Home

Services

About us

Blog

Contacts

Travel Planning Mobile App Development for Dubai Tourism Industry: Complete Guide for Tour Operators and Travelers

Dubai continues to break tourism records year after year, establishing itself as one of the world's most dynamic travel destinations. With 18.72 million international overnight visitors in 2024 and 51,100 tourists arriving daily, the emirate's tourism industry demands sophisticated digital solutions that can match its world-class hospitality standards. The convergence of luxury tourism, cutting-edge technology, and diverse visitor demographics creates unprecedented opportunities for mobile app development companies to revolutionize how tourists experience Dubai.

A-Bots.com, a mobile app development company with over 70 completed projects and client relationships spanning 1.5 to 5+ years, specializes in creating custom solutions for the tourism and hospitality sector. Our development team understands that Dubai's tourism ecosystem requires more than generic booking platforms—it demands comprehensive digital experiences that seamlessly integrate visa processing, accommodation booking, attraction reservations, dining experiences, and real-time itinerary management. From boutique travel agencies managing 50 clients annually to large tour operators handling 10,000+ bookings per year, we deliver scalable mobile applications that enhance operational efficiency while elevating customer satisfaction.

The Dubai tourism market presents unique technical challenges that A-Bots.com has successfully addressed across multiple projects. Multi-language support for Arabic, English, Hindi, Urdu, Tagalog, and Russian becomes essential when 90% of visitors come from international markets. Payment gateway integration must accommodate diverse preferences including UAE Dirham transactions, international credit cards, digital wallets like Apple Pay and Google Pay, and region-specific payment methods. Real-time synchronization between tour operators' backend systems and travelers' mobile applications ensures that schedule changes, weather alerts, or attraction closures reach customers instantly—critical functionality when coordinating desert safaris, yacht cruises, or skydiving experiences.

Custom mobile app development for tourism businesses extends beyond consumer-facing features to encompass comprehensive business management tools. Tour operators managing complex multi-day itineraries across Dubai, Abu Dhabi, and Sharjah require sophisticated scheduling algorithms that account for traffic patterns, prayer times, attraction operating hours, and seasonal variations. Financial management modules must track commission structures for hotel partnerships, calculate profit margins on bundled packages, generate invoices in multiple currencies, and provide real-time revenue analytics. Customer relationship management functionality enables tour operators to maintain detailed client profiles, track booking histories, identify upselling opportunities, and automate personalized marketing campaigns.

A-Bots.com's approach to tourism app development combines technical expertise with deep industry knowledge gained through partnerships with travel agencies, hotel chains, and destination management companies. We implement agile development methodologies that allow tourism businesses to launch minimum viable products within 3-4 months, gather user feedback from actual bookings, and iteratively enhance functionality based on operational data. Our quality assurance testing specifically addresses tourism industry pain points: verifying booking confirmation workflows under high concurrent user loads during peak season, testing payment processing across international banking networks, ensuring offline functionality when tourists lose internet connectivity in desert areas, and validating data synchronization when tour operators modify itineraries in real-time. Whether developing Android applications, iOS solutions, or cross-platform apps using React Native or Flutter, A-Bots.com delivers production-ready tourism applications that handle everything from simple day tours to complex 14-day luxury travel packages.

The Dubai Tourism Market: Opportunities and Statistics

Dubai's tourism sector generated $179.8 billion in visitor spending during 2024, representing a remarkable growth trajectory that positions the emirate as a global tourism powerhouse. The city welcomed 9.88 million international overnight visitors during the first half of 2025 alone, marking a 6% increase compared to the same period in 2024. This sustained growth occurs despite significant expansion in hotel supply, with Dubai now offering 154,016 rooms across 830+ establishments—demonstrating robust demand that consistently absorbs new inventory while maintaining average occupancy rates of 78.2%.

The demographic composition of Dubai's tourist base reveals strategic opportunities for targeted app development. India contributed 2.2 million visitors in 2024, representing a 22% year-over-year increase and establishing itself as the single largest source market. Oman sent 1.57 million tourists, Saudi Arabia contributed 1.45 million travelers, the United Kingdom delivered 1.25 million visitors, and Russia accounted for 910,000 arrivals. This diversity necessitates mobile applications with comprehensive localization features—not merely translation, but cultural customization including Halal dining filters for Muslim travelers, family-friendly activity recommendations for Gulf Cooperation Council visitors, and luxury shopping experiences for Russian and Chinese tourists.

Average visitor spending patterns inform strategic app monetization opportunities. Tourists spend an average of $1,900 per visit, with expenditures concentrated in accommodation (35-40%), dining and entertainment (25-30%), shopping (20-25%), and tours and activities (15-20%). The average length of stay reached 10 days in 2024, though this metric varies significantly by visitor origin—Western European tourists typically book 5-7 day trips, while Asian visitors often extend stays to 12-14 days to maximize return on long-haul flight investments. Mobile applications that optimize daily itineraries to maximize value, suggest complementary experiences, and provide exclusive booking discounts directly address tourists' purchasing decision processes.

Dubai International Airport processed 92 million passengers in 2024, with projections indicating 96 million passengers by the end of 2025. This infrastructure capacity supports the Dubai Tourism Strategy 2031, which targets 40 million annual hotel guests and AED 450 billion ($122.5 billion) in GDP contribution from tourism. Hotel revenue per available room climbed to AED 401 in the first nine months of 2025, up 8% year-over-year, while average daily rates reached AED 509. These premium pricing levels reflect Dubai's positioning as a luxury destination where tourists expect high-quality services—creating willingness to pay for premium mobile app features that enhance convenience and exclusivity.

The competitive landscape includes established global platforms like Booking.com, Airbnb Experiences, Viator, and GetYourGuide, alongside local players such as Visit Dubai (the official tourism app), Careem (regional ride-hailing with tourism features), and numerous hotel-specific applications. However, significant gaps persist in comprehensive trip planning solutions that integrate the complete customer journey from visa application through post-trip reviews. Tour operators managing complex itineraries often rely on email chains, WhatsApp groups, and PDF documents—creating fragmented communication that leads to missed confirmations, schedule confusion, and customer dissatisfaction. A sophisticated mobile platform that consolidates all planning elements while maintaining tour operator control represents a substantial market opportunity.

Comprehensive Travel Planning App Concept

The proposed travel planning application serves dual user bases with distinct interfaces and functionalities. Tourists access a beautiful, intuitive frontend featuring visual itineraries, interactive maps, booking confirmations, real-time notifications, and seamless payment processing. Tour operators, travel agencies, and personal guides utilize a powerful backend dashboard enabling itinerary creation, client management, vendor coordination, financial tracking, and performance analytics. The platform evolves from a planning tool into a comprehensive marketplace connecting tourists with hotels, restaurants, attractions, transportation providers, and experience vendors.

Frontend Experience for Tourists

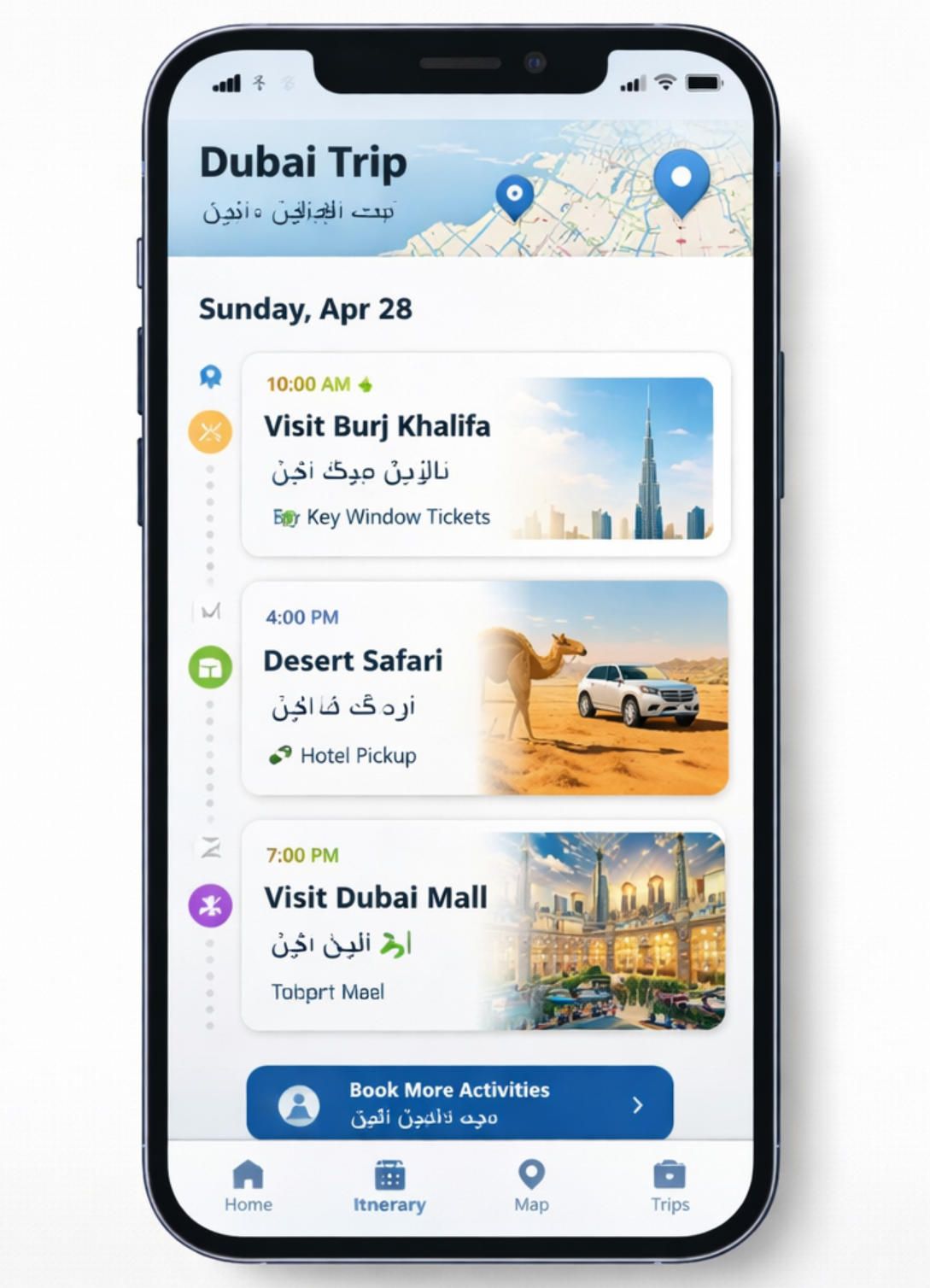

The tourist-facing application opens with personalized dashboard displaying upcoming trips, saved destinations, and curated recommendations based on travel preferences, past bookings, and seasonal availability. Visual itinerary presentation uses timeline layouts showing daily activities with color-coded categories: accommodation (blue), dining (green), attractions (purple), transportation (orange), and free time (gray). Each itinerary item expands to reveal detailed information including addresses with Google Maps integration, operating hours, estimated visit duration, dress code requirements, weather forecasts, and proximity to prayer facilities for Muslim travelers.

Interactive maps layer multiple data points to enhance navigation and discovery. Pin markers identify confirmed bookings, suggested alternatives, nearby amenities, metro stations, taxi stands, and parking facilities. Route visualization shows optimized paths between activities accounting for traffic patterns, with estimated travel times updated in real-time using Google Maps API or Mapbox integration. Geofencing triggers location-based notifications—when tourists arrive at Dubai Mall, the app automatically displays their reserved restaurant table details and reminds them about the Dubai Fountain show scheduled 30 minutes before their dining reservation.

Booking management consolidates all confirmations in a unified interface eliminating the frustration of searching through email chains. Hotel reservations display check-in/check-out times, room categories, included amenities, and direct calling buttons to hotel concierge. Restaurant bookings show table confirmations, menu highlights, dress codes, and cancellation policies. Attraction tickets appear as scannable QR codes or barcodes for contactless entry, with backup email confirmations accessible offline. Transportation bookings include driver contact information, vehicle details, pickup locations with map pins, and real-time tracking when drivers depart for collection.

Budget tracking features provide daily spending summaries, category breakdowns showing allocation across accommodation, dining, activities, and shopping, and alerts when approaching pre-set budget limits. Currency conversion displays prices in both UAE Dirhams and users' home currencies using real-time exchange rates. Expense categorization allows tourists to photograph receipts, automatically extract amounts using OCR technology, and organize spending for reimbursement or personal financial tracking.

Pre-trip preparation checklists guide tourists through essential tasks: visa application status with document requirements and processing timelines, travel insurance recommendations with direct purchase links, vaccination requirements for UAE entry, packing suggestions based on weather forecasts and planned activities, currency exchange guidance with rate comparisons, and SIM card/eSIM options for mobile connectivity. Each checklist item tracks completion status, sends reminder notifications approaching deadlines, and provides helpful resources.

The review and memories section encourages post-trip engagement through photo uploads organized by location and date, rating prompts for hotels, restaurants, and attractions used during the visit, social sharing functionality to Facebook, Instagram, and Twitter, and trip highlight compilations generating sharable videos. This user-generated content creates valuable marketing material for tour operators while building community among travelers.

Backend Dashboard for Tour Operators

Tour operators access a comprehensive management platform designed for efficiency and control. The itinerary builder provides drag-and-drop interface for scheduling activities, accommodation blocks for hotel room allocations, restaurant reservation management linked to partner venues, attraction ticket inventory with real-time availability feeds, and transportation coordination including airport transfers, inter-emirate travel, and private vehicle arrangements.

Template libraries accelerate planning by storing successful itinerary frameworks for common trip types: 5-day Dubai highlights packages combining Burj Khalifa, Dubai Mall, Desert Safari, Dubai Marina cruise, and Gold Souk visits; 7-day UAE tours adding Abu Dhabi's Sheikh Zayed Grand Mosque, Ferrari World, and Al Ain; luxury experiences featuring Michelin-starred dining, private yacht charters, helicopter tours, and VIP shopping services; family-oriented itineraries highlighting theme parks, water parks, beach clubs, and kid-friendly restaurants. Tour operators customize templates by adjusting dates, swapping activities, modifying accommodation standards, and personalizing based on client budgets and preferences.

Client communication tools streamline interactions through in-app messaging with read receipts and response time tracking, automated notification sending for booking confirmations, itinerary updates, payment reminders, and departure alerts, document sharing for visa letters, hotel vouchers, attraction tickets, and insurance certificates, and video calling for personal consultations with screen sharing to collaboratively review itinerary options. Conversation histories maintain complete records of client preferences, special requests, dietary restrictions, mobility requirements, and past feedback.

Vendor relationship management integrates with hotel reservation systems via API connections to check room availability, confirm bookings, and receive instant confirmations. Restaurant partnerships enable table reservations with specified party sizes, seating preferences (indoor/outdoor, window/corner), and special occasion notes for anniversary celebrations or birthday surprises. Attraction ticket vendors provide real-time inventory feeds preventing overbooking, dynamic pricing data reflecting seasonal demand, and group discount calculations. Transportation providers offer fleet availability, vehicle category selection (sedan, SUV, luxury, minibus), and driver assignment with multilingual capability matching.

Financial management modules track comprehensive business metrics. Revenue reporting displays booking values, commission earnings from hotel and attraction partnerships, service fees charged to clients, and upselling revenues from upgrades and add-ons. Expense tracking monitors guide payments, attraction ticket wholesale costs, transportation vendor invoices, and marketing expenditures. Profit margin analysis calculates per-trip profitability, identifies high-value client segments, compares performance across different package types, and projects annual revenue based on booking pipeline. Payment processing supports multiple methods including credit card gateway integration via Stripe or PayPal, bank transfer instructions with automated reconciliation, installment payment scheduling for high-value bookings, and refund management with automated processing.

Analytics dashboards visualize key performance indicators: monthly booking volumes trended over time, average booking values segmented by trip duration and customer origin, conversion rates from inquiry to confirmed booking, customer acquisition costs across marketing channels, client satisfaction scores aggregated from post-trip reviews, and repeat booking percentages measuring customer loyalty. These insights enable data-driven decision making regarding marketing investment, package pricing, vendor selection, and service improvements.

Marketplace Integration and Ecosystem Development

The application's evolution into a comprehensive marketplace creates a network effect benefiting all stakeholders. Hotels, restaurants, attractions, and transportation providers gain direct distribution channels to tourists, while travelers access verified options with transparent pricing and instant booking confirmation. The marketplace begins with curated partnerships ensuring quality control, then expands through application processes allowing additional vendors to join the platform.

Hotel marketplace listings display comprehensive property information including photo galleries, amenity lists (pools, gyms, spas, business centers), location maps with proximity to metro stations and major attractions, room categories with square footage and bedding configurations, pricing calendars showing rate variations across dates, guest reviews with verified booking badges, and real-time availability status. Dynamic pricing algorithms adjust rates based on demand patterns, seasonal trends, local events (Dubai Shopping Festival, Formula 1 races, Expo exhibitions), and competitor pricing. Tour operators receive negotiated commission rates (typically 10-18% for confirmed bookings), while hotels benefit from guaranteed occupancy and reduced dependency on global OTA platforms charging 15-25% commissions.

Restaurant reservation systems integrate table management software allowing restaurants to control inventory, set maximum party sizes, block certain time slots during private events, and apply minimum spending requirements for peak dining hours. Menu previews display signature dishes with professional photography, allergen information, spice level indicators, and Halal certification badges. Review aggregation combines in-app ratings with imported scores from Google Reviews, TripAdvisor, and Zomato, providing comprehensive reputation signals. Restaurants pay per-booking fees (AED 5-15 depending on party size) or monthly subscription fees for premium listing placement and enhanced analytics.

Attraction and activity marketplace covers diverse categories: theme parks (IMG Worlds of Adventure, Motiongate Dubai, Bollywood Parks), water parks (Aquaventure, Wild Wadi, Laguna Waterpark), cultural experiences (Dubai Museum, Sheikh Mohammed Centre for Cultural Understanding, Al Fahidi Historical Neighborhood), adventure activities (skydiving, hot air balloon rides, deep-sea fishing, dune bashing), yacht and cruise bookings (Dubai Marina dinner cruises, luxury yacht charters, traditional dhow cruises), spa and wellness services (luxury hotel spas, traditional hammams, yoga retreats), shopping experiences (personal shoppers, mall VIP services, Gold Souk guided tours), and nightlife options (rooftop lounges, beach clubs, entertainment venues). Each listing includes availability calendars, group size capacities, age restrictions, cancellation policies, and what's-included/what's-not-included breakdowns.

Transportation marketplace encompasses airport transfer services with meet-and-greet at arrivals hall, private car rentals with drivers for daily sightseeing, luxury vehicle options (Mercedes S-Class, BMW 7 Series, Range Rover), inter-emirate transfers to Abu Dhabi, Sharjah, Ras Al Khaimah, and Al Ain, helicopter tours providing aerial views of Palm Jumeirah and Burj Khalifa, and seaplane excursions combining scenic flights with exclusive beach landings. Real-time vehicle tracking allows tourists to monitor approaching pickups, while automated SMS notifications confirm driver assignments 24 hours before scheduled services.

The marketplace implements quality assurance through verified vendor onboarding requiring business licenses, insurance certificates, tourism authority approvals, and safety compliance documentation. Performance monitoring tracks on-time ratings, customer satisfaction scores, response times to booking requests, and complaint resolution effectiveness. Automated alerts flag vendors with declining performance metrics, triggering support team interventions or temporary listing suspensions until issues resolve. This quality control maintains platform reputation and user trust essential for long-term success.

Technical Architecture and Development Approach

Building a robust travel planning application requires careful technology selection balancing functionality, scalability, development speed, and maintenance requirements. The recommended technology stack leverages proven frameworks while accommodating future expansion as user bases grow and feature sets expand.

Mobile Application Development

Cross-platform development using React Native or Flutter enables simultaneous iOS and Android delivery from a single codebase, reducing development time by 30-40% compared to native development while maintaining near-native performance. React Native benefits from extensive library ecosystem, strong community support, and easier integration with web-based admin dashboards sharing JavaScript/TypeScript code. Flutter provides excellent UI rendering performance, comprehensive widget libraries for complex interfaces, and growing adoption among enterprise applications.

Native development becomes preferable for features demanding maximum performance optimization or deep platform integration: iOS native (Swift) for advanced camera functionality processing receipt OCR, complex animations on itinerary timelines, and Apple Pay integration; Android native (Kotlin) for custom notification handling, background location services during guided tours, and Google Pay implementation. Hybrid approaches combine cross-platform frameworks for standard screens (login, search, lists) with native modules for performance-critical features.

Backend infrastructure leverages cloud services for scalability and reliability. AWS (Amazon Web Services) or Google Cloud Platform provides server hosting with auto-scaling during peak booking periods, database management using PostgreSQL for relational data (bookings, user profiles, itineraries) and MongoDB for flexible document storage (activity descriptions, vendor profiles, review content), and CDN (Content Delivery Network) for fast image and video delivery to users worldwide. Serverless architectures using AWS Lambda or Google Cloud Functions handle episodic workloads like payment processing, notification sending, and analytics calculation without maintaining always-on servers.

API architecture follows RESTful design principles with clear endpoint structures (/api/v1/bookings, /api/v1/hotels, /api/v1/itineraries), comprehensive documentation using Swagger/OpenAPI specifications, versioning supporting backward compatibility as features evolve, and authentication using JWT (JSON Web Tokens) for secure session management. GraphQL provides alternative API approach enabling clients to request exactly required data fields, reducing payload sizes and improving mobile app performance on slower connections.

Real-time features utilize WebSocket connections for instant messaging between tourists and tour operators, live itinerary updates pushing changes to client apps immediately, booking confirmation notifications appearing within seconds of vendor acceptance, and collaborative itinerary editing allowing tour operators and clients to simultaneously modify plans. Firebase Cloud Messaging (FCM) and Apple Push Notification Service (APNS) deliver push notifications ensuring tourists receive critical alerts even when apps run in background.

Payment processing integrates established gateways supporting Dubai's payment ecosystem. Stripe connects to UAE banks and supports AED transactions, credit cards (Visa, Mastercard, American Express), digital wallets (Apple Pay, Google Pay), and installment payment plans. PayPal provides international payment acceptance critical for pre-trip bookings from customers worldwide. Local payment gateways like Telr, PayTabs, or Checkout.com offer regional expertise, direct banking relationships with UAE financial institutions, and potentially lower transaction fees. PCI DSS (Payment Card Industry Data Security Standard) compliance ensures secure cardholder data handling through tokenization, encryption, and regular security audits.

Third-party integrations enrich functionality through established services: Google Maps Platform provides geocoding (converting addresses to coordinates), directions API (route optimization), Places API (attraction information and reviews), and Street View imagery. Amadeus, Sabre, or Travelport offer global distribution systems accessing real-time hotel inventory and airline reservations. Viator or GetYourGuide APIs supplement proprietary attraction marketplace with global tour and activity inventory. SendGrid or Twilio handle transactional emails (booking confirmations, itinerary sharing) and SMS notifications (departure reminders, urgent updates). Cloudinary or AWS S3 manages image storage, transformation (automatic resizing for different screen sizes), and optimization for fast loading.

Security and Data Privacy

Tourism applications handle sensitive personal data requiring robust security measures. Data encryption protects information at rest (stored in databases) using AES-256 encryption and in transit (transmitted over networks) using TLS 1.3. User authentication implements multi-factor authentication options for tour operator admin accounts, OAuth 2.0 integration allowing sign-in via Google, Facebook, or Apple ID, and password policies enforcing complexity requirements. GDPR compliance (despite UAE location, serving European tourists) necessitates explicit consent collection, data portability allowing users to export information, right to deletion enabling account removal and data purging, and privacy policy transparency explaining data usage.

Payment security follows PCI DSS standards including tokenization replacing card numbers with random identifiers, avoiding direct card data storage on application servers, secure payment page isolation using embedded Stripe or PayPal forms, and fraud detection monitoring unusual transaction patterns. Booking data backup maintains hourly incremental backups, daily full database snapshots, multi-region replication ensuring data survival even during datacenter failures, and disaster recovery procedures tested quarterly.

Development Timeline and Investment Requirements

Realistic development planning accounts for design complexity, feature scope, integration requirements, and quality assurance processes. A comprehensive travel planning application with tourist frontend, tour operator backend, and marketplace functionality typically requires 6-9 months from concept to production launch.

Phase 1: Discovery and Planning (4-6 weeks) includes requirements gathering through stakeholder interviews with tour operators and target tourists, competitive analysis of existing platforms, user persona development defining primary user types and their needs, feature prioritization using MoSCoW framework (Must have, Should have, Could have, Won't have initially), and technical architecture design selecting frameworks, databases, and third-party services.

Phase 2: Design (6-8 weeks) produces wireframes outlining screen layouts and navigation flows, UI design creating high-fidelity visual mockups with brand colors, typography, and imagery, interactive prototypes enabling stakeholder testing before development begins, and design system documentation standardizing components for consistent implementation.

Phase 3: Development (14-18 weeks) progresses through core features implementation building user authentication, itinerary management, booking flows, and payment processing; backend API development creating endpoints serving mobile applications and admin dashboards; admin dashboard construction for tour operator management interfaces; marketplace integration connecting hotels, restaurants, attractions, and transportation providers; and third-party integrations implementing maps, payment gateways, notification services, and analytics.

Phase 4: Quality Assurance (4-6 weeks, partially overlapping development) conducts functional testing verifying all features work as specified, integration testing confirming proper communication between mobile apps, APIs, and external services, performance testing simulating high concurrent user loads during peak booking seasons, security testing identifying vulnerabilities through penetration testing and code reviews, and user acceptance testing gathering feedback from pilot tour operators and test tourists.

Phase 5: Deployment and Launch (2-3 weeks) handles app store submissions to Apple App Store and Google Play Store, server infrastructure provisioning setting up production environments with monitoring, marketing preparation creating launch campaigns and promotional materials, training documentation and sessions for tour operator onboarding, and soft launch limited release to select tour operators before full public availability.

Investment requirements vary based on feature complexity, design sophistication, and development team location. Rough budget estimates for a comprehensive platform:

- MVP (Minimum Viable Product) with core itinerary planning, basic bookings, and simple tour operator dashboard: $50,000 - $80,000

- Standard platform including marketplace integration, payment processing, and advanced analytics: $100,000 - $150,000

- Enterprise solution with AI recommendations, multi-language support, complex vendor integrations, and white-label capabilities: $200,000 - $300,000+

These estimates assume development by experienced teams familiar with tourism technology. Costs cover mobile app development (iOS and Android), backend API and database implementation, admin dashboard web application, design and user experience, quality assurance testing, and project management. Ongoing maintenance, hosting, support, and feature enhancements typically require 15-25% of initial development cost annually.

Revenue Models and Business Strategy

Sustainable platform success requires diversified revenue streams aligned with value delivery to users and vendors. Multiple monetization approaches create financial resilience while maintaining competitive pricing.

Commission Model charges percentage fees on completed bookings: hotels typically negotiate 10-18% commissions depending on property tier and booking volume, restaurants pay 8-12% on reservation values or fixed fees per table booking (AED 5-15), attractions charge 12-20% on ticket sales with volume discounts for high-performing channels, and transportation services contribute 10-15% on ride values. Commission models align platform success with vendor success, incentivizing quality matching and customer satisfaction.

Subscription Pricing targets tour operators managing regular booking volumes: basic tier ($99-149/month) includes unlimited itinerary creation, client management for up to 500 active travelers, standard customer support, and basic analytics; professional tier ($249-349/month) adds priority marketplace placement, advanced analytics dashboards, white-label mobile app options, and API access for website integration; enterprise tier ($499-799/month) provides unlimited clients, dedicated account management, custom integrations with existing CRM systems, and multi-user team accounts with role-based permissions.

Transaction Fees apply to platform-facilitated payments: payment processing fees covering gateway costs plus small markup (2.9% + AED 1 per transaction), booking fees charged to tourists for reservation convenience (AED 5-15 depending on booking value), and currency conversion fees for international payments (1-2% above interbank rates).

Premium Features offer optional upgrades: concierge services providing 24/7 phone support and emergency assistance (AED 49-99 per trip), travel insurance integration with commission splits from insurance partners, VIP experiences granting early access to limited-availability attractions or exclusive dining reservations, and personalized planning services where platform experts build custom itineraries for premium fees (AED 200-500 depending on complexity).

Advertising and Promotions generate ancillary revenue: featured listings allowing vendors to pay for prominent homepage placement or search result boosting, sponsored recommendations integrated contextually within itineraries, banner advertising for UAE businesses targeting tourist demographics, and affiliate partnerships with international travel brands (luggage, insurance, tour gear).

Data and Analytics Services monetize aggregated insights: market research reports providing tourism trends, booking patterns, and visitor demographics to Dubai tourism authorities and industry organizations; vendor performance benchmarking offering comparative analytics helping hotels and attractions understand their competitive positioning; and API licensing allowing third-party developers to build complementary services atop platform data.

Initial focus typically prioritizes commission models generating transaction-based revenue from day one, while building subscription offerings as tour operator user base grows and demonstrating value justifies recurring fees. Premium features and advertising expand gradually as platform achieves critical user mass creating attractive audience for promoters.

Competitive Advantages and Market Differentiation

Success in Dubai's competitive tourism technology market requires clear differentiation addressing unmet needs and delivering superior value compared to existing alternatives.

Comprehensive Integration distinguishes this platform from fragmented solutions: travelers currently juggle booking confirmations across email, WhatsApp, and paper printouts, causing frequent confusion about meeting times, locations, and confirmation details. Consolidating everything within a single application significantly enhances user experience. Tour operators similarly benefit from eliminating scattered spreadsheets, disconnected vendor communications, and manual itinerary formatting, streamlining operations and reducing errors.

Local Market Expertise provides advantages over international platforms lacking Dubai-specific knowledge: deep understanding of cultural sensitivities including Ramadan schedules, prayer time integration, Halal dining filters, and modest dress recommendations; comprehensive UAE vendor networks built through direct relationships with local hotels, restaurants, and attractions; and regulatory compliance ensuring adherence to Dubai tourism licensing requirements, payment regulations, and consumer protection standards.

Real-Time Synchronization addresses critical pain point where itinerary changes create communication delays. Immediate push notifications instantly inform tourists when tour operators modify schedules, ensuring everyone stays coordinated. Automated vendor updates flow directly into itineraries when restaurants confirm reservations, attractions acknowledge ticket purchases, or transportation providers assign specific drivers. This real-time connectivity dramatically reduces last-minute confusion and customer complaints.

Offline Functionality recognizes that tourists frequently lose internet connectivity in desert safaris, underground metro stations, or areas with poor coverage. Downloaded itineraries remain accessible offline, allowing tourists to review schedules, navigate using offline maps, and access booking confirmations without network connectivity. Smart synchronization automatically updates information when connections restore, merging offline actions with server-side changes.

Personalization and Intelligence differentiates through smart recommendations: machine learning analyzes past bookings, review ratings, and browsing behavior to suggest relevant attractions and restaurants; weather-aware scheduling automatically suggests indoor activities when forecasts predict extreme heat; dynamic route optimization reorders itinerary sequences minimizing travel time between destinations; and budget-conscious alternatives propose comparable experiences at lower price points when tourists exceed spending limits.

Quality Control and Trust establishes platform credibility through rigorous vendor vetting and performance monitoring. Unlike platforms accepting any provider willing to pay listing fees, selective onboarding ensures consistent quality standards. Transparent review systems display genuine tourist feedback, while automated performance tracking identifies underperforming vendors before they damage platform reputation.

Implementation Roadmap and Success Metrics

Launching a successful travel planning platform requires phased rollout balancing ambitious vision with practical execution constraints. The recommended approach progresses through clearly defined stages, each building upon previous accomplishments while validating assumptions before major investment escalation.

Stage 1: MVP Launch (Months 1-4) focuses on core functionality demonstrating concept viability. Develop tourist mobile app with itinerary viewing, booking confirmations, map integration, and basic notifications. Build tour operator web dashboard enabling itinerary creation, client management, and booking status tracking. Establish partnerships with 15-20 key vendors including 5 hotels across budget ranges, 8 restaurants representing diverse cuisines, 5 major attractions (Burj Khalifa, Desert Safari, Dhow Cruise, Dubai Mall, Global Village), and 2 transportation providers. Onboard 3-5 pilot tour operators representing different business models (luxury specialist, budget packages, family focus). Target 100-200 successful bookings validating technical functionality and user experience.

Stage 2: Marketplace Expansion (Months 5-8) builds ecosystem network effects. Scale vendor partnerships to 50+ hotels, 30+ restaurants, 20+ attractions, and 10+ transportation providers. Implement commission payment processing ensuring timely vendor settlements. Develop review and rating systems encouraging user-generated content. Launch subscription pricing tiers for tour operators demonstrating recurring revenue potential. Expand tour operator base to 15-25 active agencies generating 500-1000 monthly bookings. Establish customer support infrastructure handling inquiries, resolving issues, and gathering feedback.

Stage 3: Feature Enhancement (Months 9-12) differentiates through advanced capabilities. Implement AI-powered recommendation engine personalizing suggestions based on user preferences and behavior. Add multi-language support covering Arabic, English, Hindi, Russian, and Chinese serving top tourist origin markets. Develop offline functionality allowing access without internet connectivity. Integrate advanced analytics providing tour operators actionable business intelligence. Launch white-label options enabling larger tour operators to rebrand app with their identity. Achieve 25-40 active tour operators and 2000-4000 monthly bookings.

Stage 4: Market Leadership (Months 13-24) consolidates competitive position and explores expansion. Expand geographically covering Abu Dhabi, Sharjah, Ras Al Khaimah, and Al Ain. Develop enterprise features supporting large tour operators with team management, custom workflows, and API integrations. Launch consumer-direct booking allowing independent travelers to build itineraries without tour operator intermediation. Establish brand recognition through marketing campaigns, tourism industry partnerships, and thought leadership. Target 50-100 tour operators and 10,000+ monthly bookings establishing market leadership.

Success measurement tracks multiple dimensions: User Metrics including monthly active users (tourists), monthly active tour operators, average bookings per tourist, tour operator retention rate, and app store ratings and reviews; Business Metrics monitoring gross booking value (total transaction volume), revenue (commissions, subscriptions, fees), average commission rate, customer acquisition cost, and lifetime value; Operational Metrics assessing booking confirmation rate (successful completions vs. initiated transactions), average booking time (speed of transaction completion), vendor response time (how quickly providers confirm reservations), customer support resolution time, and system uptime and reliability.

Quarterly review cycles evaluate performance against targets, identify underperforming areas requiring intervention, and inform strategic decisions about feature prioritization and marketing investment. Continuous iteration based on data-driven insights ensures platform evolution matches market needs and maintains competitive differentiation.

Conclusion

Dubai's tourism industry stands at the intersection of tradition and innovation, welcoming nearly 19 million international visitors annually while targeting 40 million by 2031. This explosive growth creates urgent demand for digital solutions that streamline planning complexity, enhance tourist experiences, and improve operational efficiency for tour operators. A comprehensive travel planning mobile application addressing this need represents a substantial business opportunity worth millions in annual transaction value.

A-Bots.com's expertise in mobile app development positions the company perfectly to deliver tourism technology solutions for Dubai's dynamic market. Our experience building complex booking systems, payment integrations, real-time synchronization, and user-friendly interfaces translates directly to tourism application requirements. We understand the technical challenges of supporting 50,000+ daily tourist arrivals, the business logic of commission-based marketplace economics, and the user experience expectations of international travelers accustomed to world-class service.

The proposed travel planning application transforms fragmented tourism experiences into seamless digital journeys. Tourists gain single platform accessing comprehensive trip information, eliminating confusion and enhancing enjoyment. Tour operators improve operational efficiency through centralized client management, automated vendor coordination, and data-driven insights. Hotels, restaurants, attractions, and transportation providers benefit from direct distribution channels reducing dependence on expensive third-party platforms. This alignment of stakeholder interests creates sustainable competitive advantages and long-term business viability.

Technology continues advancing rapidly, bringing new capabilities that further enhance tourism applications. Artificial intelligence enables conversational itinerary planning where tourists describe preferences in natural language and systems generate optimal schedules. Augmented reality overlays historical information, navigation directions, and restaurant recommendations atop live camera views as tourists explore Dubai's streets. Blockchain technology creates transparent review systems where verified bookings guarantee authentic feedback. Voice assistants provide hands-free access to itinerary information while tourists navigate busy souks or relax on beaches.

For tourism businesses considering digital transformation, the question isn't whether to invest in mobile technology, but when and how. Delaying risks competitive disadvantage as early adopters capture market share and build network effects. Rushing into development without proper planning produces suboptimal solutions requiring expensive rebuilds. The optimal path combines clear vision defining long-term goals, pragmatic execution starting with focused MVP validating assumptions, and continuous iteration incorporating user feedback and market evolution.

A-Bots.com invites tourism industry stakeholders—tour operators, travel agencies, destination management companies, hotel groups, and attraction operators—to explore collaborative opportunities developing next-generation travel planning platforms. Our proven methodologies, technical expertise, and commitment to client success ensure projects deliver measurable business results while exceeding user expectations. The future of Dubai tourism runs on mobile technology, and that future starts with conversations happening today.

Contact A-Bots.com to discuss your tourism application development needs and discover how custom mobile solutions can transform your business operations while delighting your customers. Together, we'll build the digital experiences that make Dubai's tourism vision a reality.

✅ Hashtags

#DubaiTourismApp #TravelPlanningApp #TourOperatorSoftware #DubaiMobileAppDevelopment #TourismTechnology #ItineraryManagementApp #DubaiTravelTech #TourismMarketplace #TravelAppDevelopment #SmartTourism #DubaiHospitalityTech #MobileBookingPlatform #TravelInnovation #DubaiDigitalTourism

Other articles

App Developers Sydney | Custom Mobile App Development 2026 Sydney has emerged as a global technology hub with IT spending projected to reach A$146.85 billion in 2025. The city's tech ecosystem, centered around Tech Central, hosts 81 ASX-listed digital companies worth $52 billion and attracted 65% of Australia's startup funding in 2024. From unicorn success stories like Canva and Atlassian to government initiatives supporting innovation, Sydney offers exceptional opportunities for mobile app development. This comprehensive guide covers development costs, key industries, technology trends, and how to choose the right development partner for your project. A-Bots.com provides custom mobile development and professional testing services across iOS, Android, and cross-platform frameworks.

App Developers Brisbane: Custom Taxi App Development for Urban Mobility Solutions Brisbane's transportation sector demands sophisticated mobile applications capable of serving 2.5 million residents and nearly 9.5 million annual visitors. This comprehensive guide examines the local app development landscape, profiling leading companies including Code Heroes and App Gurus alongside their technical capabilities and notable projects. The article analyzes existing Brisbane taxi app platforms such as 13cabs, Black & White Cabs, and Rydo, identifying market gaps where custom development delivers competitive advantage. Technical considerations spanning Flutter frameworks, real-time GPS integration, and payment gateway implementation provide actionable insights for transportation businesses. International development perspectives from A-Bots.com demonstrate how cross-border partnerships can introduce approaches that differentiate Brisbane taxi applications in an increasingly competitive market.

Perth Parking App and Uber App Perth: Custom Development Guide Perth stands as the world's most isolated major city, stretching 150 kilometers along the Western Australian coastline with a population exceeding 2.38 million. This unique geography creates distinct challenges for parking and rideshare services that standard applications fail to address effectively. The article examines current Perth parking app solutions including City of Perth Parking and EasyPark integration, analyzes the Uber app Perth market where Uber dominates with 80% share following Ola's 2024 exit, and explores opportunities for custom mobility development. With the global smart parking market projected to reach USD 33.82 billion by 2033 and Australian ride-hailing growing at 13.9% CAGR, Perth presents substantial opportunities for innovative transportation applications.

Custom CAD, 3D Modeling, BIM and Digital Twins Australia’s engineering and manufacturing sectors are accelerating digital transformation, but the country’s scale, remoteness, and resource-intensive operations often expose the limits of off-the-shelf software. This guide explains where custom engineering software delivers measurable advantage - from CAD and 3D modeling tools to BIM collaboration platforms and full-site digital twins for mining, construction, and advanced manufacturing. You will learn what Australian teams typically need: real-time monitoring, predictive maintenance, regulatory-aligned BIM workflows, and deep integrations with existing operational systems. A-Bots.com builds tailored engineering applications that match sector-specific requirements and production realities.

Modular AI Companion Robots From the pixelated Tamagotchi pets that sold over 98 million units to Furby's groundbreaking robotic personality, interactive companions have captivated generations worldwide. The smart toys market now exceeds $21 billion and continues rapid expansion toward $38 billion by 2030. Modern modular companion robots combine artificial intelligence, computer vision, and swarm coordination to serve as educational tutors, household assistants, and security monitors within a single adaptable platform. This analysis examines technological evolution, market opportunities, and implementation strategies for next-generation robotic companions. A-Bots.com provides custom development services including mobile applications, IoT integration, and AI-powered interaction systems, building on successful projects like the Shark Clean robot vacuum controller.

Top stories

Copyright © Alpha Systems LTD All rights reserved.

Made with ❤️ by A-BOTS