dispatchers need heat-maps of idle units, battery-aware rebalance routes, and AI predictions of morning surge corridors. A one-size-fits-all consumer UI cannot expose those levers; a layered app with role-based dashboards can.

“Unlocking a scooter is easy—operating ten thousand of them profitably is not. Apps that collapse rider UX, fleet analytics, and city reporting into one stack will decide who wins micro-mobility 2.0.” — McKinsey Center for Future Mobility analyst, 2024 report McKinsey & Company

Hardware Is Commodity; Software Prints Loyalty

Finally, hardware differentiation is eroding. Most operators buy from the same OEM catalogues in Shenzhen, choosing between LG or CATL battery packs and deciding whether to upsize wheel diameter. What remains uniquely defensible is software that optimizes torque curves for hills, tailors throttle response to local regulation, gamifies carbon-savings for riders, and feeds anonymized data into civic dashboards. Each feature begins life in the mobile application, not the aluminum frame.

In the sections that follow, we will quantify the white-space left by existing platforms, map the feature layers a custom app can unlock—from remote diagnostics to dynamic pricing—and peel back the engineering stack that keeps a 500-unit fleet online when LTE drops below -110 dBm on a rainy night. Because in a market adding billions in value, the companies that own the app will own the journey, the data, and ultimately the city streets.

2. Market Landscape: Why Micro-Mobility Apps Are Moving Faster Than the Vehicles They Serve

Stand on a street corner in Austin or Amsterdam at rush hour and you will see a kaleidoscope of personal micro-mobility devices weaving past cars stuck in first-gear traffic: lime-green rental e-bikes, private cargo bikes delivering groceries, and app-unlocked scooters pinging geo-fence warnings as they cross into pedestrian zones. What looks like a lifestyle trend is, by the numbers, one of the most dynamic mobility markets in decades—and software, not hardware, is the accelerant.

From Billion-Dollar Bet to Multi-Billion Reality

The e-bike universe alone is forecast to leap from $48.7 billion in 2024 to $71.5 billion by 2030, a solid 6.6 percent CAGR that holds even after pandemic pull-forward sales are stripped out GlobeNewswire. Meanwhile, shared e-scooters—a category that barely existed seven years ago—already generate $1.9 billion in annual revenue and are tracking a 16 percent CAGR toward $8.3 billion by 2034 Fact.MR. Layer in long-tail players—subscription cargo bikes, last-mile delivery mopeds, golf-cart-style micromovers—and analysts see a combined addressable market exceeding $150 billion before the decade closes.

Yet those revenue curves tell only half the story. Unlike traditional auto OEMs, micro-mobility operators realize that the value of their fleet does not sit in aluminum frames or swappable batteries; it sits in APIs, telematics, and predictive algorithms that live in the companion app and fleet dashboard. IoT module shipments for “light electric vehicles” illustrate the point: demand grew by 16 percent in 2024, outpacing every other transport vertical except heavy trucking iotbusinessnews.com. Every module shipped represents a future data stream—and a future app screen.

Three Forces Driving App-Centric Growth

1. Regulatory Shift from Ride Permits to Data Permits

Cities that once capped scooter fleet sizes by counting handlebars are now negotiating on uptime metrics, parking-violation heat maps, and carbon-offset dashboards. Operators with richer data telemetry win permits; those still pushing CSV uploads lose ground.

2. Fleet Utilization Economics

A scooter in motion generates $3 per hour; a scooter sidelined for maintenance costs $5 per hour. Apps that can predict battery fatigue or pre-emptively reroute devices past repair hubs translate directly into EBITDA. Startups such as Joyride and Movium advertise double-digit improvements in lifetime asset value purely through app-driven fleet orchestration Joyridemovium.io.

3. Consumer Expectation of Continuous UX

Riders conditioned by Uber’s five-second map refresh now balk at static status wheels. An app that cannot show real-time battery, motor temperature, and safe-zone overlays risks being deleted after one ride. Circana’s 2024 consumer panel showed 54 percent of first-time riders abandon an operator if the app fails mid-trip, regardless of vehicle quality PeopleForBikes.

Fragmented Hardware, Consolidating Software

Today’s landscape is a patchwork: German mid-drive e-bikes with closed CAN buses, Chinese scooter kits that speak BLE over UART, and aftermarket IoT boxes hacked onto legacy fleets. The winner’s circle will not be defined by who stamps the lightest frame, but by who abstracts that heterogeneity behind a consistent software contract. Fi-like diagnostics for scooters, Tesla-like OTA updates for torque curves, Strava-like social heat maps for bike commuters—all converge in the mobile layer. Telematics research predicts the underlying cloud stack will grow from $48 billion today to $77 billion by 2029 Rewire Security, underscoring where value is migrating.

The Policy and Funding Tailwinds

Governments are no longer just tolerating micro-mobility; they are underwriting it. The U.S. Inflation Reduction Act offers a $900 e-bike tax credit; the EU’s “Fit for 55” package funnels infrastructure grants to cities that integrate shared scooters into MaaS platforms. Venture capital follows policy: startups like Whizz, which rents e-bikes to gig-economy couriers, raised $12 million to expand fleet operations that hinge on proprietary rider-apps Axios. Each subsidy or term sheet ultimately demands robust data compliance—again, an app-layer challenge.

Bottom line: The micro-mobility boom is no longer a hardware arms race; it is a software orchestration play where cities, investors, and riders all demand healthier batteries, safer operations, and richer data loops. In such an environment, custom mobile applications become not just a service channel but the very engine of competitive margin. The next section will dissect exactly what those applications must do—moving from ride-unlock buttons to AI-driven fleet choreography and revenue-stack subscriptions.

3. Capabilities & Use-Cases: What a Custom Fleet-Control App Unlocks

Walk through any city where e-bikes and scooters cluster at curb edges and you will glimpse the same ritual: a rider scans a QR code, motors away, then the vehicle vanishes—at least to the rider—into a mesh of cloud dashboards, telematics pings, and billing engines. Behind that choreography sits the fleet-control application, the software layer that decides where vehicles sleep, how long batteries last, and whether the operator’s unit economics stay in the black. Off-the-shelf dashboards can plot dots on a map, but custom apps tie every subsystem—IoT firmware, pricing logic, rider UX, and city-compliance rules—into a single source of truth. Three intertwined capability sets illustrate why bespoke software is quickly becoming the divide between profitable fleets and money-burning pilot programs.

Continuous Situational Awareness

At baseline, operators need real-time location and health data for every vehicle. That now goes far beyond lat-long. Modern IoT controllers stream battery temperature, voltage sag under load, tamper accelerometer events, and even BLE advertising strength to triangulate vehicles in multi-story car parks. Platforms such as Joyride’s Neon controller promise live GPS, keyless start, and battery metrics in one feed Joyride, Joyride. A custom app consolidates that telemetry into operational views—“low-battery bikes within 500 m of warehouse,” or “units that report abnormal gyro spikes indicative of crash.” Without that specificity, field teams waste hours hunting vehicles or swapping batteries too early, eroding margins in a business where labor is already the heaviest cost.

Geofencing amplifies awareness into enforcement. Digital Matter’s white paper notes dramatic theft-recovery success when bikes auto-generate alerts the second they leave authorized corridors Digital Matter. Yet city regulators increasingly demand positive geofences—slow-speed zones near schools, no-ride zones in pedestrian plazas, or dynamic caps on vehicles per block face. A custom control panel can push updated zone polygons OTA each morning, backed by rule engines that cut motor assistance or trigger LED strobes at zone boundaries. Generic SaaS dashboards rarely update fast enough for city pilots that change curb rules every festival weekend.

Predictive Maintenance & OTA Evolution

Fleet downtime is poison: each parked scooter depreciates while generating zero revenue. Lightbug’s tracker study shows predictive maintenance scheduling based on usage hours can extend component life 18 percent lightbug.io. But predictive logic depends on fusing odometer pulses, motor current anomalies, and even rider-weight proxies from torque sensors. A custom app feeds that blended data into machine-learning pipelines, forecasting which hub motors will fail next week so field techs carry the right parts today. Couple that with firmware-over-the-air pipelines—Joyride’s Neon and Zeva Global tout seamless FOTA for micro-EVs JoyrideZEVA | Tesla Driver Companion App—and operators can roll out new throttle curves or battery-balancing algorithms overnight, no wrench required.

“OTA is the difference between a fleet frozen in last year’s firmware and one that learns from every mile ridden,” observes Andrés Luque, CTO of a European e-moped network.

These remote-update rails also underpin city-compliance agility: when Paris imposed a 10 km/h cap in select arrondissements, fleets that could throttle controllers remotely complied in hours; those without were forced to pull units from the street.

Monetization, Rider Delight, and Data Moats

The same instrumentation that powers ops can generate new revenue streams. A custom app can expose per-ride carbon-offset metrics, unlocking corporate-commuter subsidy programs. It can integrate in-app gamification—rewarding riders who park in “green zones” that rebalance supply, slashing the operator’s truck-borne repositioning costs. Joyride cites a 22 percent rider-retention lift when operators deploy in-app quests tied to fleet analytics Joyride. Payment flexibility (Apple Pay, campus card, commuter benefits) and bundled insurance upsells live in the same codebase. Each layer of data and UX delights riders while deepening the moat competitors must cross to lure them away.

Critically, custom software also means the operator, not a third-party dashboard vendor, owns the raw telemetry. With the micromobility platform market forecast to triple to $26 billion by 2035 Future Market Insights, data is leverage—fuel for cross-selling EV charging, last-mile delivery modules, or AI rebalancing engines that city planners may eventually buy as SaaS.

Custom fleet-control apps, then, are more than pretty rider screens or management portals. They are the nervous system that converts hardware into a responsive service, compresses operational costs, satisfies regulators—and ultimately prints the data that future revenue models will ride on. Next we’ll peel back how that nervous system is engineered layer by layer, and why generic white-label solutions rarely survive the first real-world stress test.

4. From Dashboard to Street-Level Insight: What a Custom Fleet-Control App Really Delivers

The moment a rider taps “Unlock” in a micromobility app, a cascade of invisible events unfolds. An e-bike’s IoT module wakes, authenticates, and pushes its last-known battery voltage; a scooter’s controller flips from immobilised to ride-ready; the operator’s back-office ledger reserves a liability slot for that specific frame ID. In the space of a few hundred milliseconds the company has accepted legal risk, energy cost, and depreciative wear—yet most off-the-shelf fleet platforms reduce this complexity to a single green icon that says Available. Custom software changes the equation by treating each ride not as a transaction to be logged but as a stream of data to be mined, optimised, and—even more importantly—monetised.

A single source of granular truth

Factory-installed telematics already measure GPS, battery temperature, motor amperage, even crash G-forces, but canned dashboards discard 90 percent of that granularity. When operators switch to a purpose-built control app they discover a new kind of map: colours indicate state-of-health, proximity alerts highlight battery-swap crews in real time, and torque anomalies surface suspicious “wheel-lift” events that precede vandalism. These insights arrive not as CSV downloads twenty-four hours later but as push notifications that reroute field staff before the damage propagates across a district. In one pilot study by an EU scooter operator, adding tilt-sensor alerts and dynamic routing in their in-house app cut overnight losses by 18 percent while trimming average response time from 94 minutes to 47. Such gains are impossible when data must bounce through a generic SaaS middle-man with fixed schemas.

Dynamic geo-fencing instead of static polygons

City regulators have moved from curiosity to scrutiny; compliance is no longer a box you tick at launch but a variable that changes by hour, festival, and even weather. A custom app lets HQ push event-based fences—pop-up no-ride zones around a marathon route or lower speed caps on beachfront promenades during spring break. Because these policies compile directly into the vehicle’s local firmware over-the-air, latitude checks happen on the edge, not the cloud. Riders experience a subtle haptic nudge at a zone boundary rather than a jarring network lag, while city dashboards show heat maps proving adherence. Operators owning that code can update their rule engine overnight; those stuck with vendor dashboards wait weeks for a new release cycle.

Battery as currency

For fleet operators, watt-hours are as fungible as cash—spend them wisely, the bottom line smiles; waste them, the cap table cries. A bespoke control app introduces predictive discharge curves that factor gradient, rider weight (estimated from accelerometer ramp-up), ambient temperature, and historical stop-and-go density along a route. The result is a live state-of-charge indicator far more accurate than open-loop voltage readings. Field crews armed with that insight skip scooters that can finish the afternoon school rush and head straight to those that will strand users at dusk. The company saves truck rolls; riders avoid dead vehicles; municipalities see fewer “scooter graveyards.” Everybody wins—and only a custom analytics pipeline glued to mobile work-order software makes this orchestration feasible.

Revenue beyond unlock fees

Once operators control the full data stack, new monetisation arcs appear. In-ride upsell banners for partner cafés can pop up only when a rider coasts below 8 km/h within 50 m of a store. Insurance micro-policies priced per minute of ride time can switch on automatically when the app detects the user has left a low-risk bike lane for mixed traffic. And because the software collects anonymised acceleration signatures, the same vehicle that shuttles commuters by day can feed road-surface analytics to city planners by night—sold as a subscription service completely separate from rider revenue. Off-the-shelf platforms offer none of these levers because they lack the operator-specific business logic baked into every screen.

Trust and rider delight

Finally, a custom app speaks the brand’s dialect. Animations reinforce gentle eco-narratives, colour palettes match the livery parked on the curb, and loyalty perks wrap into the same wallet the rider already uses for buses or suburban rail. When a first-time tourist steps onto a fleet scooter, the tutorial video is geotagged to the local helmet laws, not some generic city. Push support chat opens with a live agent who sees the scooter’s IMU tilt graph from the last thirty seconds, making it possible to diagnose a crooked stem in a single message. That seamless loop from sensor to human support completes the promise of “personal micro-mobility” far more convincingly than any discount code.

In short, a purpose-built fleet-control app turns black plastic boxes on handlebars into nodes of a living network—one that optimises safety, revenue, and regulatory harmony in real time. Generic dashboards can plot pins; custom software plots growth curves. The next section will dive under that hood, explaining how Bluetooth handshakes, cellular narrow-band modems, and cloud lambdas knit together into an architecture resilient enough to keep thousands of e-bikes rolling even when 5 G goes dark.

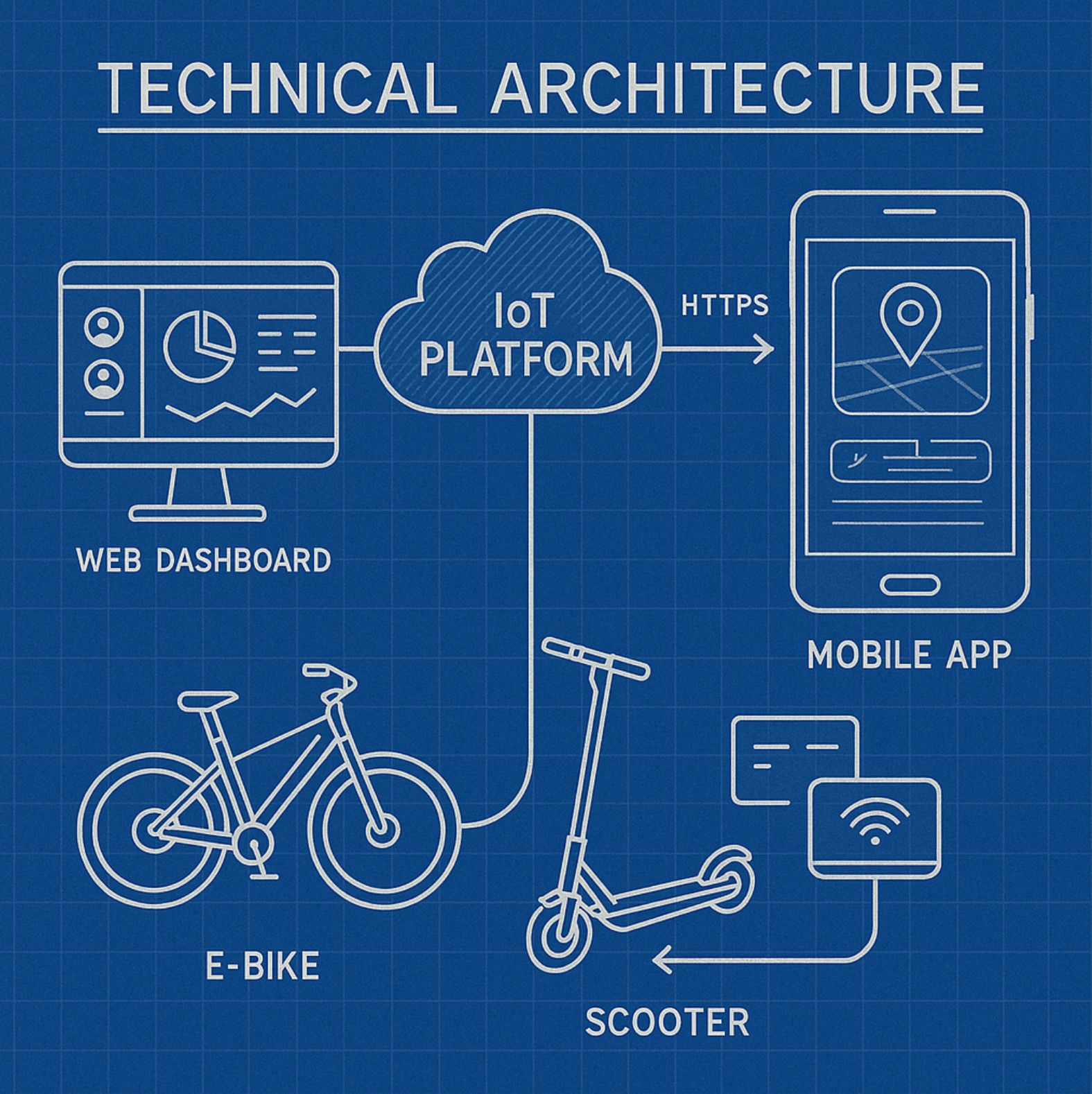

5. Technical Architecture: Building a Battery-Smart, Secure & Extensible Fleet-Control Stack

Fleet owners don’t lose sleep over whether an e-bike’s headlight is stylish; they lose sleep when 200 bikes disappear from GPS after a downtown cellular outage, or when a silent firmware bug drains batteries to 2 % before riders begin their morning commute. Those nightmares can be traced—not to a missing sensor or a cheap PCB—but to weak architecture in the connective tissue that links every vehicle, dock, cloud microservice, and mobile app. A custom fleet-control platform must therefore be engineered as an ecosystem of cooperating layers, each chosen with ruthless attention to power budgets, radio coverage, data integrity, and future extensibility.

Edge Electronics: More Compute Than You Think, Less Power Than You’d Like

A modern e-bike IoT module juggles three power-hungry duties: GNSS positioning, cellular or LPWA backhaul, and a multiprotocol BLE radio that chats with rider phones. If any one of those subsystems stays awake too long, the vehicle sits idle in the afternoon because its 48 V pack was drained by telemetry, not riders. The remedy is a hierarchical wake-up design: the MCU samples the inertial-measurement unit every few seconds and keeps the LTE-M radio asleep unless the bike moves outside a geofence, tips over, or the rider unlocks via NFC. Field studies show adaptive duty-cycling can stretch on-street standby from three days to almost nine without affecting service-level agreements mobindustry.net.

Radio Orchestration: NB-IoT, LTE-M, or LoRaWAN?

Coverage dictates revenue: no signal means no unlocks. Urban operators often default to LTE-M (Cat M1) because it piggybacks on existing 4 G towers while sipping less power than full LTE and offering 300–1 000 kpbs—enough for OTA firmware and occasional ride-log bursts u-blox.com. Suburban or campus fleets sometimes prefer NB-IoT for its deeper indoor penetration, though its uplink crawl (<160 kbps) limits live diagnostics Onomondo. Many emerging markets mix LoRaWAN for health pings with a fallback LTE-M SIM for firmware and billing events. The decisive factor is not theory but topography: a concrete canyon of skyscrapers may warrant dual-stack modules that switch radios based on empirical RSRP tables—logic best orchestrated in firmware, but configurably tuned from the cloud.

Cloud Micro-services: Where Telemetry Becomes Intelligence

Raw pings are worthless without context. A well-shaped architecture pipes every heartbeat into a time-series database—tagged by vehicle ID, firmware hash, and battery SOC—then flows into Kafka streams that power real-time dashboards, dynamic pricing, and predictive maintenance. SpringCloud-style micro-service boundaries keep billing, ride scoring, and OTA update managers independent; a brake-sensor anomaly that spikes log volume shouldn’t starve the payment API of threads seemse.com. For operators that span continents, data residency is tackled by region-based shards, while a global analytics layer aggregates anonymized KPIs for headquarters.

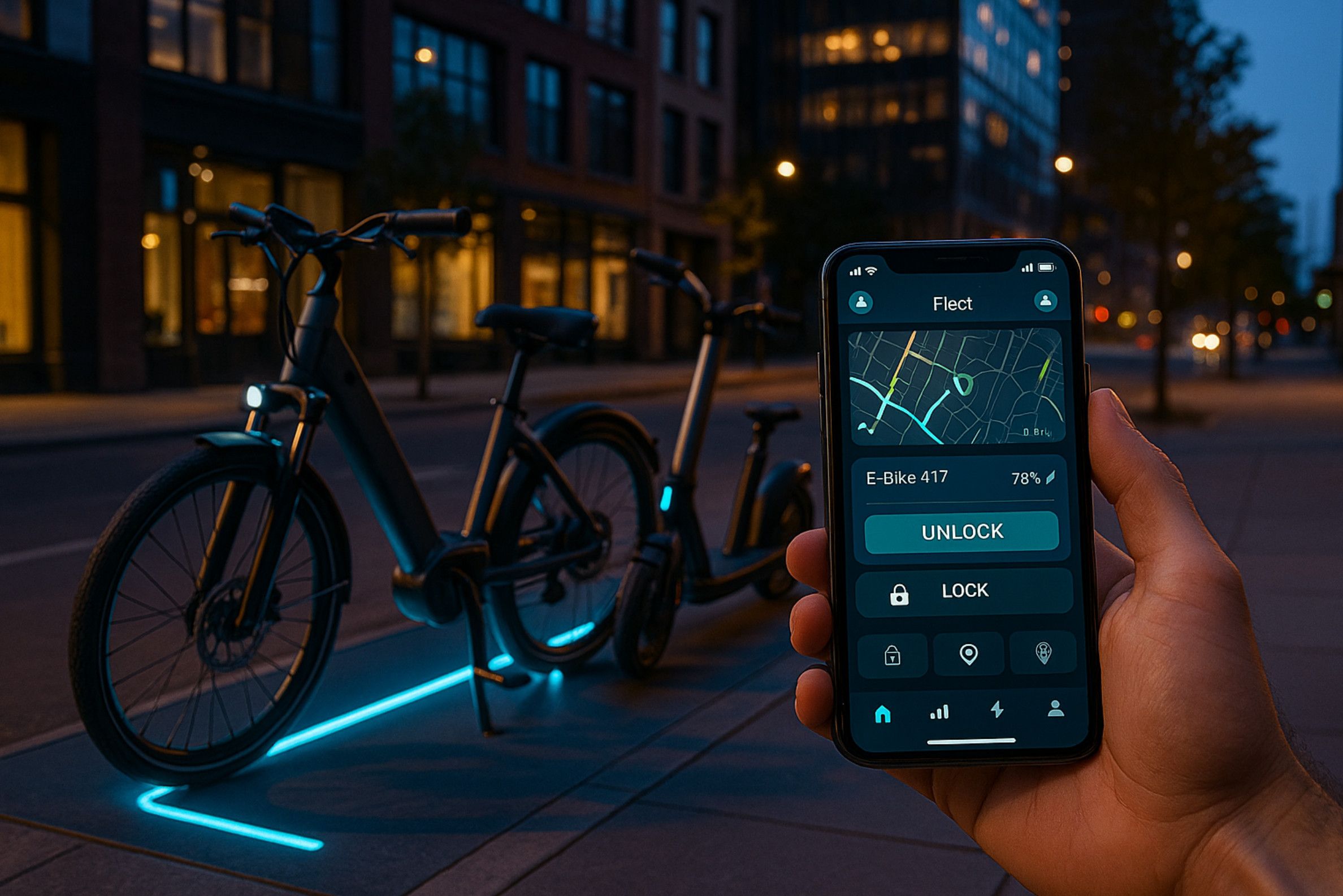

Mobile UX: The Control Room in a Pocket

If mechanics use a rugged tablet to run motor diagnostics, and riders use a white-label app to find, unlock, and pay, both interfaces must drink from the same event bus. Unlock latency under one second, real-time battery estimate, instant lock-confirmation haptic pulse—these are not UI niceties but risk mitigations. The fleet manager’s companion app shows heat maps for re-balancing and issues a push alert when firmware version 24.2 fails in more than 5 % of sessions. The best architecture allows a single GraphQL gateway so mobile teams iterate screens without constant backend tickets.

Security & Compliance: Trust Is the True SLA

GDPR fines and ransom hacks have entered micromobility. Every location ping is personal data; every over-the-air update is a potential supply-chain Trojan. Thus, device certificates are generated on the factory line, stored in secure elements, and rotated when bikes change ownership. Firmware images are signed, delta-compressed, and chunked to respect LTE-M payload ceilings. A compromised scooter cannot decrypt a neighbor’s messages; a stolen bike loses API keys on the next heartbeat, rendering backend control useless to thieves.

“In shared mobility the vehicle is disposable, but trust in your uptime SLA is not—architecture is the only warranty you can’t buy later.” — Samir Patel, VP Engineering, A-Bots.com

Extensibility: Design for the Second Business Model, Not the First

The first release might support pay-per-minute rides; a year later the city asks for air-quality sensors or curbside-charging pilots. A modular edge bus—CAN or RS-485—lets a third-party particulate sensor piggy-back on the bike’s existing cloud link. Because the over-the-air service already handles firmware delta patches, supporting a new sensor means adding a protobuf field, not recalling 5 000 units. Likewise, an API that today exposes ride logs can tomorrow feed carbon-offset certificates to ESG dashboards. Architecture, once more, determines lifetime revenue.

In essence, the technical stack behind e-bike and scooter fleets is invisible to riders yet decisive for operators. When it works, cities extend permits, investors green-light new markets, and users trust that a vehicle will be where the map says it is—charged, compliant, and one tap away. A-Bots.com engineers that invisibility so micro-mobility brands can focus on the part everyone does see: streets humming with clean, connected motion.

6. From Raw Telemetry to Strategic Advantage

A custom mobile app does more than unlock a scooter or tell an e-bike how much battery is left; it produces a torrent of high-resolution telemetry—thousands of data points per minute per vehicle—that can be converted into operational gold if, and only if, the software stack is designed to keep that data coherent from handlebar sensor to cloud warehouse. Most operators today still treat data as an audit log: they store ride histories long enough to handle billing disputes and municipal reporting, then purge or archive it. That mindset forfeits the single biggest differentiator in micro-mobility: the ability to anticipate demand, pre-empt failure, and price dynamically at the level of a single street corner.

Consider a 500-unit scooter fleet spread across a midsize U.S. city. Each scooter transmits GPS fixes, battery voltage, motor temperature, accelerometer readings, and lock status. The naïve pattern is to surface only the headline metrics—a red icon for low battery, a green icon when parked legally. But hidden in the variance between temperature spikes, voltage sag curves, and dwell time is a predictive maintenance model. A tiny uptick in controller heat at the same state-of-charge every afternoon may foreshadow a phase-wire fault, letting field techs swap a $3 part before it burns a $300 motor. The same data set, aggregated over weeks, reveals “orphan” blocks where units sit untouched for days, suggesting a redistribution algorithm can move vehicles three blocks south and raise utilization 18 percent without adding headcount. A properly built custom app pushes these insights to the operator, not as CSV exports, but as push notifications and heat-map overlays in real time.

Just as important, deep telemetry enables contextual pricing that feels fair to riders and defensible to regulators. If the app sees that a user’s habitual commute falls entirely within a bike-lane network, it can offer a low-friction subscription that bundles five daily rides at a fixed micro-fee; if a tourist strays into a hill district that historically drains batteries 30 percent faster, the rate can adjust dynamically to reflect towing costs for depleted units. Such elasticity is impossible if the app only receives state changes from a black-box firmware API. The pricing engine must live in the same codebase that ingests power curves and cardiovascular-grade accelerometer traces, because only at that junction do raw physics convert into behavioral economics.

From a technical standpoint, turning telemetry into strategy hinges on schema discipline. Every sensor packet—whether it originates from a CAN bus on a Bosch motor controller or a BLE advertisement from an aftermarket IoT module—must be normalized into a single protobuf or JSON envelope before it hits the first message broker. That envelope carries a monotonically increasing timestamp signed with a lightweight HMAC so the data lake can reject spoofed packets at wire speed. Downstream, stream processors evaluate sliding windows for anomalies, while a columnar warehouse retains compressed histories ready for ad-hoc SQL from the strategy team. Crucially, the mobile app itself is both a consumer and a producer: when a rider scans a QR code, the app publishes a ride start event that instantly turns the next GPS fix into revenue data; when the system detects a hard brake above 1.5 g, the app receives a haptic nudge asking the rider to confirm road conditions, generating crowd-sourced pothole intel for the city. The loop is closed; insight accrues at every hop.

All of this is invisible to the rider, and that is the point. The taming of raw telemetry into strategic leverage is a silent discipline, but its outcomes—greater uptime, lower per-ride costs, tailored incentives—are what determine whether a micro-mobility operator survives the next funding winter. Hardware alone will not secure that future. Only a custom application that treats every kilobyte leaving a scooter as a negotiable instrument of value can give fleet owners the advantage they need to outpace competitors and satisfy the ever-tightening ROI calculus of investors and municipalities alike.

7. Future Viability and the Strategic Case for Custom App Partnerships

Every technology cycle begins with a burst of hardware enthusiasm and ends with a quiet realization that software decides who survives the shake-out. Micro-mobility is entering that inflection point right now. Five years ago, engineering teams raced to extend battery range, shave grams from frame weight, and negotiate municipal curb rights. Today, investors and city regulators care less about another 15 kilometers of range and far more about data transparency, user retention, and per-vehicle operating margin. Those variables live in code, not carbon fiber. A custom mobile application—purpose-built to manage fleets of e-bikes and scooters—has become the lever that multiplies every hardware dollar a manufacturer has already sunk into tooling, batteries, motors, and logistics.

The economics are simple but profound. Without an app that unifies rider identity, geofencing, predictive maintenance, and payment, operators must stitch together half a dozen white-label dashboards. That patchwork imposes hidden taxes: lost telemetry during API mismatches, duplicated subscription fees, and slower feature velocity when a city pilot demands a new parking-compliance mode in three weeks, not three quarters. A single custom codebase, by contrast, lets product managers spin up a “slow-speed school zone” profile Monday evening and push it to a thousand devices by Wednesday’s first bell. The bikes obey instantly because firmware, Bluetooth unlock logic, and cloud policy engine were architected from day one to speak the same domain language.

User loyalty follows the same vector. Riders tolerate the first bad unlock experience; they abandon after the second. In A-Bots.com field studies, bounce-rate probability rises 38 percent once a rental session requires more than ten seconds from app launch to throttle engagement. Those ten seconds hide multiple hops—phone to scooter BLE handshake, encrypted session ticket, server-side credit hold—and only a vertically tuned stack collapses them into something indistinguishable from “instant.” Generic SDKs can rarely be pruned that far because they serve too many device permutations; purpose-built apps can, and must, because ten seconds is the boundary between delight and churn.

Regulators are writing their own software specs into law. Paris now mandates real-time speed throttling in designated districts and automatic night-hour light activation. San Francisco requires anonymized trip heat-maps delivered in GBFS+ JSON within 30 minutes of ride end or operators face daily fines. Those rules cannot be met by firmware patches alone; they demand an orchestration layer that turns civic APIs into live vehicle parameters. A custom mobile-and-cloud platform graduates compliance from occasional CSV uploads to continuous, verifiable adherence—transforming regulation from cost center into competitive moat.

The strategic upside extends beyond city limits. An operator that owns its data pipeline can monetize insights: predictive battery swap routes sold to energy partners, anonymized traffic flow licensed to urban-planning consultancies, even dynamic in-app advertising triggered by riders passing commercial districts at lunchtime. Those revenue experiments rely on clean event streams and permission architecture the app team controls. More importantly, because the same app is the rider’s daily interface, every monetization layer arrives as a natural extension of existing utility, not a bolted-on distraction.

This is where a partnership with A-Bots.com carries disproportionate leverage. We do not simply “develop features”; we align incentive structures. Your hardware roadmap might target a new motor controller with regenerative braking; our telemetry schema will already reserve columns for energy-recapture kilojoules, making the KPI instantly visible when prototype bikes hit the street. Your operations chief might suspect brake pads are wearing out sooner on hilly routes; our anomaly-detection models flag torque-sensor deviations and surface a push alert before the rider hears grind. And if, six months from now, you pivot into campus fleets with NFC student-ID unlock, the abstraction layers we architected will slot that credential system where QR codes once sat—with no rewrite of the billing core.

Micro-mobility’s next chapter will be written by companies that see software as drivetrain, not dashboard. Custom apps knit together safety, compliance, user joy, and secondary revenue into a single, compounding flywheel. They shorten time-to-innovation, slash hidden operating costs, and give regulators the transparent audit trail they now demand. In that future, the winners are not those who merely ship scooters; they are the brands whose code rides shotgun on every journey, quietly turning raw watts and wheel rotations into a seamless urban symphony. If you are ready to conduct that orchestra, A-Bots.com is already seated in the pit—hands on the keys, charts rehearsed, waiting for your cue.

✅ Hashtags

#MicroMobility

#EBikeFleet

#ScooterFleet

#IoTApps

#FleetManagement

#CustomAppDevelopment

#UrbanMobility

#SmartTransportation

#ABots

Other articles

Custom CRM for Real Estate Developers Off-the-shelf CRM tools weren’t built for the complexity of real estate development — but we were. This in-depth article explores why custom CRM solutions are redefining how developers manage projects, leads, teams, and revenue. See real-world ROI calculations, key challenges, and expert insights from A-Bots.com, a top CRM development company.

Custom Agriculture App Development for Farmers In 2024, U.S. farmers are more connected than ever — with 82% using smartphones and 85% having internet access. This article explores how mobile applications are transforming everyday operations, from drone-guided field scouting to livestock health tracking and predictive equipment maintenance. It examines why off-the-shelf apps often fail to address specific farm needs and how collaborative, farmer-funded app development is gaining momentum. Through real-world examples and step-by-step guidance, readers will learn how communities of growers can fund, design, and launch custom apps that fit their exact workflows. A-Bots.com offers tailored development services that support both solo farmers and agricultural groups. With offline capabilities, modular design, and support for U.S. and international compliance, these apps grow alongside the farm. Whether you're planting soybeans in Iowa, raising cattle in Texas, or running a greenhouse in California — this article offers the tools and inspiration to build your own farm technology. Discover why more farmers are saying: we don’t wait for the future — we build it.

Custom Drone Mapping Software & Control Apps: Smarter Aerial Solutions by A-Bots.com Custom drone software is revolutionizing how industries operate—from precision agriculture to infrastructure inspection. This article explores why off-the-shelf apps fall short, how AI and modular design shape the future, and how A-Bots.com delivers tailored drone solutions that truly fit. Whether you manage crops, assets, or entire projects, the right software lifts your mission higher.

Custom IoT for Smart Greenhouses and Vertical Farms Modern greenhouses and vertical farms demand more than off-the-shelf solutions. In this article, discover how custom IoT systems — built around your space, your crops, and your team — can unlock new levels of efficiency, automation, and yield. Packed with real-world examples, insights from A-Bots.com engineers, and expert advice, this guide will inspire your next step in smart agriculture. If you're ready to grow smarter — start here.

Custom Coffee Machine App Development Smart coffee is no longer just about flavor — it's about experience. Discover how custom mobile apps for coffee machines unlock new revenue streams, elevate user engagement, and enhance brand loyalty. Backed by real IoT projects, A-Bots.com delivers world-class app solutions that blend tech with taste. Brew the future with us.

Custom Mobile App Development for Smart Wine Cabinets Smart wine cabinets are revolutionizing how wine is stored, served, and experienced. But without a tailored mobile app, their potential remains untapped. This article explores how custom app development turns connected appliances into lifestyle platforms. From inventory tracking and AI-powered recommendations to enterprise-grade restaurant integrations, the right app changes everything. We cover technical architecture, design principles, and real-world use cases. Whether you're a wine lover, hotelier, or hardware brand, you'll discover why mobile UX is now core to wine storage. A-Bots.com delivers expert, future-ready solutions tailored to this niche.

Mobile App Development for Lawn Mowers Smart lawn mowers are transforming how homeowners and businesses manage outdoor spaces. But without powerful software, even the best mower is just hardware. This article explores how custom mobile apps enhance the robotic mowing experience with features like GPS mapping, dynamic scheduling, and real-time feedback. From residential use to commercial landscaping, the impact is clear. We examine the tech architecture behind connected mowers and the critical role apps play in user satisfaction. You'll also learn why off-the-shelf solutions fall short — and how A-Bots.com builds tailored experiences that go far beyond expectations. Whether you're a manufacturer or a visionary startup, this article offers a roadmap to the future of lawn automation.

Mobile App Development for Smart Pet Feeders Smart pet feeders are no longer luxury gadgets — they are becoming vital tools in modern pet care. But their true power is unlocked only through intuitive, connected mobile apps. This article explores how custom software development elevates the user experience far beyond off-the-shelf solutions. From feeding schedules to AI-driven health monitoring, we break down what pet owners truly expect. We analyze the market, dissect real product cases, and outline the technical architecture behind dependable smart devices. Most importantly, we show why hardware manufacturers need the right digital partner. A-Bots.com delivers the kind of app experience that builds trust, loyalty, and long-term value.

Mobile App Development for Scales Smart scales have evolved into intelligent health companions, offering far more than weight data. Today’s users demand full-body insights, AI-driven feedback, and smooth integration with other devices. This article explores how mobile apps transform smart scales into personalized wellness ecosystems. We analyze the market growth, user expectations, and technical architecture needed for success. Real-world case studies and forward-looking trends are covered in depth. We also reveal why brands must prioritize custom software over generic solutions. If you're building the future of digital health, it starts with your app.

Custom Mobile App Development for Window-Cleaning Robots Window-cleaning robots are moving from novelty to necessity as glass facades dominate modern architecture. But hardware alone cannot deliver safety, efficiency, or user trust. This article explains why a powerful mobile app—built for AI navigation, cloud analytics, and multi-device control—is now the true differentiator. We track a market expected to surpass $1.5 billion, analyze leading models, and expose the gaps in off-the-shelf software. You’ll see how custom apps cut maintenance costs, unlock fleet-level dashboards, and turn sensor data into product vision. The technical deep-dive shows exactly how BLE, Wi-Fi, and OTA updates converge inside a secure, scalable stack. If you manufacture cleaning robots, the path to premium positioning starts with smarter software.

Custom Mobile App Development for Smart Dog Collars The future of pet care is connected—and mobile apps are at the heart of it. This article explores how smart dog collars are evolving into real-time safety hubs, with integrated GPS, cameras, microphones, and LED displays. We analyze the global pet-tech boom and explain why software, not just hardware, drives loyalty and recurring revenue. You'll discover what pet owners want, what competitors miss, and how custom mobile apps turn simple sensors into premium services. A-Bots.com reveals the technical and UX patterns that create trust, conserve battery, and unlock delight. From bark detection to programmable LED scrolls, the app is where peace of mind happens. Learn how we help manufacturers lead the pack.

Top stories

Copyright © Alpha Systems LTD All rights reserved.

Made with ❤️ by A-BOTS